By Hedge Fund Insight staff Over the past three years Schroders has been tracking the default defined contribution (DC) investment strategies of the UK’s top 350 listed companies every six months to monitor change in asset allocation. Schroders note that “firms are making steady progress towards more diversified investment strategies, which we believe will help deliver […] Read more »

A.M. Best Comments on Insurers’ Hedge Fund Activity: Road Ahead Looks Rocky

By Ken Johnson, CFA, CAIA, FRM, Vice President, A.M. Best. Headlines reflecting the recent underperformance from the hedge fund industry have caused insurers to rethink their current investment allocations, and whether or not to add allocations to this non-traditional asset class going forward. However, the ongoing low interest rate environment and more recent equity volatility have […] Read more »

Hedge Fund Stats of the Day – 408 and $18bn

By Hedge Fund Insight staff S&P Global Market Intelligence Quarterly Hedge Fund Tracker Findings*: Hedge Funds Sell Off Equity Stakes: Hedge funds have sold off significant portions of their total equity holdings, shedding over $18 billion in total equity positions from Q4 2015 to Q1 2016. This is the second consecutive quarterly equity sell […] Read more »

Spotlight on Merger Arbitrage at Paulson & Co

By Hedge Fund Insight staff Introduction – Part One This article is divided into three parts. The first part is the genesis of the article – the new supply of funds engaging in the strategy of merger arbitrage, including one from Paulson & Co. The second part is John Paulson’s writing on the strategy […] Read more »

Graphic of The Day: Axis Capital’s Hedge Fund Allocations

By Hedge Fund Insight staff In 2015 Bermudian insurer Axis Capital started to implement a shift in it’s “other investments” which had driven the variations in investment performance for the firm. The strategic shift was to reduce the exposures to hedge funds and put the capital released into direct lending, real estate and private […] Read more »

Cayman’s Share of World Hedge Funds Shrinks, Particularly For New Funds

By Hedge Fund Insight staff Recent data releases from Eurekahedge show the increasing significance of onshore hedge funds, and the consequent relative decline of hedge funds registered offshore. Year by year Cayman Islands registered hedge funds took less share of the domiciles of funds launched. This trend accelerated post 2008 to the extent that […] Read more »

Challenges YTD For Active Managers Says GAM

From Global Asset Management March concluded a volatile quarter across financial markets, as modest headline moves in many cases belied significant intra-quarter risk reversals and choppiness. The MSCI World index closed down 0.2% for the quarter against a very steep sell-off through 11 February, followed by a reversal and strong rally into the end […] Read more »

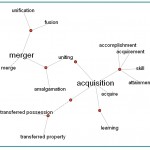

Hedge Fund M&A … Deals Are Flowing

By Madison Street Capital 2016 is gearing up to be one of the most active years in terms of M&A activity for the hedge fund industry. Propelled by the wave of transactions in the fourth quarter of 2015, many positive factors are leading indicators that M&A deal momentum will continue, positioning 2016 to be a […] Read more »

Hedge Fund Groups Still Largely Ignoring Social Media Opportunities

From Peppercomm Hedge funds are becoming a hot topic on social media, though hedge funds themselves still sit on the sidelines. In a just-released survey of trends in hedge fund communications, communications and marketing firm Peppercomm found conversations about hedge funds happening in 2015 at never-before seen levels on social media. The media analysed were […] Read more »

VAT Year-End Approaching: Are Hedge Fund Managers Ready?

By Kamlesh Chauhan, Senior Manager, Haysmacintyre The rules governing VAT are continually changing due to new VAT legislation being introduced, updates in HMRC’s guidance and interpretation and various case law precedents and decisions being released over time. Hedge fund businesses will often not have considered their VAT position in any detail for a number […] Read more »