By Hedge Fund Insight staff

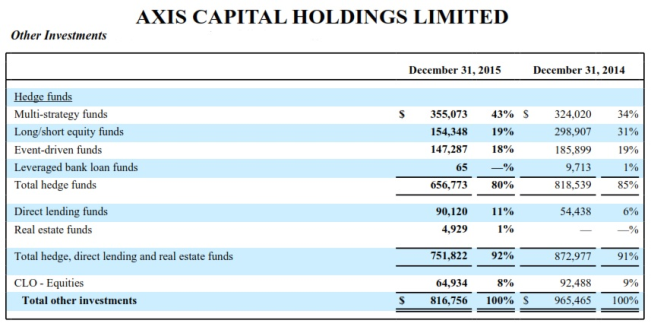

In 2015 Bermudian insurer Axis Capital started to implement a shift in it’s “other investments” which had driven the variations in investment performance for the firm. The strategic shift was to reduce the exposures to hedge funds and put the capital released into direct lending, real estate and private equity, which Axis Capital described as having higher expected returns.

The company’s Form 10-K for end-2015 states that the $162 million decrease in the fair value of hedge funds in 2015 was driven by $180 million of net redemptions offset by $18 million of price appreciation. Axis Capital chose to redeem from half of it’s equity hedge funds rather than scale back across all the portfolio of hedge funds. There was also an active decision taken to switch some capital from event driven funds to multi-strategy hedge funds.

Axis has made total commitments of $310 million to managers of direct lending funds. To date, $88 million of this commitment has been called. The Bermuda-based insurer has made a total commitment of $60 million as a limited partner in a multi-strategy hedge fund, of which $48 million has been called to date. During 2015, Axis Capital made a $100 million commitment to a real estate fund, of which $5 million has been called to date.

Net net Axis Capital was reducing exposure to equity focused hedge funds and increasing capital commitments to alternative lending/credit strategies.