By Hedge Fund Insight staff

Introduction – Part One

This article is divided into three parts. The first part is the genesis of the article – the new supply of funds engaging in the strategy of merger arbitrage, including one from Paulson & Co. The second part is John Paulson’s writing on the strategy of merger arbitrage in a general sense. This strategy overview was written in 2005, but the principles still apply. And thirdly a look at how John Paulson turns the generalised framework into actually running a fund engaged in merger arbitrage.

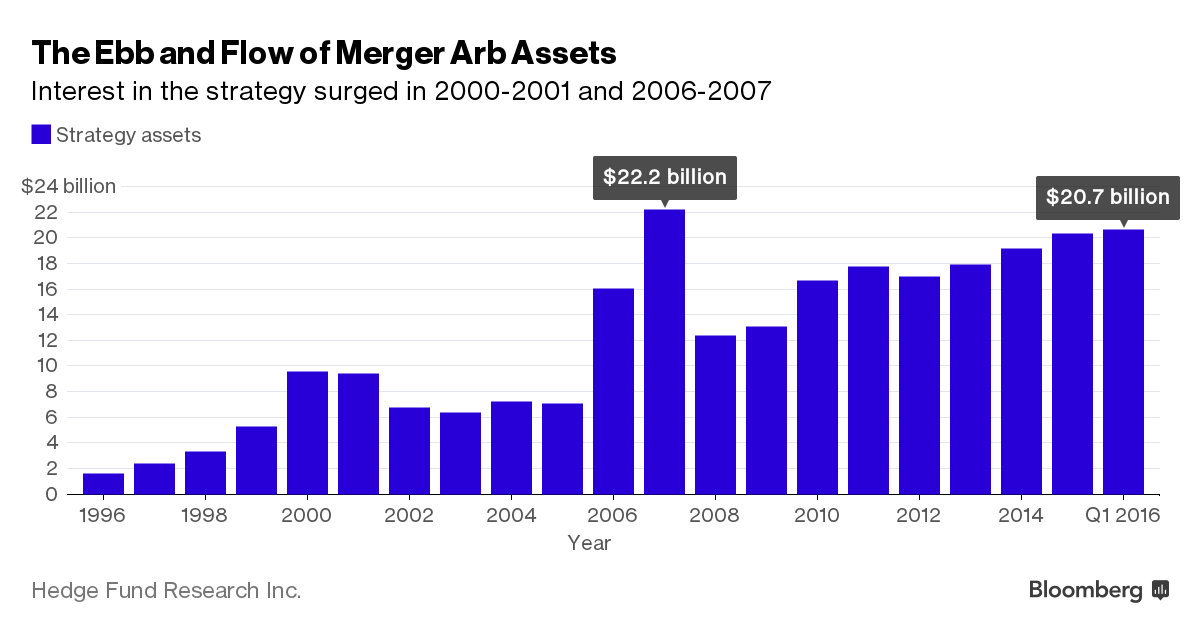

This week Bloomberg published an article on merger arbitrage coming back into fashion among investors. The graphic accompanying the article is below, followed by the relevant extract:

Billionaire John Paulson’s Paulson & Co., Manikay Partners, a $1.9 billion firm led by Shane Finemore, and Arrowgrass Capital Partners have all raised new funds to speculate on corporate mergers, saying the return expectations are higher than they’ve been for years, according to people familiar with the firms. Multistrategy firms like Taconic Capital Advisors, Farallon Capital Management and Och-Ziff Capital Management LLC have also increased their allocation to mergers.

Merger arbitrage strategies, which generally bet that a target company’s shares will climb toward the offer price and the bidder’s will fall, are among the best performers this year, returning 1.3 percent in the first quarter, while the industry overall is slightly down. Yet returns may falter if merger activity slows.

Part Two – “The “Risk” in Risk Arbitrage” by John Paulson*

One of the great practitioners in risk arbitrage, seasoned by over 40 years of investing, once said to me, “risk arbitrage is not about making money, it’s about not losing money”. In effect, the true skill in risk arbitrage is about avoiding losses. And to avoid losses, one must understand, evaluate and manage risk.

Risk arbitrage1, or merger arbitrage, entails capturing the spread between the price an acquirer has agreed to pay for a target and the price the target trades at after the deal is announced. In a cash deal, the arbitrageur would merely buy the target at a discount to the cash offer price and exchange the target stock for cash at its completion. In a stock deal, the arbitrageur would buy the target and, in order to lock in the spread, short the acquirer in an amount equal to the number of shares the arbitrageur is due to receive in exchange for the target’s shares. The spread is the discount the target trades at to the merger consideration and can be expressed in either absolute, percentage or annualised terms.

