From PitchBook Data, Inc./Merrill DataSite

Private Equity Hotspots – UK for deals, Southern Europe for Fundraising,

IT for Growth Deals, Bolt-Ons for Buyouts

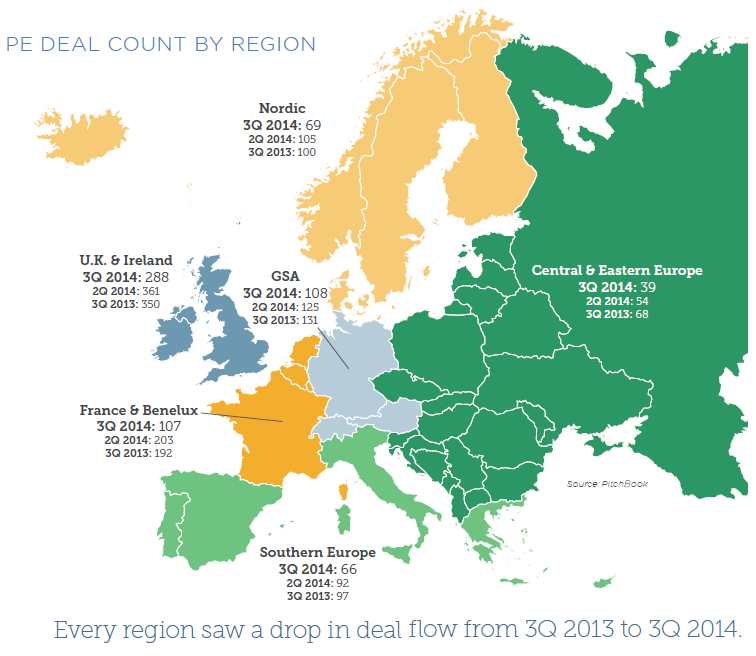

2014 hasn’t been the banner year industry professionals were expecting in Europe. Private equity (PE), venture capital (VC) and growth investment deal counts were soft in 3Q, which likely means that 2014 will end the year well below 2013 levels, both by counts and value. That’s somewhat surprising, given the optimism that investors and industry players had entering the year. Cheap credit, high levels of dry powder and renewed confidence in the European economy were supposed to spur investments; so far, no such luck.

As many have noted, PE firms were often scuttled by the strong IPO and M&A markets, which competed for and won a number of deals that may have otherwise gone to buyout shops. As long as equity prices remained high, PE investors were often sidelined. Recently, however, the public markets in Europe have swooned over slowing growth, chilling the ambitions of retail investors and strategic buyers. The competition that had been flummoxing PE, in other words, appears to be weakening, which may translate into a long-awaited uptick in PE deal counts.

As was the case in previous European Breakdowns, struggling regions in Europe haven’t seen as many deals close as industry professionals expected. Southern Europe’s woes continued in 3Q; the 66 deals logged in the quarter were the fewest since the 59 completed in 3Q 2010. Ditto for the Nordic region, whose 69 deals in 3Q were a low mark going back to the 62 completed in 3Q 2009. Stronger economies like the UK’s and Germany’s

have brought in higher deal counts. It seems that, for all the talk of a private equity playground in Europe, only the strongest economies have withstood the concerns so far.

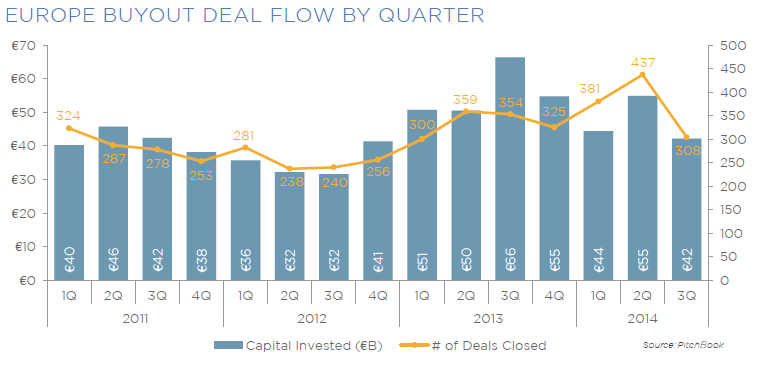

That said, we can’t discount what industry insiders have been saying, namely that competition for deals in Europe is heated. Credit has become much more available for buyouts, both from European lenders and opportunistic U.S. firms heading overseas. Paired with the amount of dry powder in the industry, investors have been able to stretch more to land large deals; through 3Q, 13 buyouts have been completed valued at over €1 billion, which puts 2014 ahead of the overall numbers seen in 2009, 2010 and 2011.

