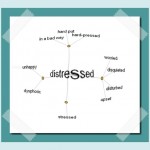

By Hedge Fund Insight staff Blackrock has initiated a Global Private Markets Survey* covering respondents from public pensions, corporate pensions, insurers, family offices, foundations and endowments, and sovereign wealth funds. The key graphic was this one: Distressed Investing and Direct Lending are seen by institutional investors as amongst the best opportuities in private credit. […] Read more »