By Simon Kerr and Hedge Fund Insight staff

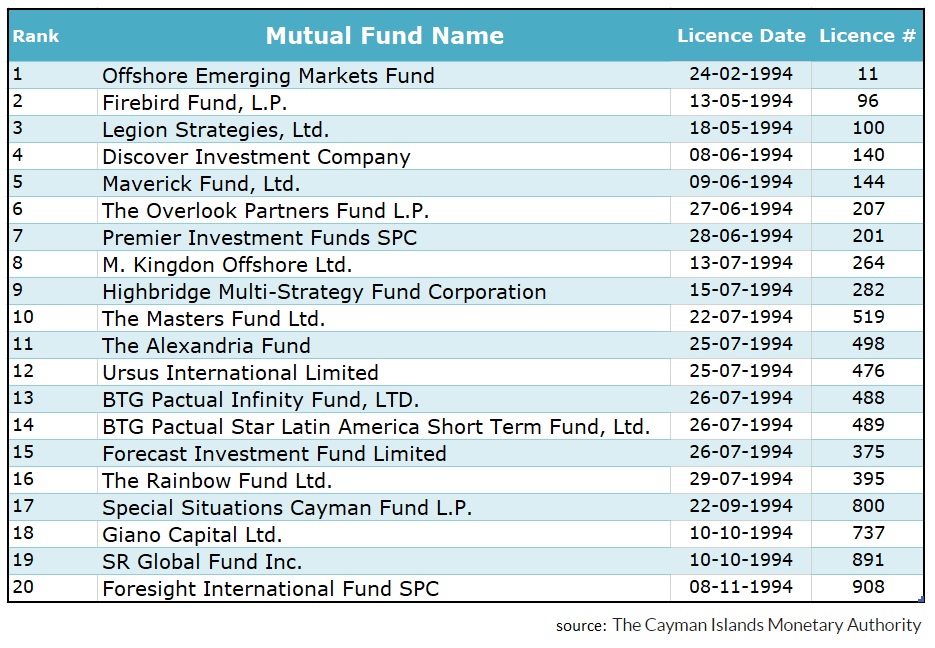

In 1994 the Cayman Islands Monetary Authority introduced a registration regime for mutual funds established on the islands. Most Cayman Islands Mutual Funds are engaged in hedge fund strategies, many are offshore versions of domestic (US) hedge funds (LLPs). As the concept of hedge fund strategies was adopted elsewhere Cayman became the global offshore hub.

Nearly thirty years later the total number of mutual funds has reached just over thirteen thousand*. Cayman Islands mutual funds are in several regulatory categories. In size order they are Registered Funds, Master Funds, Administered Fund, Limited Investor Funds and Licenced Funds. Master Funds were segregated as a regulatory category as recently as 2012, and Limited Investor Funds were permitted in 2020. Here we will look at on the longest-established Cayman Islands Mutual Funds, which are all classified as “Registered Funds”. Not all Registered Funds are hedge funds, we will tend to focus, after the first twenty names, on those that are.

The oldest established 20 Cayman Islands Mutual Funds (hedge funds) includes several funds run by management firms that have attained leading-brand status. The first registered brand name fund is a Tiger cub – Lee Ainslie’s Maverick Capital – the firm was established the year before Maverick Fund was registered in the Caymans (see also #80). Kingdon Capital Management advises the $189m (2022) M.Kingdon Offshore Fund (8). Highbridge Capital (9) was an early leader of multi-strategy investing under one roof, and is now a subsidiary of JP Morgan.

Amongst the longest established twenty funds that are still registered as mutual funds in Cayman are several specialist equity funds. Firebird Fund (No. 2) from Firebird Management LLC invests around $126m (Source:SEC Filings) in the former Soviet Union and emerging Eastern Europe. The Overlook Partners Fund (6 and 26) is managed by Overlook Investments investing in a value-style in Asian Equities outside Japan. Firebird and Overlook are long-only funds. Discover Investment Company (4) is an asian equity fund run by Regent Fund Management, owned by Jim Mellon. Regent has been involved in special sits investing and varying the risk profile of funds with hedging.

