From Eurekahedge European fund managers recorded net asset outflows of US$4.3 billion while registering performance-based gains of US$2.8 billion during last month. Total assets in European hedge funds stood at US$480.9 billion as of June 2019, below their January 2018 high of US$577.5 billion. On a year-to-date basis, European hedge fund managers have seen performance-driven gains of US$13.1 […] Read more »

Large Hedge Funds Bear The Brunt of Redemptions – Graphic of the Day

Differential Performance Noteworthy at Half Year Point – European CTAs Suffer

By Hedge Fund Insight staff At the half way point of the year, in terms of consolidated data releases, the picture for hedge funds at the top level looks okay – broad hedge fund indices are flat (e.g. the HFRI Asset Weighted Composite Index is up 1.35%), and flows have been positive (over $17bn in […] Read more »

Hedge Funds in Europe in Graphics in 2018

For 2008 it has been estimated by data provider Preqin that Europe-based investors allocated a combined €175bn to hedge funds; today there are over 1,100 institutional investors in Europe actively investing over €404bn in hedge funds – a huge increase since the GFC. In 2017 Preqin produced a study with AIMA looking at employment in the hedge fund sector; the study estimated that […] Read more »

Graphic of the Day: Consistent Flows to Medium-Sized Hedge Funds

By Hedge Fund Insight staff The global hedge fund industry has attracted US$342.1 billion of net asset flows since January 2013, out of which billion dollar hedge funds accounted for US$206.9 billion of these net capital allocations, while funds with assets under US$500 million collectively recorded net asset inflows of US$49.3 billion over this period. There […] Read more »

Churning of Asian Hedge Funds Takes Its Toll

By Hedge Fund Insight staff Only hedge funds based in North America had positive flows in both the first and second quarters of this year, according to data from Preqin. Net net hedge funds in Europe had positive flows in the first half of the year and hedge funds based in Asia-Pacific had net […] Read more »

Demand for European Hedge Funds Increases

By Hedge Fund Insight staff Hedge Fund Insight has commented this year on Emerging Market (EM) hedge fund returns and capital flows in the context of the six month rule (see Emerging Market Hedge Fund Demand – The Six Month Rule in Action). The monthly report from eVestment on hedge fund industry capital flows remarked […] Read more »

Hedge Fund Industry Infographic from Preqin with 2017 Outlook

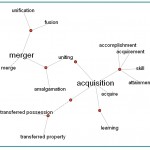

Spotlight on Merger Arbitrage at Paulson & Co

By Hedge Fund Insight staff Introduction – Part One This article is divided into three parts. The first part is the genesis of the article – the new supply of funds engaging in the strategy of merger arbitrage, including one from Paulson & Co. The second part is John Paulson’s writing on the strategy […] Read more »

Hedge Fund M&A … Deals Are Flowing

By Madison Street Capital 2016 is gearing up to be one of the most active years in terms of M&A activity for the hedge fund industry. Propelled by the wave of transactions in the fourth quarter of 2015, many positive factors are leading indicators that M&A deal momentum will continue, positioning 2016 to be a […] Read more »