From Insight Investment The Bank of Japan (BoJ) announced on 31 October that it would dramatically increase the scale of its quantitative easing (QE) programme. Passed by a majority 5-4 vote of the BoJ’s Policy Board, it announced the intention to purchase ¥80 trillion (£440bn) of Japanese government bonds a year, marking an increase […] Read more »

Hedge Fund Performance Fees – A Growing Problem

By FundCalcs/ Global Perspectives Introduction Hedge funds’ performance fees are a key component of every fund’s Net Asset Valuation calculation. Since the economic crisis of 2008, hedge fund performance and incentive fees have become more complex. The standard “2 and 20” fee model is often not the case anymore. This has meant calculations on […] Read more »

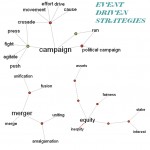

Targets For Event Driven From Following The PE Spotlight In Europe

From PitchBook Data, Inc./Merrill DataSite Private Equity Hotspots – UK for deals, Southern Europe for Fundraising, IT for Growth Deals, Bolt-Ons for Buyouts 2014 hasn’t been the banner year industry professionals were expecting in Europe. Private equity (PE), venture capital (VC) and growth investment deal counts were soft in 3Q, which likely means that […] Read more »

Institutional Flows Power Growth for Claren Road, MKP Capital and BlueCrest in Credit

By Hedge Fund Insight staff In all investment strategies of the hedge fund industry the big have got bigger. The growth of assets has tended to be dominated by the top managers, whether in CTAs, macro or multi-strategy. In the period since the Credit Crunch of 2008-9 this long-term trend has accelerated. Between the […] Read more »

Event Driven Funds Give Back in October

Simplify Mid-Month Pulse 780 Funds Reporting as of October 17 2014 Strategy Return Macro – Discretionary Down (2.41%) Macro -Systematic Up 3.68% Macro – Commodity Down (1.15%) Emerging Markets Down (2.28%) Fixed Income – Rel Val Down (3.29%) Asia Long-Short (ex-China) Down (6.05%) Europe Long-Short Down (3.36) China Long-Short Down (1.9) Event Driven – Special […] Read more »

Social Media Is No Longer Optional, Even For Managers Of Private Funds

By Krysten Merriman, Marketing Director of Meyler Capital We hear plenty of objections from asset managers about why they don’t think social media is relevant to their business. For example: “Our target market isn’t on social media.” Oh really? You may be surprised to hear that the fastest growing demographic on twitter is the […] Read more »

European M&A Targets in 2H 2014 – Graphic of the Day

The following graphic is taken from “Deal Drivers EMEA” published by Remark, a division of mergermarket. Mergermarket’s H1 2014 Heat Chart, which tracks ‘companies for sale’ stories, shows that there are likely to be strong appetites for dealmaking over the coming months. Activity is spread throughout a range of sectors and countries, indicating that the […] Read more »

Bridgewater’s Leadership In Building Firm Culture & Commitment To Training

By Simon Kerr, Publisher of Hedge Fund Insight Increasingly, large hedge fund groups have to be structured in how they address staffing issues. Nearly a year ago Citi Prime Finance commissioned research for a paper titled “Exploring the Concept and Characteristics of People Alpha” – the result of having surveyed 24 large and medium-sized […] Read more »

Legal Developments in Activist Investing

By Schulte Roth & Zabel LLP (“SRZ”) M&A partner David E. Rosewater, co-head of the firm’s global shareholder activism practice, along with investment management partner Stephanie R. Breslow and litigation partner Michael E. Swartz comprised the “Shareholder Activism” panel at SRZ’s 23rd Annual Private Investment Funds Seminar in January 2014. The yearly conference covers […] Read more »

How European Alts Managers Can Target The Market for ’40 Act Funds

By Philip Masterson, Senior Vice President and Managing Director at SEI Investment Manager Services The $15.7 trillion United States mutual fund market represents a huge opportunity, in theory, for enterprising European alternative investment managers to bring differentiated strategies to an investor base thirsty for new ideas and solutions. These investors range from sophisticated institutions, […] Read more »