Founder Michele Ragazzi is still associated with Giano Capital (18) as it has broadened its’ mandate from Italy-plus at inception. Giano Capital is thought to have assets of single-digit $m’s. Special Situations Cayman Fund L.P. is an equity fund (private and public equity) run by Austin Marxe of AWM Investment Company, Inc. Sloane Robinson’s Global Fund (19), run from the City of London, was designed at the outset as an EAFE fund to invest in non-US equities. SR Global Fund is believed to be run on behalf of the partners of Sloane Robinson with no external capital since 2020.

Brazilian investment bank BTG Pactual has two of the earliest registered Cayman Island Mutual Funds (13 and 14 above) and today has a range of twelve such funds. BTG Pactual’s rates and absolute return hedge fund products are more prominent than the older funds cited.

Jim Chanos’ Chanos & Company manages bear fund Ursus International Limited. The fund is around $100m in assets, which would be disappointingly small for a long/short fund, but is not unusual for a successful bear fund.

Funds of Funds in the List include SkyBridge Capital’s $230m Legion Strategies (3), Discover Investment Company (4), Doyle Capital’s Masters Fund (10), The Rainbow Fund (16) advised by James River Capital Corp. and Foresight International Fund (20)

Premier Investment Funds SPC (7) and The Alexandria Fund (11) are offshore wealth management vehicles managed by Zurich’s GSI (Global Strategic Investments AG) and Alexandria Bancorp respectively. There is no information available on Forecast Investment Fund.

Survival Rate & Drop-outs

The two oldest Caymans Islands Mutual Funds are the only funds still open that have double digit licence numbers. The 28th oldest fund has a four digit licence number. By inference a lot of funds have fallen by the wayside since 1994. Of the first thousand funds registered only 27 are still in business twenty-nine years later. Of the next thousand funds registered between June 1995 and November 1995 44 are still going. Not all funds that are still registered are active – a small minority are in the process of liquidation, but still registered. Some are effectively personal pots of offshore capital for the general partner, after outside investors have redeemed. The ongoing costs are so small that the owner(s) will pay more in personal property tax each year than the costs of keeping open the offshore fund.

Just over eight years ago in 2015 HFI listed the 20 oldest hedge funds in Cayman. Fourteen of those are still in the tenured twenty of today. III Global, Sofaer Funds, Blenheim Global Markets, the Doublewood CFM Fund, Ascot Fund, and Spirit Arbitrage Holdings have droppped out.

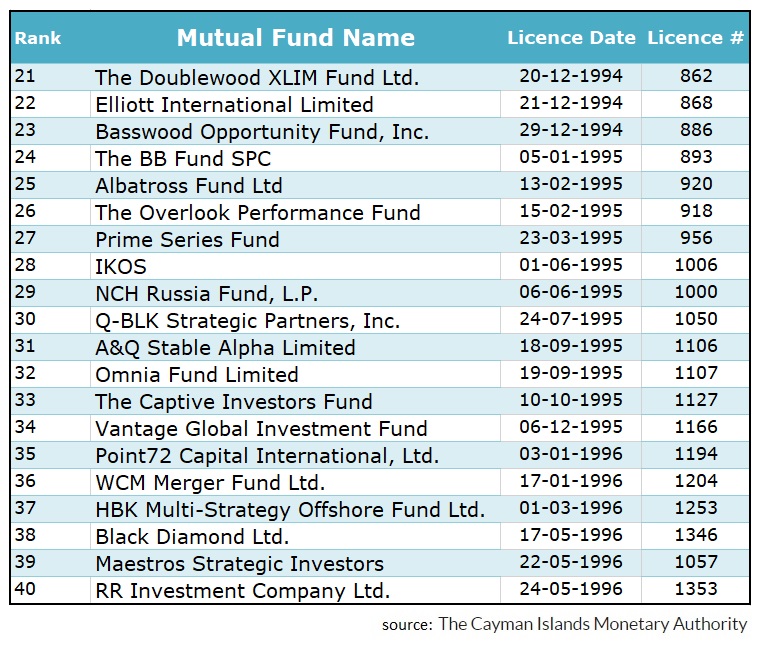

Looking at the second twenty oldest Cayman Islands Mutual Funds several hedge fund brand names crop up. Multi-strategy managers HBK and Black Diamond launched offshore hedge funds (37 and 38) in 1996. HBK Investments manages more than $25bn in strategies including risk/merger arbitrage distressed/credit and HY. Black Diamond manages $9bn in HY, distressed and turnaround strategies. See also #77 Double Black Diamond Ltd. below.