Fundraising, a harbinger of future investment activity, was level in 3Q by fund counts. Perhaps the more telling statistic comes when looking at fundraising trends by region; Southern Europe, the hardest hit by the crisis, has seen more funds raised this year than all of last year, and the Nordic, GSA and France/Benelux regions are set to match or eclipse 2013 levels, as well.

Growth Deals

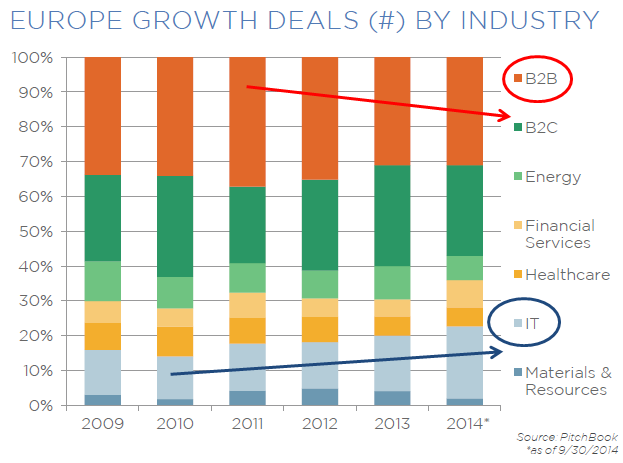

By both count and value, growth deals continued their downward slope in 3Q. Fifty-eight minority deals were made in the third quarter, a low mark since the 52 completed in 2Q 2009; About €2.3 billion was invested through those 58 3Q deals, the second lowest amount since the financial crisis. Growth deals have been waning in recent quarters, due in large part to a lack of strong fundamentals across several economies that are needed to spur minority investments. Instead, PE firms have opted to purchase struggling companies or acquisitively build their existing investments through bolt-on deals. A couple of trends have emerged over recent years – a decline in B2B growth deals and more of the growth deals taking place in the IT sector.

Buyout activity has largely recovered in recent quarters. 3Q witnessed 308 LBOs worth a combined €42.3 billion, with both figures down from the previous quarter, but in line with most quarterly figures dating back to 4Q 2012. The U.K./Ireland region saw the most LBO activity with 38%, with the France/Benelux and Nordic regions bringing in the second and third most, at 23% and 14%, respectively. Southern Europe was home to only 8% of LBOs in 3Q.

European buyout shops have indirectly benefitted from market forces affecting more traditional financing sources. Large banks have had to retrench their financing activity following the crisis, and PE firms have been able to fill the void. In tandem, debt has become much more available to buyout shops, which have utilized high-yield bonds and unitranche lending facilities to finance their deals. Additionally, U.S.-based lenders have begun voyaging across the Atlantic more to finance European LBOs, which has only increased PE confidence in the region.

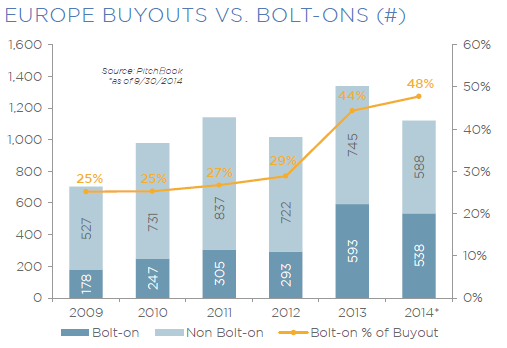

Besides platform buyouts, European PE firms have also made more bolt-on deals recently. Almost half (48%) of all control investments in 2014 have been bolt-on deals, which numbered 538 through 3Q, easily on pace to go past the 593 made last year. As we’ve noted in previous European Breakdowns, the ‘buy and build’ strategy has become more popular on the continent. Acquisitive growth is an easier route for PE-backed platforms, at least compared to organic growth, which has been lacklustre over the past several years. In terms of potential bidders, it is increasingly likely that the PE firm engaged in a buy-out already has some exposure to the sector of the target in an existing investment.

This article is edited from the report “Pitchbook Q4 European PE Breakdown”. We hope the data and commentary in this report proves helpful and informative in your decision-making process in the coming quarters. As always, if you have any comments, questions or suggestions, drop us a line at research@pitchbook.com.

About PitchBook Data

PitchBook Data, Inc. is the foremost provider of global data and research technology for the private equity, M&A and venture markets. PitchBook provides its clients with the highest-quality information on the entire investment lifecycle through its award-winning, web-based PitchBook Platform. Better Data. Better Decisions.