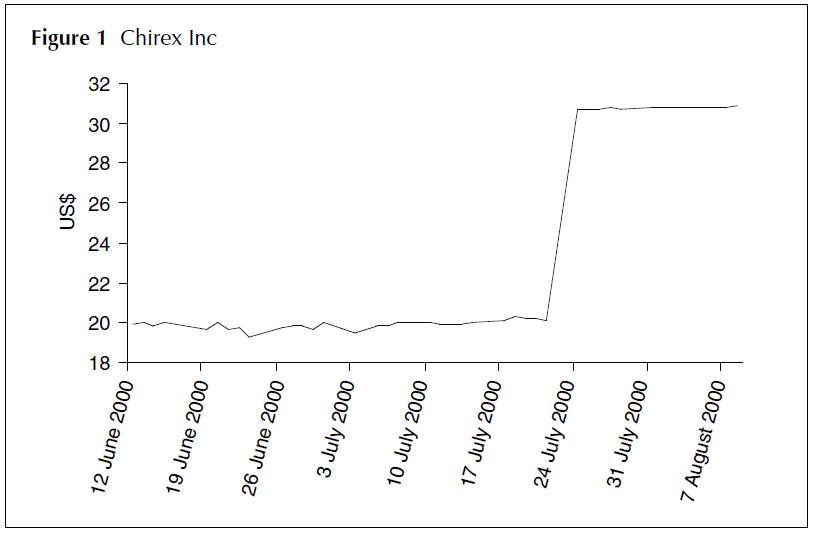

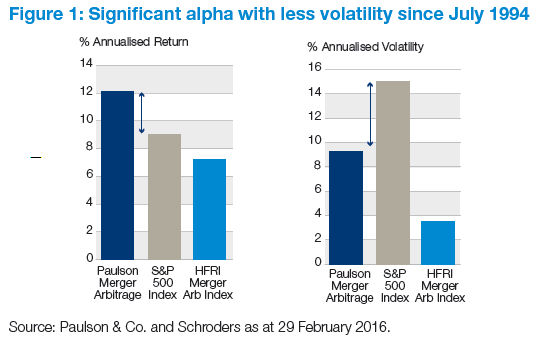

Since spreads are typically small in relation to the premium paid in a deal, the downside one takes to earn the spread can be significant. The graph in Figure 1 illustrates the magnitude of the risk/return trade off in a typical transaction.

In this example, Chirex Inc, a US-based pharmaceutical service provider, agreed, in a cash tender offer, to be acquired on July 24, 2000 by Rhodia SA, a French specialty chemical manufacturer, for US$31.25. Chirex stock jumped 101⁄2 points on the day of the announcement, from 201⁄4 to 30 3⁄4. The spread, at US$0.50, provides a gross return of 1.6% and an annualised return of approximately 17%, assuming a 35-day close. However, many factors can affect the rate of return. If the deal incurs delays and takes three months to close, the annualised return will fall from 17% to 6%. If the price is subsequently cut to below US$30.75, the deal will turn from a profit to a loss. Or, in a worst case scenario, the deal might break altogether and the stock will fall to its pre-announcement levels or lower. The “risk” in risk arbitrage is therefore anything that affects the deal’s completion, the timing of completion, or the amount of consideration received at completion. The magnitude of the risk can be substantial. In the Chirex example, the potential loss, as measured by the premium, would be US$10.50, or 21 times the potential gain.

What should be apparent from this example is that risk arbitrage is not for the average investor. The potential downside is substantial in relation to the small upside.

Using the economics of the previous example, if one were right 95% of the time in similar situations, one would only break even. The average investor may not be able to accurately assess the myriad of risks in a transaction and would be likely to lose money in this strategy. Paradoxically, the reward for the experienced manager would be stable, non-correlated returns with less volatility than the market, but able to provide comparable returns over the long term.

To manage the “risk” in risk arbitrage, one must first identify the specific risks, and then manage risk in a way that produces the desired returns. We divide risk into two general categories:

• macro risks, which pertain to general economic forces such as market volatility, interest rates, exchange rates and commodity prices; and

• micro risks, which pertain to the specific transaction such as earnings, financing and regulatory issues.

MACRO RISKS

Market

In merger arbitrage, one can generally hedge market risk by investing in announced transactions. In cash deals, the consideration is fixed, while in stock deals the consideration can be fixed by shorting the acquirer’s stock in an amount equal to the merger ratio. By locking in the spread, the expected returns are earned regardless of the direction of the market, as long as the deal closes. Sometimes, the ability to lock in a spread in stock deals can be more difficult because the ratio is not fixed and is subject to a pricing period, or a collar structure, in which the amount of stock issued will vary. However, by matching the short sales to the terms of the collar or the pricing period, the consideration can generally be locked in.

While small market movements may have minimal effect on transactions, a sharp movement, either up or down, may increase the risk of deal completion. A rapidly falling market, for example, may cause merger financing to dry up, or may cause buyers to re-evaluate the merits and/or the price of an acquisition. In September 1998, the high yield market almost shut down completely and banks used market-out covenants to rescind financing commitments, causing many leveraged buyouts to break. Similarly, financial buyers may try to negotiate a lower price if they think they can buy the company cheaper. Generally, in a rapidly falling market, cash spreads may widen due to the increased macro uncertainty while spreads in stock deals may contract or stabilise due to the “cushioning effect” of the gains realised on the short side.