Point72 Capital International, Ltd. (35) was called S.A.C. Capital International, Ltd. and remains one of Steve Cohen’s main investment vehicles. This hedge fund is one of the largest in the world at $15bn and it uses discretionary long/short equity, systematic, and macro investing strategies.

Activist manager behemoth Elliott Corporation registered offshore hedge fund Elliott International (22) in Cayman at the end of 1994. The firm manages $55bn employing a multi-strategy trading approach that encompasses a broad range of strategies, including: equity-oriented, private equity and private credit, distressed securities, non-distressed debt, hedge/arbitrage, real estate-related securities, commodities trading and portfolio volatility protection.

The other dedicated event-driven fund in the first 40 funds is Westchester Capital Management’s merger arbitrage fund (WCM Merger Fund, 36). Under normal market conditions, the fund invests at least 80% of its total assets principally in the common stock, preferred stock and, occasionally, warrants of companies which are involved in publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations. WCM has $6bn in AUM.

The oldest single-manager CTAs are given in the second twenty section. IKOS Asset Mgt. (28) was founded in London and moved to Cyprus in 2011. New Jersey-based Willowbridge Associates goes back to 1988 and has been investment advisor to the Doublewood funds (21) from inception. Willowbridge also has a CTA program in the next section – Union Spring Fund Ltd. (48) was last reported to have $640m under management.

Basswood Opportunity Fund (23) is a financial sector hedge fund of less than $100m in assets from sector-specialist advisor Basswood Capital Management.

NCH Russia Fund, L.P. is a hedge fund operated by the Collins Capital subsidiary of NCH Capital Inc. and has approximately $10 million in assets. NCH Capital is a New York based buyout specialist firm that also advises the fund ranked at #56 on this list. That fund, New Century Holdings XI, had $78.9m of assets reported to the SEC in April this year.

Funds of funds that were early registrants were A&Q Stable Alpha from UBS Hedge Fund Solutions LLC, Albatross Fund, and Omnia Fund Limited advised by Geneva’s Omnia Capital.

There are non-hedge-funds in the 21-40 section of the list. Prime Series Fund is an offshore money market fund. BB Fund is a corporate debt fund advised by Banco do Brasil. Q BLK Strategic Partners is a buyout fund managed by BlackRock Private Equity Partners. The Captive Investors Fund is a captive insurance company for clients of Captive Resources of which Raffles Insurance was the founding captive shareholder. Vantage Global Investent Fund is a global equity fund which can utilise equity index hedges. There is no information available on Maestros Strategic Investors or RR Investment Company.

