By Simon Kerr, Publisher of Hedge Fund Insight

Bfinance the investment consultant* has recently published its Market Trends Quarterly. In the manager search trends the latest quarter has seen a continuation of strong appetite for private markets strategies, even though recent declines in public markets have left investors with heightened exposures to illiquid assets. Indeed, 61% of all new manager searches over the past 12 months have targeted private markets strategies, up from 45% the previous year.

Demand for private market strategies has remained extremely strong. By taking a growing share of new search activity, this illustrates investors’ desire for rate sensitivity (floating rate debt), according to bfinance. The consultancy notes that in particular private debt represents an increasing proportion of new manager searches from their clients. Implicitly investors are trusting in the ability of high-quality managers to maintain low default/high recovery rates through a period of economic difficulty.

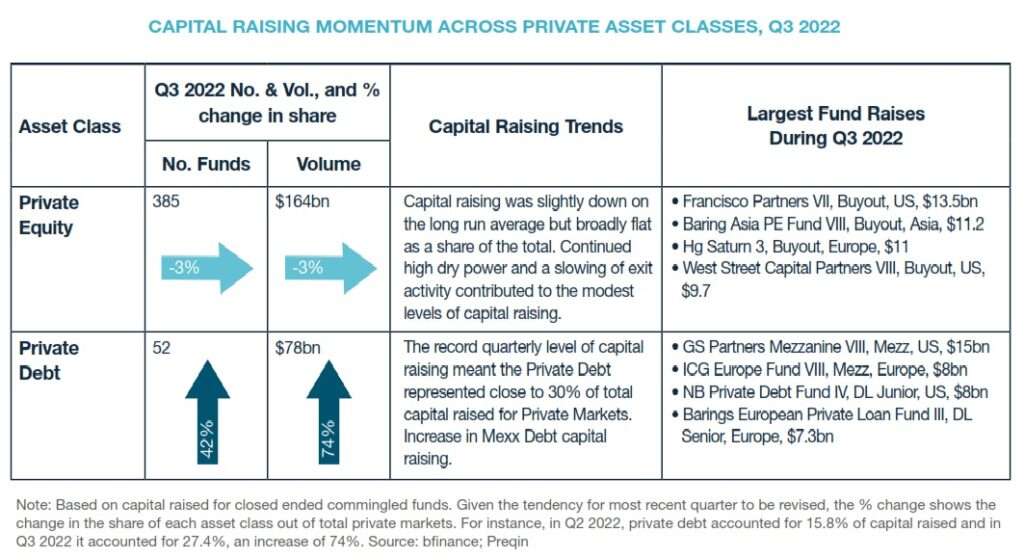

Searches in this sector spanned classic direct lending and more esoteric or ‘niche’ strategies such as leasing, royalties, bank regulatory risk transfers and more. Indeed, 22% of private debt searches targeted trade finance, drawn by its short duration profile and higher yields. The momentum of private debt growth is reflected in the capital raising in the 3Q shown in the graphic below:

Looking more broadly at fixed income, the bfinance data shows a two-year trend from investment grade strategies towards higher yielding sectors, including high yield bonds and leveraged loans. But the consultants expect that the picture will be rather different for the coming twelve months given the higher yields in conservative securities.

Bfinance has some comments on other hedge fund strategies in the Market  Trends Quarterly. Bfinance classifies global macro hedge funds and commodity trading advisors (CTAs) as Divergent alternative investment strategies. GM and CTAs continued to deliver strong performance into the 3Q of 2022, providing resilience amid bond and equity market declines. The consultant notes that these strategies delivered some of the strongest performance seen since the depths of 2008. However, “we are yet to see a significant uptick in manager searches in this space, but expect to see robust appetite as investors consider their overall portfolio strategy over the coming years,” notes the Trend Report.

Trends Quarterly. Bfinance classifies global macro hedge funds and commodity trading advisors (CTAs) as Divergent alternative investment strategies. GM and CTAs continued to deliver strong performance into the 3Q of 2022, providing resilience amid bond and equity market declines. The consultant notes that these strategies delivered some of the strongest performance seen since the depths of 2008. However, “we are yet to see a significant uptick in manager searches in this space, but expect to see robust appetite as investors consider their overall portfolio strategy over the coming years,” notes the Trend Report.

Rather, within hedge funds, the focus has been on defensive themes and multi-strategy or multi-manager styles. This is consistent with the flow information from other sources that the large multi-strategy hedge fund groups have had net inflows this year. Bfinance noted that Quantitative Multi-strategy funds were the standout performer here, gaining +11.7% in year-to-date returns. It is unclear exactly how much trend-following type strategies buoyed this quantitative sub-set of multi-strategy managers, but it will have been a positive contribution to these figures.

Only two weeks ago Hedge Fund Insight published an article reflecting the pick-up in interest in private debt from wealth managers, though based on a survey from the 1Q. The bfinance Market Trends Quarterly shows a similar pick-up in interest from pension funds and other institutional investors, but this time on a much more timely basis, and with more predictability about the capital flow outcomes as searches lead to mandates.

* About bfinance

bfinance is an award-winning specialist consultant that provides investment implementation advice to pension funds and other institutional investors around the globe. Founded in 1999, the London-headquartered firm has conducted engagements for more than 450 clients in 43 countries and has 10 offices globally. Services include manager search and selection, fee analysis, performance monitoring, risk analytics and other portfolio solutions. With customised processes tailored to each individual client, the firm seeks to empower investors with the resources and information to take key decisions. The team is drawn from portfolio management, research, consultancy and academia, combining deep sector-specific expertise with global perspective.