By Marco Boldini, head of financial services regulatory (asset management) – legal, and Robert Mellor, partner in the private equity funds team at PwC With the announcement of the UK government’s proposals for a future UK-EU Partnership for Financial Services in July, the UK appears no longer to be seeking mutual recognition of regulatory […] Read more »

Acceptance? UCITS Hedge Funds Best AUM Growth This Decade

UCITS hedge funds were not exempt from the impact of the shrinking of the global hedge fund industry, as shown by the number of closures in 2017, which was a good year for hedge funds in terms of performance. More than half of the UCITS funds listed in the Eurekahedge database charge up to 1% management fees. On the other hand, only 26.7% […] Read more »

Tages Adds Storied CTA to UCITS Platform

By Hedge Fund Insight staff Europe’s biggest hedge fund seeder has backed a new UCITS launch. Tages Capital has launched a UCITS version of the Rotella Polaris strategy, a managed futures program with a long pedigree run by Rotella Capital Management. Rotella, established by Robert Rotella in 1995, has been a pioneer in the […] Read more »

Hedge Fund Launches in 1Q 2017

From Preqin related content: Graphic of the Day: UCITS Share of European Hedge Fund Launches (Dec 2016) Cayman’s Share of World Hedge Funds Shrinks, Particularly For New Funds (April 2016) Read more »

Graphic of the Day: UCITS Share of European Hedge Fund Launches

From Eurekahedge The percentage of UCITS launches showed an upward trend between 2008 and 2011, as the post-financial crisis period created a healthy demand for regulated investment products from investors. Furthermore, the need to strengthen Europe’s overall financial system also made a strong case for managers to opt for a UCITS brand. Even though the percentage […] Read more »

Hedge Funds: Mutually Inclusive, says Neuberger Berman

By Fred Ingham, head of international hedge fund investments, Neuberger Berman A quiet revolution is happening in hedge funds. Investors continue to allocate to the asset class, but the way they are allocating is changing, while its investor base is growing broader and becoming more inclusive. With both bond and equity markets facing major […] Read more »

Absolute Hedge UCITS Strategy Review for 2014 – Winners & Losers

By Georg Reutter and Matthew Barrett of Kepler Partners Below we review each sub-sector in the Absolute Hedge universe, identifying the most important players and notable performances last year. Managed Futures After several years of poor or disappointing returns, Managed Futures were the standout sector in 2014. The sector got off to a […] Read more »

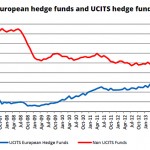

Graphic Of The Day – UCITS v Non-UCITS Hedge Funds in Europe

Source: Eurekahedge Read more »

UCITS Hedge Funds – Graphics of the Day

From Eurekahedge UCITS hedge funds have maintained a strong pattern of growth in 2014, with the industry delivering modest returns and also attracting plenty of new capital from investors. Currently the size of the industry stands at a record high of US$275.2 billion, overseen by a population of 1,016 funds. The onset of the Eurozone […] Read more »

UCITS Hedge Funds – Fund Raising Winners

By Kepler Partners LLP Having previously focused only on alternative UCITS strategies with a UK registration, to reflect the increasingly global nature of alternative UCITS we have expanded the universe we analyse to include all alternative UCITS funds regardless of their domicile. By the end of 2013 the alternative UCITS sector now controls over […] Read more »