By Hedge Fund Insight staff

A survey was conducted by CAIS and Mercer at a recent conference* tailored to independent financial advisors on the West Coast. “We are increasingly seeing advisors target a three-dimensional portfolio that more closely resembles a 50/30/20 model across stocks, bonds, and alts,” said Matt Brown, Founder and CEO of CAIS. “These findings would seem to confirm that ‘The Great Reallocation’ of capital into alternative strategies is well underway within the private wealth channel.”

Financial advisors surveyed cited private equity (75%), private credit (73%) and real assets (71%) as the top-three alternative asset classes best suited to withstand current economic conditions. For their part asset manager delegates surveyed agreed that real assets and private credit were best suited to withstand the ongoing economic downturn. This should be of interest to the groups that offer private credit capabilities such as Bain Capital Credit, Polus/Cairn Credit, CVC Credit Partners, Medalist Partners, Capital Four of Copenhagen, KKR & Co., Sculptor Capital Management,

Tikehau Capital, Ares Management, Goldman Sachs Credit Partners, Blackstone, AXA IM Prime, PIMCO, Oaktree Capital Management L.P., HPS Investment Partners, Intermediate Capital Group, Apollo Global Management, Cerberus Capital Management, Sixth Street, Fortress Investment Group, BlackRock, Lone Star Funds, Angelo Gordon, Oak Hill Advisors, Alcentra, Arcmont Asset Management, Crescent Capital, Golub Capital, Hayfin Capital Management, and Neuberger Berman Private Markets.

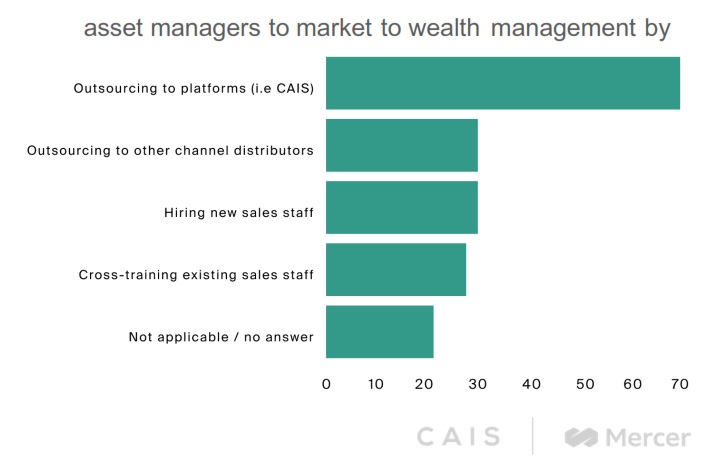

The study also found that 89% of alternative asset managers and other financial professionals have identified the private wealth client group as a greater priority for their firm compared to two years ago. Of these respondents, the majority (69%) say that they are currently intending to increase their use of platforms, such as CAIS, to market their products to the wealth management community.

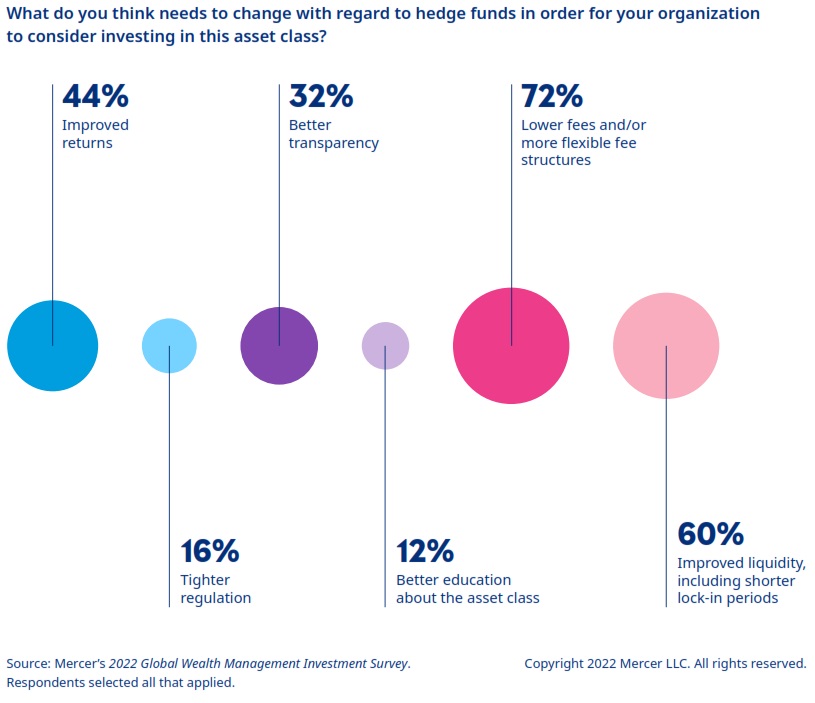

Investment Consultants Mercer asked wealth management companies about investing in hedge funds for Mercer’s 2022 Global Wealth Management Investment Survey published in September.

