By Schulte Roth & Zabel, Activist Insight and Hedge Fund Insight staff Recently, Schulte Roth & Zabel (SRZ), a leading financial services law firm, and Activist Insight released their 2018 Activist Investing Annual Review. The review analyzes recent trends in shareholder activism, ranks the top activist investors, and predicts what’s to come for activist investing. 2017 proved to be a […] Read more »

Elliott Tops The Activist Top 10 For Third Year In A Row

Data source: The Activist Investing Annual Review 2018 produced by Activist Insight in association with Schulte Roth & Zabel (SRZ). Elliott Management tops “The Activist Top 10” for the third year in a row. Activist Insight selects the list based on the number of campaigns, average size of targets, news stories generated and annualized returns. “The Activist Top […] Read more »

Activist Investing in Europe

From Activist Insight* By the end of September, 2017 had seen more than 100 European-based companies publicly subjected to shareholder demands. Reached slightly later this year than last, and much earlier than in 2015, that milestone signals that if activism in Europe has lost its capacity to shock, its future also looks secure. Activity is still a long way […] Read more »

Activism’s New Paradigm

By Gregory Taxin and Betsy Atkins* Shareholder activism in the U.S. has increased greatly over the past decade, measured not only in scope and the pools of capital dedicated to it but also in sophistication and in the range of tactics employed. There is currently more than $120 billion in dedicated activist funds at work, […] Read more »

Activism’s New Rules

By Montieth M. Illingworth, president of Montieth & Company There it was in black and white in none other than The New York Times. Quotes from the CEO of DowDuPont, followed by ones from a line up of shareholders echoing the sentiment, that all is now actually much better for the company. The breakup once […] Read more »

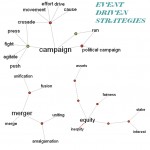

The Year in Activism Infographic

From Activist Insight related content: Consultant Verus Negative on Outlook for Event Driven Hedge Funds (Jan 2017) Can Activism Survive A Down Market? (March 2016) John Paulson on the Benefits of Activism (Dec 2010) Read more »

Quotations of the Day from “Activist Investing in Europe” Conference

By Hedge Fund Insight staff “Activism is a cyclical activity – as returns drop off the capital applied to the strategy goes down.” – Edward Bramson, Sherborne Investors Management LP “Non-professional activists are engaging in activist investing. So I think the amount of capital in the strategy in Europe is not going to […] Read more »

Best Practice for Activists Dealing with the CEO

By Marshall Sonenshine, Chairman and Managing Partner at Sonenshine Partners. 1. Market Forces: Advising the CEO in an Era of Shifting Understandings of Leadership We deal makers represent and counsel CEOs, who are generally unusually talented and demanding people from whom in turn much is demanded. We do this in markets that are often […] Read more »

Distressed is Investors’ Preference Within Event-Driven

By the Capital Solutions Team of Barclays Prime Services* In light of the recent performance of event-driven HFs, we wanted to understand how it had affected investors’ perceptions of the strategy, and what their likely allocation plans were with regard to event driven strategies as a result. Performance versus investor expectations We began by […] Read more »

Hybrid Equity Bridges Private Equity & Hedge Funds So Attracts Investors

By Diane Harrison, principal of Panegyric Marketing. Prior to the mid 2000s, private equity represented the de facto route to long-term appreciation for investors seeking to access investment strategies yielding double-digit returns. After the credit crisis of 2008 effectively closed the doors on efficient and profitable exits for many private equity funds, investors found their […] Read more »