A rapidly rising market can create problems in arbitrage as well. For example, the Internet fever of 1999 caused rapid run-ups in the stock price of many buyers, causing the target’s stock price to rise to levels where huge loses would be incurred if the deal were to break. The rapid increase in the potential downside caused spreads in certain deals to widen. In January, 1999, the At Home acquisition of Excite was announced. At Home ran from US$50 on the day of announcement to over US$94. This caused Excite to rise from the mid-US$60s before the deal was announced to over US$170, creating potential downside of over US$100 per share. The spread responded accordingly and widened from US$8 when the deal was announced to US$30. Numerous other examples exist including, most recently, JDS Uniphase’s acquisition of E-Tek Dynamics and JDS Uniphase’s proposed acquisition of SDL Inc.

Interest Rates

A rise in interest rates negatively affects certain deals and is a red flag in arbitrage. Higher interest rates will make financing more difficult, affecting the ability of borrowers to incur debt, and increasing the cost of debt. Higher interest rates will also negatively affect earnings for certain industries, such as banks, insurance and automobile companies. Difficult financing conditions, combined with negative earnings surprises, may cause buyers to terminate deals and cause the stocks of targets to collapse.

Other Economic Factors

Commodity prices, exchange rates and other economic factors may negatively affect the profitability of particular industries, which in turn could increase the probability of deal termination. To avoid losses, arbitrageurs must be aware of these trends and the impact they may have on targets.

MICRO-RISKS

There are many risks pertaining to particular transactions that may give rise to a deal breaking. After 20 years in the merger or risk arbitrage business, I still uncover new risks because markets are always evolving. However, I have attempted to highlight some of the important risks that may affect a deal’s outcome.

Earnings

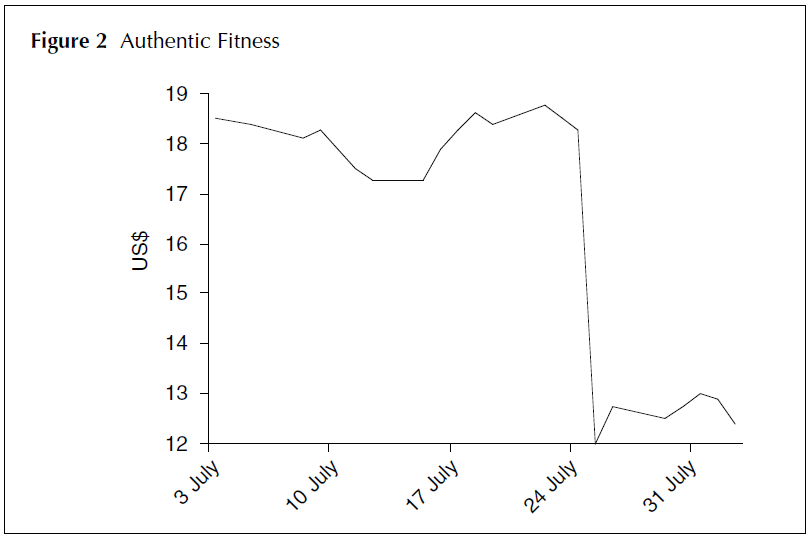

One of the most common reasons for a deal to break is due to an unexpected decline in the target’s performance. Buyers typically value an acquisition based on a multiple of earnings and the projected growth in earnings. If, between the announcement of a deal and its closure, the target fails to meet the buyer’s earnings expectations, the buyer may attempt to negotiate a lower price or terminate the transaction. The result can be devastating. The example in Figure 2, while one of many, illustrates the risk of an earnings disappointment. In this case, the Warnaco Group cancelled its purchase of Authentic Fitness Corporation (AFC) and stated, “After it became clear that AFC will report a loss for its fourth quarter and report earnings below street estimates for its fiscal year, the board unanimously concluded to terminate the merger agreement”.

Financing

In cash transactions, the ability to finance the purchase of the target may, in certain circumstances, pose a substantial risk to deal completion. While all buyers believe they can raise the money at the time of announcement, a rise in interest rates, an earnings decline in either the target or the acquirer, or a decline in the stock market may all cause financing difficulties. In a recent deal, PSC shares plunged after Welch Allyn called off the merger as it “was unable to obtain sufficient financings” (see Figure 3).

Legal

A thorough understanding of legal issues is imperative to evaluate the risks in a transaction. Such issues include the specifics regarding tender offers, exchange offers, cash mergers, stock mergers, spin-offs, state takeover statutes, corporate by-laws and articles of incorporation. One must also be familiar with litigation risk as the buyer, or the seller, may be involved in litigation which could affect the deal’s completion. Consider the US$145 billion judgment against Philip Morris in Florida State Court, announced after Philip Morris agreed to buy Nabisco, or the US$800 million patent infringement suit filed against Seagate in the midst of its proposed merger with Veritas. An understanding of a broad spectrum of legal areas is paramount in assessing the risk of a transaction.

Premium

The premium the acquirer pays for the target can be used as a starting point in estimating the downside risk if the deal fails. Generally, the greater the premium, the greater the downside risk. Premiums of 75%, 100% or even 150% are not uncommon in risk arbitrage. In such situations, the arbitrageur must carefully weigh the risk/return trade-off and avoid those situations where the return is not adequate for the risks assumed.

Merger Agreement

Not all merger agreements are created equal and, in fact, vary widely in the parties’ degree of commitment to completing the transaction. The weakest form of a merger agreement is an agreement-in-principle or a letter-of-intent, both of which virtually allow either party to walk from the transaction at will. Even definitive agreements can vary widely as to the circumstances under which the buyer can walk from a transaction. Merger agreements must be examined closely to investigate any due diligence conditions, any performance tests, material adverse change clauses, drop-dead dates, walk-away provisions, and regulatory outs. Clearly, the tighter the merger agreement, the greater the certainty of deal completion.

Taxes

A dollar in cash is not always a dollar in cash. The after tax proceeds to the investor can vary widely, depending on the tax structure of the transaction and the tax status of the shareholders. This is especially true as more and more transactions are cross-border deals involving multiple tax codes and investors of different nationalities. For example, the receipt of cash in a merger may sometimes be taxed as a dividend and not as a capital gain. While this may have limited impact on a US fund, it could be disastrous for an offshore fund which, although it incurs no tax on capital gains, is subject to a 30% withholding tax on dividends. Consider the situation where the arbitrageur buys Company A for US$19.50 and sells it to Company B for US$20.00, earning a US$0.50 spread. If the transaction is taxable as a dividend, 30% of the US$20 (ie, US$6.00) will be withheld by the depository and paid to the IRS. Instead of a US$0.50 gain, this example will provide a US$5.50 loss for the offshore investor.

Consideration

While most deals involve either all cash or all stock, there are a near infinite number of possible permutations. Merger consideration could include:

• a mixture of cash and stock in fixed proportions;

• cash and stock in fixed amounts subject to proration;

• cash and stock in unlimited proportions;

• fixed dollar amount of stock subject to a collar;

• fixed dollar amount of stock subject to a pricing period;

• fixed ratio of stock with a dollar cap;

• stock and a spin-off;

• stock, a spin-off and debt; and

• stock, a spin-off, debt and cash.

The risk the form of consideration poses to the arbitrageur is in the ability to lock in the value of the consideration at the time of closing to ensure a positive spread. This may not always be possible if the consideration does not trade, is illiquid, is contingent, is based on a random pricing period or is subject to an unknown proration. The following quotation from the press release regarding the acquisition of Trimark by AMVESCAP highlights how complex the form of consideration can be:

AMVESCAP will offer Trimark shareholders a mix of consideration valued at approximately CDN$27.00 per share. Total consideration will include a fixed amount of cash of approximately CDN$760 million and, at current prices, approximately CDN$1.97 billion in shares or other AMVESCAP linked securities, all subject to proration. Trimark shareholders may elect either AMVESCAP Ordinary Shares or shares of an AMVESCAP Canadian subsidiary which are exchangeable into ordinary Shares (“Exchangeable Shares”). If the trading price of the underlying AMVESCAP Ordinary Shares increases or decreases by up to 12.5% from the current level, the number of shares to be issued will be adjusted accordingly. The final value of the consideration to be offered will be based upon the weighted average of the Canadian dollar equivalent of the trading prices of AMVESCAP Ordinary Shares on the London Stock Exchange for a period of five consecutive trading days ending the day that is three business days prior to the closing. Additionally, Trimark shareholders may elect to receive consideration in the form of up to CDN$1.3 billion in principal amount of equity subordinated debentures (“ESDs”) subject to a minimum ESD issuance of CDN$100 million. The ESDs are a form of convertible debenture security with a 6.0% coupon, three year term and a strike price at the AMVESCAP Ordinary Share price calculated as of the issue date and an appreciation cap of 20% above the strike price.

Acquirer

One must examine the acquirer as well as the target in a merger transaction. In a cash transaction, for example, one must ensure that the acquirer has the ability to raise the cash to complete the transaction. Also, one needs to know the reputation of the acquirer, as some acquirers are known for being tough negotiators and may try to negotiate the price downward given any opportunity. In stock deals, a recurring risk is that the acquirer itself may become a takeover target. This is one of the biggest risks in risk arbitrage. Since the arbitrageur is long the target and short the acquirer, a bid for the acquirer could cause the acquirer to rise and the target to fall, resulting in losses in both the long and the short side. This happened in the proposed acquisition of Ocular Science by Wesley Jensen. Only two days after the two companies signed a definitive merger agreement, Bausch & Lomb bid for Wesley Jensen, causing the deal with Ocular to break, Ocular’s stock price to fall and Wesley Jensen’s stock price to soar, leading to large losses for some arbitrageurs.

Fraud

Unfortunately, fraud is a risk that may be difficult to uncover until it is too late. While infrequent, many examples exist, including the creation of Cendant through the merger of HFS with CUC International, the proposed sales of North Face and Sunbeam, and, in the biggest fiasco of all, Bre-X. In the cases of CUC, Northface and Sunbeam, management used irregular accounting practices to overstate earnings. When the frauds were uncovered, the stocks collapsed. Bre-X was the most bizarre story of all. Advised by JP Morgan, Bre-X was billed as the largest, lowest cost and most profitable gold prospect in the world, with a value estimated by mining analysts of US$11 billion. Bre-X became the target of a fierce bidding war between Barrick Gold, Freeport McMoran and Placer Dome, with bids exceeding US$5 billion. In the end, Freeport prevailed, only to find out that the mine was a complete fraud, supposedly masterminded by an employee who then, supposedly, committed suicide. Ultimately, the stock price of Bre-X declined from a high of US$27 to zero.

Regulatory

“In the risky realm of arbitraging mergers and acquisitions, government scrutiny can be perilous and costly”, states Marcelo Price of Dow Jones (From Dow Jones News Service). Very true. Regulatory concerns frequently cause spreads to widen, leads to delays in closing and ultimately cause deals to unravel. The most common form of government scrutiny would be antitrust. In the United States, either the Justice Department or the Federal Trade Commission reviews mergers to ascertain their competitive implications. In Europe, each individual country has its own regulatory authority investigating mergers, eg, the Federal Cartel Office in Germany and the Monopolies and Mergers Commission in the United Kingdom. In addition, the European Commission investigates mergers for their impact on the European Union. Many deals have broken due to antitrust enforcement, including such landmark cases as Staples/Office Depot and Lockheed Martin/Northrop Grumman.

However, anti-trust authorities are not the arbitrageurs’ only regulatory concern. Many industries have their own specialty government watchdogs. In the United States, these include the Federal Communications Commission for communication deals; the Committee on Foreign Investment for national security concerns; the Federal Reserve for bank deals; State Insurance Commissions for insurance deals; and State Public Utility Commissions for utility, cable and telephone deals. Some deals cause a virtual regulatory quagmire. Our firm’s analysis of the merger of Entergy and FPL Group ended promptly after we read the following paragraph from the press release:

The merger requires the approval of shareholders of both companies, the Securities and Exchange Commission, the Federal Energy Regulatory Commission, the Nuclear Regulatory Commission, and the Federal Communications Commission; the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act; and the completion of regulatory procedures in Arkansas, Florida, Louisiana, Mississippi, Texas and the city of New Orleans. The companies’ objective is to complete the transaction within 15 months.

Timing

Not only must the arbitrageur predict the outcome of a transaction, but he must also estimate the time to completion. If a deal takes significantly longer to complete than anticipated, the rate of return will decline to uneconomic levels. Intense regulatory review will frequently prolong the time to closing. Dow Chemicals’ acquisition of Union Carbide, announced on August 4, 1999, had still not received antitrust clearance as of its first anniversary. If one had put the transaction on the day of the announcement, the annualised return-to-date would be less than 5.0%. Other regulatory reviews have taken longer. Consider the following Bloomberg news story: “The Federal Energy Regulatory Commission rejected Wisconsin Energy and Northern States Power plan to merge and told the companies to come back in three months with a new plan. The two companies first proposed their merger two years ago”.

Due Diligence

Announced mergers with due diligence conditions always raise a red flag and create uncertainty as to when, and if, the deal will be completed. Some due diligence clauses are open-ended while others have a specific time, or event, to their completion. One must always research whether there are any due diligence conditions, and be wary of any deals with such clauses. The following news stories are not unusual.“BanyanCorporation announces that it has signed a Letter of Intent to merge with Echo Marketing Corporation. Additional details will be made available as soon as both companies conclude their due diligence”. Four months later, “Banyan Corporation announces that after extensive due diligence it has withdrawn from its merger with Echo Marketing Corporation”. Or, “EDS today announced it has withdrawn its proposal to acquire Policy Management Systems after completing due diligence”.

Other

There are many other risks that may need to be considered including, environmental liabilities, customer concentration, shareholder vote requirements, and management issues. Each of these risks has affected a deal’s outcome in previous situations. The important point for the arbitrageur is to know which potential risks are relevant to which particular situations.

Risk Management

Once the arbitrageur understands the “risks” in risk arbitrage he can then begin constructing a portfolio of deals that balances risks and limits downside exposure. Unfortunately, every deal has risk, so one cannot avoid risk entirely. Instead, one must prudently manage risk to produce a desired return with minimal drawdowns and low market correlation.

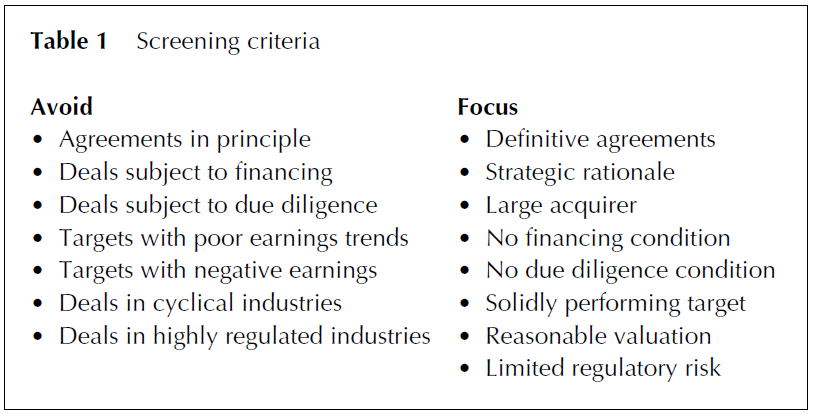

To manage portfolio risk, we first examine the potential downside in a transaction. We eliminate, up front, the riskier arbitrage transactions, which over time have proven a poor or even negative expected value. Instead, we look for deals whose characteristics imply a high probability of closing (see Table 1).

By avoiding low quality deals and focusing on high quality deals, we reduce both the micro and macro risks of our portfolio. For example, by eliminating from our portfolio deals subject to financing or deals with poor performing targets, we remove deals that have a lower probability of closing in a stable market as well as a higher probability of breaking in a deteriorating macro economic environment. On the other hand, by focusing on the strategic combinations of solidly performing targets by large acquirers, we increase the probability that deals in the portfolio will close in all market environments.

To further reduce the risk of our portfolio we:

• constantly monitor events which could alter the risk profile of a transaction, and, when necessary, adjust positions;

• diversify the portfolio across industries to avoid the influence of any industry specific risks;

• diversify the portfolio amongst deals to limit the impact any unforeseen event could have on a portfolio position;

• diversify the portfolio across cash and stock deals to mitigate the effect of rising or falling markets;

• size individual positions according to their potential downside and the probability of that downside;

• hedge stock deals according to their full merger ratios and use “put” protection, when necessary, to limit downside loss; and

• focus on deals with structures that perform better in declining markets.

CONCLUSION

The same wise gentlemen who told me “risk arbitrage is not about making money, its about not losing money” also told me, “if you watch the downside, the upside will take care of itself”. To manage the downside, one must first have a thorough understanding of the “risk” in risk arbitrage. Using that understanding, one must then construct a portfolio that eliminates poor quality transactions and focuses on high quality deals. To further manage risk within the portfolio, one must constantly monitor one’s positions for any changes, hedge all positions, limit position size, and broadly diversify across deals and industries. By implementing these criteria, the manager will be able to deliver the benefits of this strategy: non-correlated, low volatility returns.

Part Three – A Merger Arbitrage Fund Managed By John Paulson

– The Schroder GAIA Paulson Merger Arbitrage Fund

Paulson & Co have half of the firm’s AUM in merger arbitrage strategies – about $7bn out of $14bn (and coincidentally 50% of the firm’s AUM is employee capital). The Schroder GAIA Paulson Merger Arbitrage Fund is a $781m Luxembourg SICAV giving access to Paulson’s merger arbitrage strategy for a minimum investment of only $10,000 – plus there is daily pricing. The Schroder GAIA Fund is used as an example of how Paulson & Co implement the strategy in practice, or if you like turn the general principles of Part Two into running a merger arb fund. This Part contains (A) a Q&A with John Paulson describing the fund, (B) Paulson & Co’s take on the recent environment for merger arbitrage, (C) Paulson’s outlook for the strategy, and (D) performance data.

(A) Q&A With John Paulson on the Schroder GAIA Paulson Merger Arbitrage Fund

Could you tell us a bit about Paulson & Co and the team involved with this fund?

I founded Paulson & Co in 1994. Since then, my team and I have built the firm’s investment capabilities and infrastructure so that today it has approximately $14 billion1 under management. We now employ 133 people in New York, London and Hong Kong.

All our strategies are based on the same underlying investment philosophy and objectives: preservation of capital, above average returns, low volatility and limited correlation to the broader markets. Paulson & Co. employees, including myself, are the largest category of investors in our funds. As an organisation, Paulson & Co. relies on the entrepreneurial spirit of its employees and encourages teamwork. The firm is a partnership, which helps foster the highest degree of alignment between ourselves and our investors.

I am the portfolio manager for all the funds but am supported by a team of 52 investment professionals1, both sector and transaction specialists, who contribute to the management of the funds. Andrew Hoine and Jim Hoffman are co-managers of the funds, and each have over 20 years’ experience in the merger business.

What is special about this fund?

The merger arbitrage funds are our oldest and largest and with $7 billion under management, they represent approximately 51% of our total assets1. They have a proven, 22 year track record of delivering strong performance from a diverse set of merger-related opportunities. These include exploiting price spreads between bidder and target, topping bids, liquidations, bankruptcy reorganisations, pre-announced deals and exchange offers, and this broad approach provides opportunities in all types of market conditions. Schroder GAIA Paulson Merger Arbitrage forms a part of this offering and specifically benefits from:

1. Depth of experience within the investment team

2. Clear expertise and competitive edge

3. A unique, clearly defined strategy that has produced uncorrelated returns over 22 years.

The investment approach is to intentionally generate alpha across the cycle. In this approach recognising patterns and mitigating risk at the appropriate time are seen as key factors.

What is the fund’s investment universe?

The fund only invests in opportunities where we believe we have a definitive edge, with a primary focus on North America and Europe.

The strategy is not constrained to using specific instruments or securities and we use all types of publicly traded securities. In practice this is mainly equities and bonds, however, selectively we also use over-the-counter instruments, options, swaps (including credit default swaps) and other derivatives.

How do you generate new ideas?

Investment opportunities are sourced from a number of channels, including newsflow and trade publications, as well as our relationships with sell-side institutions, industry contacts and the professional network of our investment team.

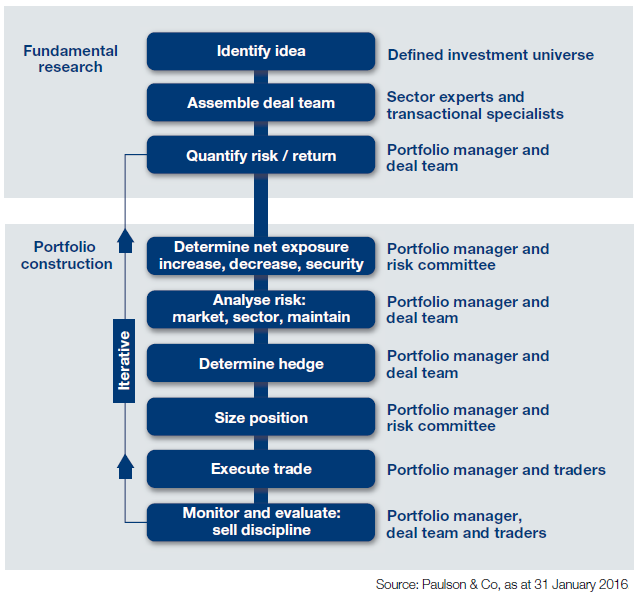

What is the investment process then?

Our investment professionals are specialists, either in particular sectors and industries or in specific functions, such as transactions, regulation, banking or accountancy. Given that event-driven opportunities do not recur frequently, they are difficult and expensive for most investors to research effectively. We attempt to exploit this “informational inefficiency” by using our specialist expertise to undertake detailed fundamental bottom-up analysis to develop a full understanding of the risks and rewards surrounding such events.

When an analyst identifies a potential opportunity, he or she will perform an initial analysis of the company, its industry, peers, the expected event, and then present their findings to the Head of Research and the portfolio manager. An intense review of the analysis follows and, if initially attractive to the portfolio manager, this typically results in a request for further investigation. Subsequent to this and further discussion, a decision to invest may be made. During this stage of the process, the analyst team is also asked to come up with ideas to hedge the position. This typically involves collaboration between the portfolio manager and the analyst team, with a focus on market, sector and company specific risk. Approximately 75% of our research is carried out internally.

The Investment Process Is Driven By Fundamental Research

How do you construct the portfolio?

The initial focus when structuring the portfolio is on what we believe will be low risk/high return deals. Each possible opportunity is scrutinised and ranked based on risk. Focusing on the low-risk end of the pool, we review return characteristics and choose what we believe to be the best risk-adjusted return deals for the portfolio.

Deals with the best risk-adjusted return characteristics will receive higher weightings (up to a maximum of 10% – the position limit set by UCITS regulations). The portfolio typically comprises 30 to 60 positions, and is diversified by geography and by sector.

The top 10 positions will typically represent between 20 to 40% of the portfolio. The majority of the positions in the portfolio are invested in companies with large market capitalisations.

Managing risk in the portfolio is clearly very important. What is your approach?

The primary objectives of the fund are capital preservation, low correlation to broader markets, and minimal downside volatility. We use various direct and market hedges to minimise market correlation and drawdowns.

Furthermore, we carefully examine the potential for, and probability of, upside and downside risks in a transaction. In doing so, we eliminate upfront the riskier arbitrage transactions, which over time have proven to have a poor, or even negative, expected value. The initial position sizes are determined so that the potential downside does not exceed 2% of net asset value.

Furthermore, we look for deals whose characteristics imply a high probability of closing. Our focus is on strategic combinations of solidly performing targets by large acquirers. This increases the probability that deals in the portfolio will close in most market environments.

We also size individual positions according to their potential downside, the probability of that downside, the potential upside, the probability of that upside, and the probability of the deal collapsing. We have developed a proprietary internal risk management system to suit our needs. Additionally, we use external service providers such as Riskmetrics.

The chief risk officer provides the portfolio manager with a regular package of proprietary risk reports summarising portfolio risk statistics and risk concentrations. Ad-hoc requests are also prepared as needed by the portfolio manager.

Why should investors consider a merger arbitrage strategy?

There are three main reasons to invest in merger arbitrage strategies. Firstly the strategy offers an attractive risk/return profile. On a 20 year basis, merger arbitrage strategies have outperformed the S&P 500 with considerably lower volatility than many equity indices (see Figure 1 above). Secondly, the strategy has provided capital preservation in down markets. During periods of market stress, merger arbitrage returns have suffered far less than broad equity indices. The average negative month’s return is significantly less than equity indices and, importantly, down months have been far less frequent. Lastly, it exhibits a low correlation to the broader market. Returns for the strategy are based on a manager’s ability to evaluate deals rather than the direction of the market. Opportunities exist throughout the economic cycle, as the strategy is able to short deals and exploit bankruptcy situations. It is therefore a valuable diversifier of returns and dampener of volatility within a broader portfolio.

(B) Recent Environment for Merger Arbitrage

Merger activity – slower but remains healthy

Global mergers and acquisition activity continued to be robust in the first quarter of 2016, with February 2016 being the strongest February since 2007.Industrials, technology, financial institutions and healthcare have been the strongest sub-sectors.

Financing at reasonable leverage levels remains available and rates remain relatively low and attractive. Corporate balance sheets remain healthy, notwithstanding some strained sectors such as energy, and companies are finding difficulty growing organically as underlying economic growth has been tepid at best.

Merger arbitrage spreads are attractive

On the back of a volatile stockmarket and a large universe of nearly $5 trillion of M&A activity over the last 12 months, merger arbitrage spreads continue to trade at wide levels. The large volume of deals coupled with a smaller arbitrage community, due to the lack of proprietary banking capital, has resulted in insufficient arbitrage capital to close spreads. This has created an opportunity for us to invest in existing deals where spreads have become more attractive and in new deals with wide spreads. Over the past few quarters we have been increasing our allocation to attractive risk-adjusted spreads

(C) Outlook for Merger Arbitrage and Portfolio Response

While we experienced a mark-to-market decline in the first quarter, we believe our portfolio has significant embedded value and will rebound in the medium-term. The key to success is to stay invested for the long-term. We believe that the discount of specialty pharma to the market will turn around given the strong fundamentals of the companies we own and the robust and growing earnings. We believe there is up to 100% upside in this part of the portfolio.

With regards to Valeant, the ad-hoc committee review is now complete and no additional items were identified that would necessitate a restatement beyond those already disclosed. The company expects to file the Form 10-K on or before April 29th which will clarify many of the uncertainties surrounding Valeant, including providing further detail on its SEC investigation. This should be a positive catalyst for Valeant and the specialty pharma sector overall. We believe Valeant should trade around $60-$100 over the next 12 months, vs. $26.30 as of the end of the first quarter, once the 10-K is filed and the uncertainty surrounding many of the above mentioned issues subsides.

Once fear and uncertainty for the overall pharma sector subsides, many of the specialty pharma companies we own, which trade at discounts of 40-50% compared to large pharma companies, could represent attractive takeover targets at very large premiums to today’s prices. For example, in February 2016, Mylan announced its acquisition of Meda, a Swedish specialty pharma company, for $7.2 billion, a 92% premium over Meda’s closing price the day before the announcement of the transaction. The steep current discounts mean that many of our specialty pharma companies would be immediately accretive to the earnings of large pharma companies and these discounts could act as a catalyst for further consolidation.

Given the continued high levels of M&A activity and attractive levels of spreads, we have increased our exposure to merger spreads which are very compelling on a risk-reward basis. Many of the deals within our portfolio are expected to close before year-end and should produce high risk-adjusted returns.

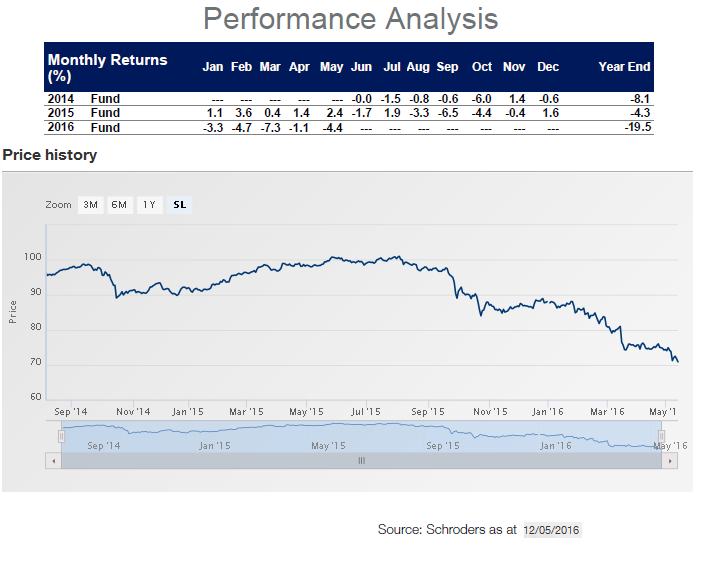

(D) Performance of The Schroder GAIA Paulson Merger Arbitrage Fund (A Accumulation Share Class)

* John Paulson wrote this section as a chapter in “Managing Hedge Fund Risk” Edited by Virginia Reynolds Parker

and published by Risk Books in 2005. This chapter is ©Risk Books.

1 In addition to mergers, risk arbitrage may also include situations such as spin-offs, recapitalisations, partial tender offers and other forms of restructurings. “Event arbitrage” situations have higher risk/return profiles, as the value of the ultimate consideration is less certain. For the purposes of this chapter, we will limit our discussions to merger arbitrage, the segment of risk arbitrage pertaining to announced corporate mergers and acquisitions.

Related articles:

Lyxor To Stick With Overweight in Merger Arbitrage (Apr 2016)

Hedge Fund Sidecars Disrupt Reinsurance Market (Feb 2015)

The Event-Driven Asset Class in a Rising Rate Environment (Nov 2013)

John Paulson on the Benefits of Activism (Dec 2010)