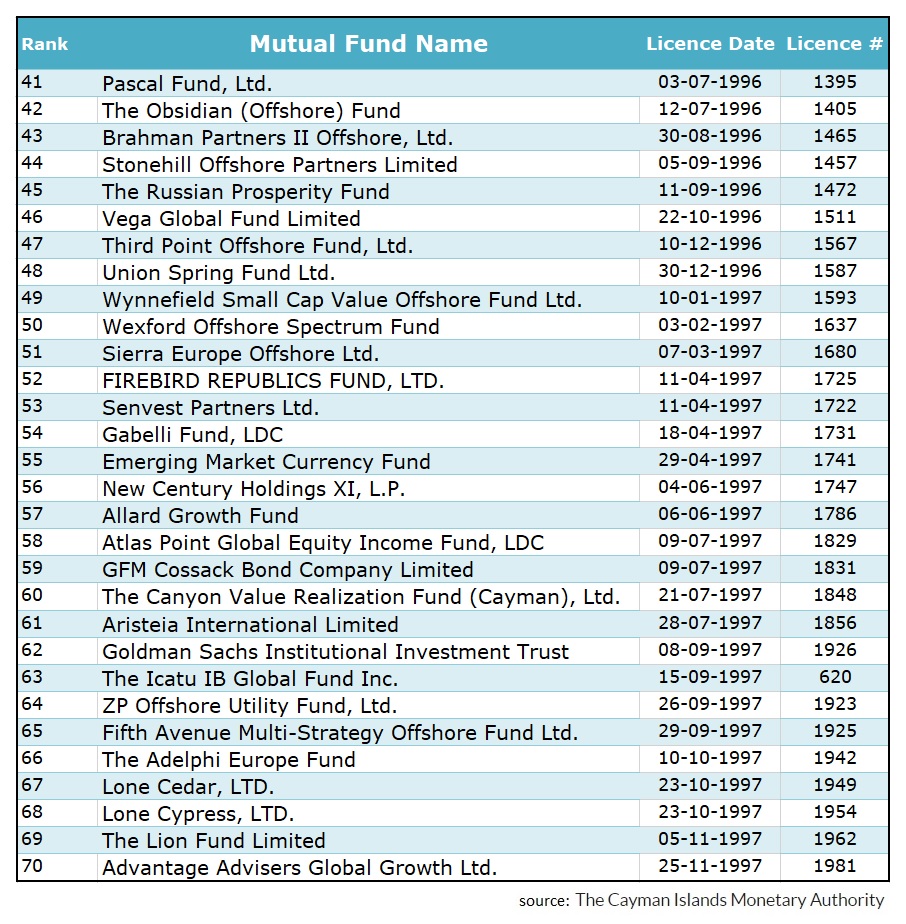

The next thirty funds amongst the oldest established includes three funds that invest behind the Iron Curtain – The Russian Prosperity Fund (45), Firebird Republics Fund (52) and GFM Cossack Bond Company (59). Prosperity Capital Managment’s $350m Fund is managed by Mattias Westman from London. Global Fund Management S.A. (GFM) is based in Panama and the Cossack Bond Fund has invested in the bonds of Azerbaijan, Iran, Bahrain, Mongolia and Belorus as well as Russia and Ukraine. Last seen the Cossack assets were over $40m, and the fees were 1 1/2 and 20%.

The brand name funds in this tranche of oldest offshore hedge funds include a Tiger cub, and several of the world’s largest hedge funds now and in the past. Two funds run by Steve Mandel’s Lone Pine Capital were registered in October 1996. Lone Cedar Ltd. (67) is one of three feeder funds to Lone Cypress Ltd. (68) a $14bn fund. Lone Pine Capital runs $35.5bn in total and Lone Cedar makes up $3.7bn of it.

The $6.1bn Third Point Offshore Fund is a feeder fund for the $11.8bn Offshore Master Fund. Daniel Loeb has added corporate credit and structured credit to the activism and event-driven and fundamental strategies with which Third Point started. Third Point has a multi-decade track record of advocating for operational or portfolio change to drive long-term shareholder value through engagement with mature, publicly-listed companies. An event-driven and value approach is said to help Third Point identify catalysts in mergers and acquisitions, restructurings, and other special situations that will unlock value.

Mario Gabelli is the is the sole shareholder, director and employee of MJG Associates, that provides advisory services to private investment partnerships and offshore funds in the Gabelli Group, including Gabelli Fund LDC (54). Gabelli Fund LDC may have only a few million dollars invested in it, but is still actively managed in the same style as other Gabelli Group funds, with an empahsis on cashflow and value.

The Obsidian Fund is amongst the oldest surviving global fixed income hedge funds. Stuart Spodek at BlackRock, has been the lead portfolio manager since 2007. He is responsible for the Fund’s overall risk budgeting and sector allocation decisions including credit-risk assumption on this multi-strategy bond fund. Another brand name fixed income manager on the list is Canyon Capital Advisors LLC, whose Value Realization Fund (60) controls $18.9bn of assets, making it amongst the largest on this list.

