By Hedge Fund Insight staff

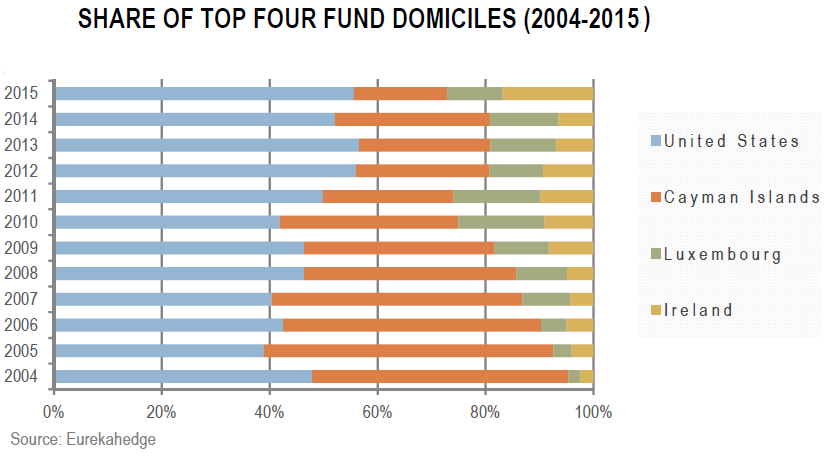

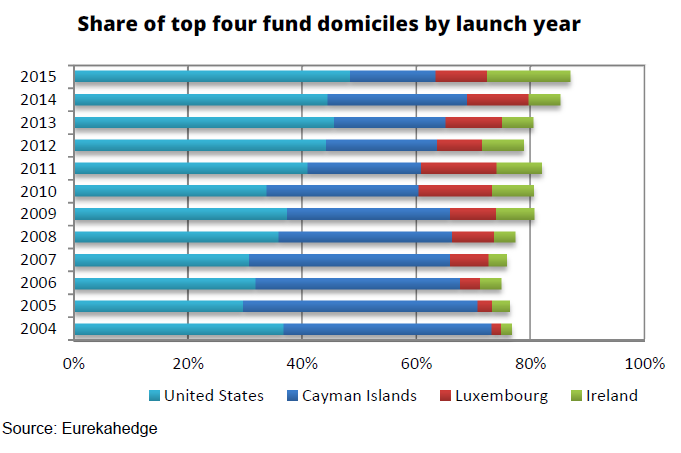

Recent data releases from Eurekahedge show the increasing significance of onshore hedge funds, and the consequent relative decline of hedge funds registered offshore. Year by year Cayman Islands registered hedge funds took less share of the domiciles of funds launched. This trend accelerated post 2008 to the extent that last year only 15% of launches were for funds domiciled in Cayman. Ten years ago over 30% of launches were for Cayman-registered funds.

As a consequence of a declining share of new launches, plus the growth of managed accounts, funds-of-one, ’40 Act Funds and Alternative UCITS structures, the absolute share of global hedge funds registered with the Cayman Islands Monetary Authority has declined significantly over the last ten years.

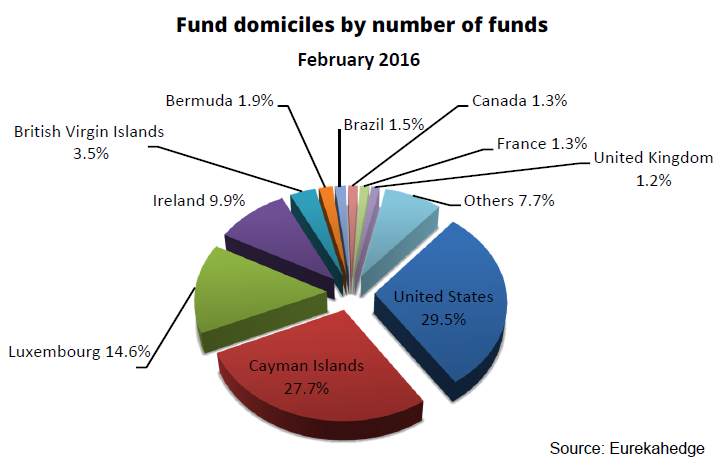

An examination of the fund database of Eurekahedge shows that currently 27.7% of the world’s hedge funds are domiciled in the Cayman Islands, and that means that the offshore centre has been overtaken by the United States of America as the home of the most hedge funds.

related articles: