By Hedge Fund Insight staff

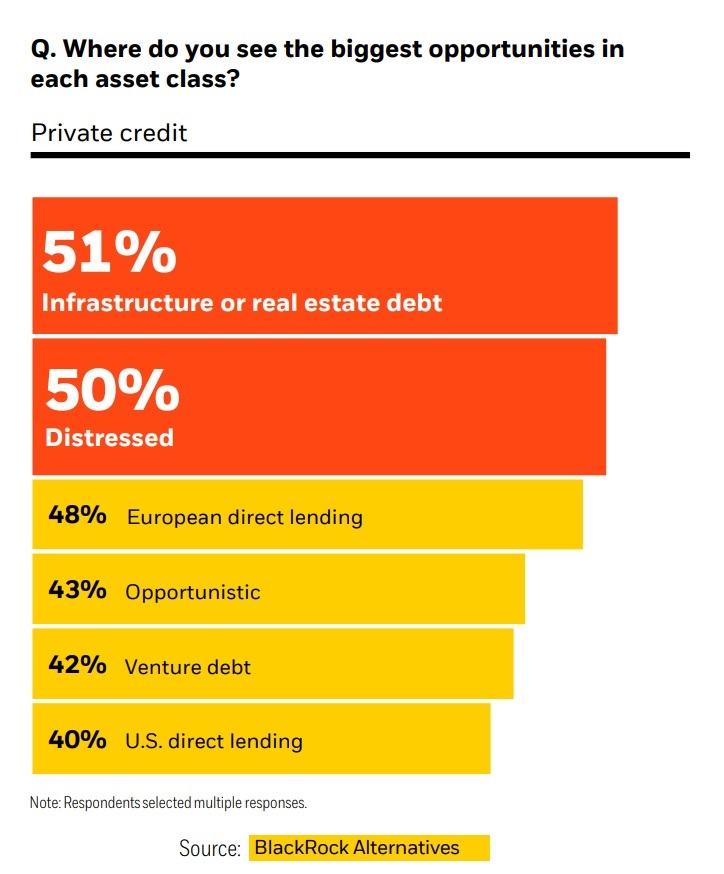

Blackrock has initiated a Global Private Markets Survey* covering respondents from public pensions, corporate pensions, insurers, family offices, foundations and endowments, and sovereign wealth funds. The key graphic was this one:

Distressed Investing and Direct Lending are seen by institutional investors as amongst the best opportuities in private credit. The motivation is clear as fully 82% of respondents gave income generation as the most important factor in driving allocations to private markets.

*Interviews conducted by third-party consultancy iResearch Services. Responses were received from October 2022 through January 2023.

related content:

Private Credit In Demand From Institutional Investors – bfinance Data

Private Credit Preferred Strategy of Wealth Managers – Mercers Survey

Davidson Kempner Secures THE DEAL in European NPLs

Demand For Hedge Fund Strategies – CTAs Level with Merger Arb & Cryptocurrencies