Aristeia International (61) is one of two feeder funds for a $9.65bn Master Fund. Aristeia Capital, the investment adviser, aims to produce absolute returns through spread trading in the corporate credit markets. Aristeia Capital hedges portfolios according to the macro environment to control risk.

Senvest Partners is the flagship fund of Senvest Management, and is probably best known for being a beneficiary of the short-squeeze on Gamestop shares two years ago. Senvest Partners had its best year in performance terms for 25 years as the retailer’s shares became it’s most successful position ever in dollar profit terms. Senvest Management oversee $3.3bn in total.

Stonehill Offshore Partners (44) is invested in distressed, high yielding, and defaulted debt and other opportunistic investments as advised by the manager of $3.2bn Stonehill Capital Management (SCM).

Wexford Capital has assets under management of $2bn, and half of that is in the Wexford Offshore Spectrum Fund (50). The Spectrum Fund employs a multi-strategy approach informed by a value bias investing in long/short equity, distressed, fixed income macro investing and commodities.

Vega Global Fund (46) was once the largest hedge fund with a European investment adviser. Madrid’s Vega Asset Management had peak assets of $13bn trading a global macro strategy in bonds, interest rates and currencies. Relatively small losses triggered so many redemptions that Vega’s assets fell 80% in just over a year.

Brahman Capital Corp launched Brahman Partners II Offshore (43) in 1996, and it remains the firm’s largest fund at $690m (peak $1.3bn) out of a firmwide aum of $2.1bn. Brahman Capital believes the CEO is the largest change agent at a company, and require a CEO who it believes is a top level executive and agent of change, high quality business, and compelling valuation in order to invest. Brahman combines this idiosyncratic long strategy with a short portfolio focused on alpha generating, single name stocks led by a dedicated short team.

NWI Management LP is a New York based global macro manager with an emphasis on emerging markets. The Emerging Market Currency Fund (55) is a $1bn hedge fund.

Wynnefield Capital, Inc. is a New-York-based investment advisor to a $70m offshore hedge fund (49) focused on US public-equity markets and exchange traded funds. The fund is a value investor, specializing in U.S. small-cap companies.

Zimmer Partners’ ZP Offshore Utility Fund, Ltd. ( 64) is one of four feeder funds to a $7.7bn Master Fund. It was nominated for an award by Investors Choice last year for Specialist Equity Fund over $1bn.

Advantage Advisers Global Growth, L.L.C. (70) is a $122m equity long/short hedge fund focused on global growth companies, and Alkeon Capital Management, LLC serves as investment advisor for the fund.

Amongst the geographically specialist funds is Sierra (51) of New York investing in European equity, and Allard Partners’ Allard Growth Fund (57) that may be the oldest Cayman Islands Mutual Fund managed from Asia (Hong Kong and Sydney Australia). Allard Growth Fund takes an absolute return approach to investing in Asia. Adelphi Capital illustrates a trend of the maturing hedge fund industry as it has converted to a family office. The Adelphi Europe Fund (66) has the general partners residual capital in it.

Other funds in the third table above: Atlas Point Global Equity Income Fund, LDC (58 ) is a Cayman Islands exempted limited duration fund from CIBC. The Goldman Sachs Fund listed (62) is an umbrella fund for fixed income products. Icatu ib Global Fund (63) is an umbrella fund for various types of wealth management funds run by the Brazilian bank. Fifth Avenue Multi-Strategy Offshore Fund (65) is a $241m equity-type fund run on behalf of Bessemer Trust. The Lion Fund (69) is associated with KNM Services Inc.

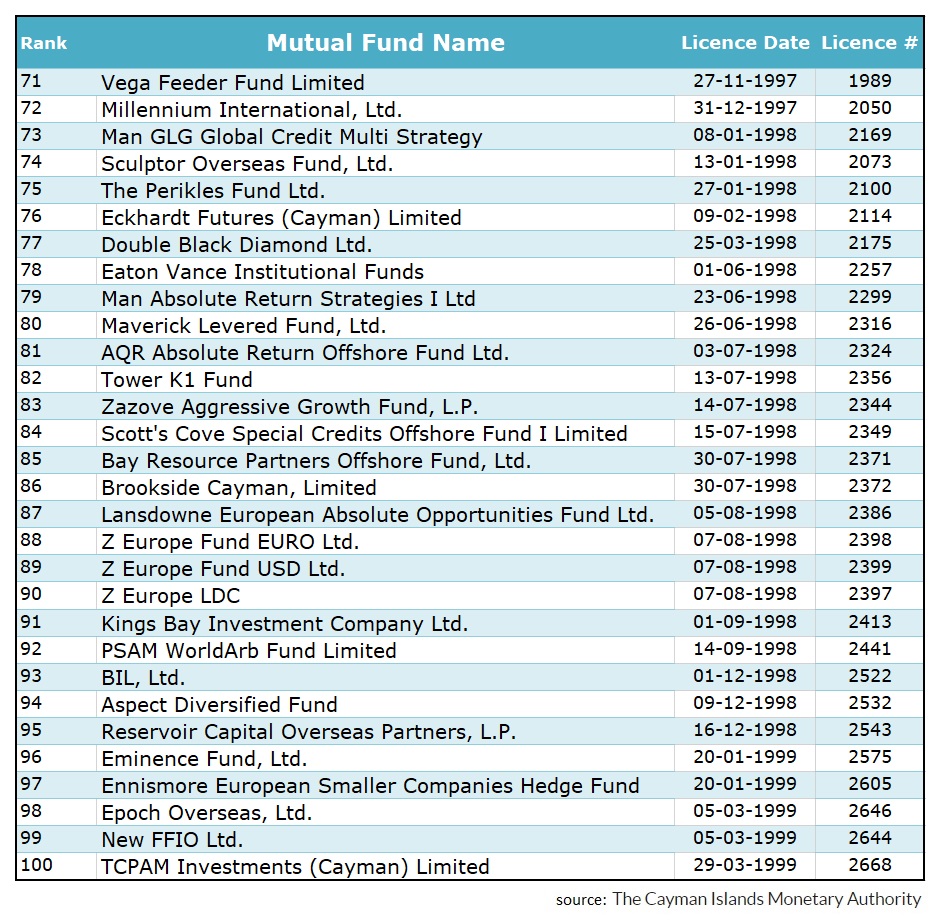

For Vega Feeder Fund (71) see older Vega fund (46) above.

Millennium International Ltd. (72) is a $9.8bn offshore fund advised by Izzy Englander’s Millennium Management. Millennium Management LLC is one of the world’s largest hedge fund management group with assets under management of $58.1bn. Millennium uses the approach of many teams (well over 200) each applying their own technique to markets. In this the firm adds value through risk measurement and varying allocation of capital.

Quant giant AQR launched its first registered offshore fund in 1998 (81). The latest Form ADV showed AUM of $119.4bn, and the firm has 30 registered Cayman Islands Mutual Funds and 21 Master Funds.

Two funds from Man GLG crop up in the last 30 funds of the 100 oldest Cayman Islands Mutual Funds. Danilo Rippa is the portfolio manager at GLG who runs the Man GLG Credit Multi-Strategy Fund. The Master Fund’s investment program is implemented through convertible arbitrage, capital structure arbitrage, credit relative value, distressed, event-driven, volatility arbitrage and other relative value strategies. The offshore Master Fund version of this fund has $355m in assets, whilst the UCITS version of this fund was wound up in January 2023. The second hedge fund from Man GLG, the Man Absolute Return Strategies I, is a fund of hedge funds run by the Man-Glenwood side of the business.

In the last group under consideration there are two CTAs of contrasting scale – the $200m Eckhardt Trading of Chicago and the $7.5bn Aspect Capital of London (#94). Bill Eckhardt maybe best known for his role with Richard Dennis in training commodity traders in Chicago in a programme called Turtle Traders. Aspect Capital was founded by Anthony Todd and Martin Lueck, with Lueck being the L in AHL.

Quoted company Sculptor Capital Management has $35bn of asssets invested in credit, real estate and in multi-strategy.The Sculptor Overseas Fund is thought to be a feeder fund for the Sculptor Master Fund ($9.3bn).

The Perikles Fund was advised by Soditic Asset Management, and although it is still registered in Cayman it was de-Listed fron the Irish Stock Exchange in 2016.

Tokyo’s Tower Investment Management Company runs the oldest Long/Short Japanese equity hedge fund. The K1 Fund has been award-winning in its time and grew in assets so much in one year that one of its’ marketers became Japan’s largest individual tax payer – the first time in Japan that an employee rather than owner of a business topped the taxpayer ranking, in a year when the firm managed $1.5bn.

Another investor in Asian markets (including Japan) of long standing is Jamie Rosenwald of Dalton Investments LLC of Santa Monica ($3bn+ aum). Rosenwald advises Kings Bay Investment Company (#91, $63m assets) on investments which have a high margin to intrinsic value.

Zazove Associates is a $2.2bn manager that runs several offshore funds managing investments in convertibles, one of which is hedged and one of which is in high yield convertibles. Zazove Aggressive Growth Fund has assets of $87m.

Scott’s Cove Special Credits Offshore Fund Ltd. is a $1.7m event-driven hedge fund managed by Phillip Schaeffer. The associated Master Fund has $49m of assets. GMT Capital Corp., based in Atlanta, GA, is the multibillion-dollar global long/short equity investment manager of the Bay Resource Partners Funds. The offshore version of the fund has been stable in its asset base, last seen at $4.1bn a year ago.

Bain Capital Public Equity LP is investment advisor to Brookside Cayman and the latter has aum of $389m. Lansdowne Partners was one of Europe’s earliest second-wave hedge fund managers, and the founders Paul Ruddock and Steven Heinz were the original managers of it’s first fund managing European equities long/short (87). Most of the firm’s aum ($7.6bn) are long-only these days, and the European L/S fund has $388m in it. Eminence Fund Ltd. (#96, $4.7bn) and Eminence Partners LP ($647m) are feeder funds for Long/Short Equity fund Eminence Master Fund Ltd. The portfolio managers/partners within Eminence Capital of New York own 87% of the onshore feeder, Eminence Partners and 11% of the offshore feeder, Eminence Fund Ltd.

The Z Europe funds (#88-90) were long/short equity funds advised by Zug Finance AG. The EURO version of the Fund was listed as going into voluntary liquidation in 2020, and the adviser was in liquidation in February 2021. The Ennismore European Smaller Companies Hedge Fund (97) is up 1446% since inception and has doubled in price in the last ten years. The onshore version of the fund has £319m in aum.

For the WorldArb Fund (#92) PSAM stands for P. Schoenfeld Asset Management Lp of New York, one of the older firms engaged in merger arbitrage. The firm invests in catalyst-driven strategies to generate absolute returns such as distressed investing and special situations. In total it manages $2.9bn of which PSAM WorldArb Fund is 41%.

Epoch Overseas Ltd. (#98, $116m) is the offshore feeder for Epoch Master Ltd. and is exempt from full reporting to the SEC because it has US-sourced assets of less than $150m. The General Partner of Epoch Overseas is Invictus RG Pte. Ltd.

Under a previous name, BIL, Ltd (93) stood for Bracebridge International Ltd and is the Boston firm’s largest fund, being $7.2bn out of a total of $12bn. New FFIO Ltd (99) is also advised by Bracebridge and accounts for a further $1bn of firm assets. The quant-focused fixed income firm was co-founded by Nancy Zimmerman, who Forbes estimates is worth $730m in her own right.

Reservoir Capital Group is a New York-base venture capital firm that creates hedge funds and private equity firms in order to make investments. Reservoir Capital Group, L.L.C. is the general partner of Reservoir Capital Overseas Partners (95). The Capital Partnership is general partner to TCPAM Investment (Cayman), number 100 on the list, and invests principally in PE and VC.

Offshore Funds More Than Holding Their Position

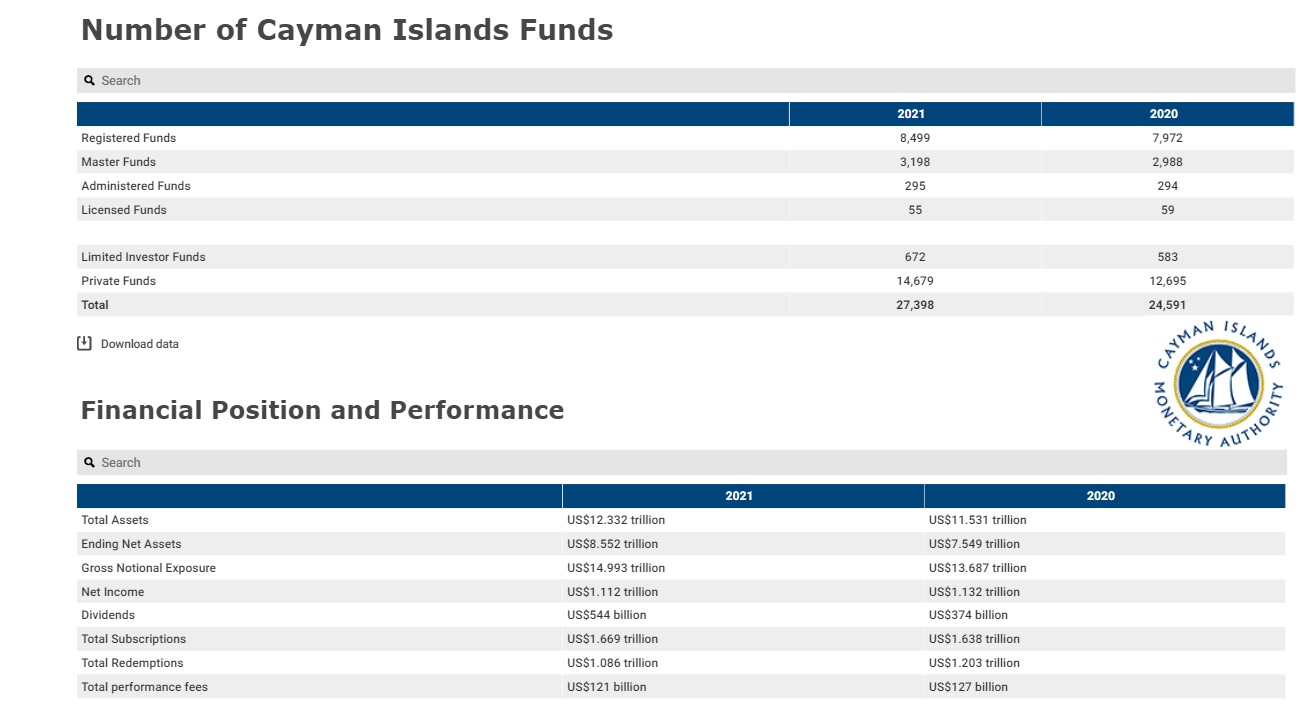

For more than a decade there has been an assumption that through changes in regulation or existing adverse regulation, such as admissability of assets for insurance companies, offshore hedge funds would diminish significantly relative to onshore hedge funds, such as LLPs/40 Act Funds in the U.S. or alternative UCITS in Europe. That has not been the case, as can be seen from the graphic below:

The most recent data release from the CIMA showed 8,769 Registered CI Mutual Funds at 1Q 2023 up from 7,331 Registered Funds in 2017, and 3215 Master Funds earlier this year compared to 2,816 Master Funds five-years previously. Cayman-based funds are in the leading jurisdiction in offshore investment funds by some margin, and that lead is getting larger.

E&OE – data sources are necessarily limited. If you represent a manager listed here and you see an error of fact please contact HFI to update.

*Data as of September 2022 from Cayman Islands Monetary Authority.