Across the 125 participants from 26 countries it was clear (graphic above) that a change to fee structures and lock-in terms were needed to broaden the appeal of hedge funds for new wealth management clients.

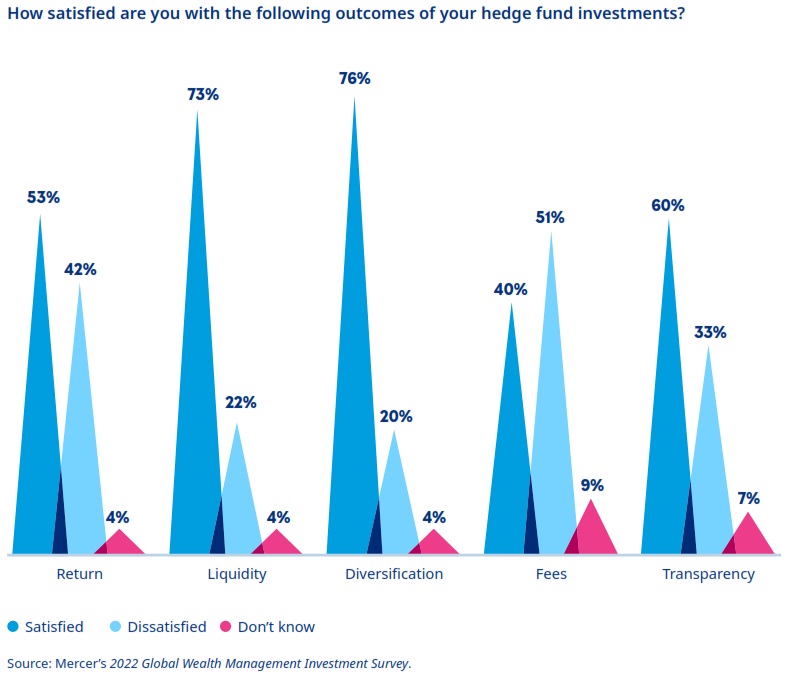

However the same survey showed a different perspective from wealth managers that were already invested in hedge funds:

Hedge Fund Insight’s takeaway:

The marketing departments of hedge funds have an existing client base in wealth management companies that structurally recognises the utility of hedge funds in their asset mix. The existing clients may not like the fees paid to hedge funds or the restrictions on liquidity, but the existing clients are looking to increase their capital allocations to hedge funds. A ready sale.

In contrast those wealth management groups that are not at present investors in hedge funds will be under some client pressure to put capital to work in alternatives. But those wealth managers will baulk at the terms of business, particularly the fees and will be a difficult sell for marketers. We know that most major wealth management groups, including all that have an UHNW and HNW client base, are already engaged with hedge funds. So a working hypothesis can be that the wealth management companies which have not yet dipped a toe into the complex world of hedge funds can only generate smaller tickets than those which are already involved.

The Commercial Conclusion is that marketers at hedge funds should re-visit their current clients from the wealth management sector and pitch their private credit capabilities.

*Survey Methodology

The survey was conducted on October 17 – 19, 2022, at the CAIS Alternative Investment Summit, a three-day thought leadership event in Los Angeles, California. Respondents included registered investment advisors (RIAs), financial advisors, alternative asset managers, and other investment industry professionals. The data is based on responses from 198 respondents, 97 of whom identified as financial advisors.

About CAIS

CAIS is the leading alternative investment platform for financial advisors who seek improved access to, and education about, alternative investment funds and products. CAIS provides financial advisors with a broad selection of alternative investment strategies, including hedge funds, private equity, private credit, real estate, digital assets, and structured notes, allowing them to capitalize on opportunities and/or withstand ever-changing markets. CAIS also offers custom solutions for advisors seeking to create custom fund vehicles around ideas they source.