By Madison Street Capital

2016 is gearing up to be one of the most active years in terms of M&A activity for the hedge fund industry. Propelled by the wave of transactions in the fourth quarter of 2015, many positive factors are leading indicators that M&A deal momentum will continue, positioning 2016 to be a record year in terms of transactions. There were 42 total transactions completed or announced in 2015 compared to 32 during 2014. Thematically, majority of transactions consisted of larger alternative asset management platforms making strategic acquisitions to help broaden and diversify the mix of investment strategies offered to their institutional clients. Given the escalating growth of allocations directed to the alternative asset space, there are strong signals that this acquisition trend will continue throughout 2016 and well into 2017. Although hedge fund industry assets continue to rise and are above pre-crisis levels of 2009, aggregate hedge fund performance in 2015 is lagging key market benchmarks like the S&P 500. Despite this underperformance, many smaller and mid-size hedge funds are back to or above their high-water mark levels, and with public alternative asset manager multiples trading at moderate to low valuations, we can expect increased buyer interest. Additionally, we anticipate strategic buyers to expand their M&A radar globally, which should result in increased cross- border deal activity, primarily in Europe and North America. Overall, size, strategy and scalability are going to dictate buyer preferences, while distribution and access to capital will make potential sellers more apt to do a transaction.

Hedge Fund Industry Deal Environment

Even with smaller net flows and mediocre industry performance, the current deal environment is still strong. Overall, HF industry asset growth is inevitable and the need to satisfy investor demand is the biggest driver for consolidation. Simply put, for larger HF managers the current capital raising environment has never been better and the need for more product to offer clients is extremely high. On the other end of the spectrum, smaller HF managers are struggling to attract new capital and are trading at AUM levels that are below the optimal portfolio strategy capacity. Adding to the difficulty is the fact that the costs of running a hedge fund operation are rapidly increasing. As a result, these factors will drive M&A, team lift-outs and potential joint-ventures on specific product launches. Different from the pre-crisis era where valuations were frothy, M&A activity in the HF industry is more restrained and thoughtful, with processes taking longer because of increased levels of due diligence procedures. Strategically, there are different ways that transactions are being structured to accommodate both buyers and sellers that do not necessarily fall into the typical mould of M&A transactions. Deals are being done as seed or incubator deals, revenue-share stakes, PE stakes, PE bolt-on’s, etc. In terms of valuation, acquisition and guideline public company multiples in the HF sector ended 2015 at a moderate 7.1x EBITDA multiple. The cause is three-fold: Mediocre performance driving down firm Profitability Uncertainty regarding variability of cost structure in an increasingly regulated industry Buyers being more conservative with their Valuations Nevertheless, hedge fund managers with strong infrastructures and definable yet differentiated strategies will still command a broad audience, and thus a strong valuation, when they become available. Higher demand strategy areas which address a larger firm’s product need such as distressed credit, emerging markets, global macro and certain other definable alternative strategies will continue to receive premium pricing, potentially in excess of the median multiple.

M&A Market Trends in HF Industry

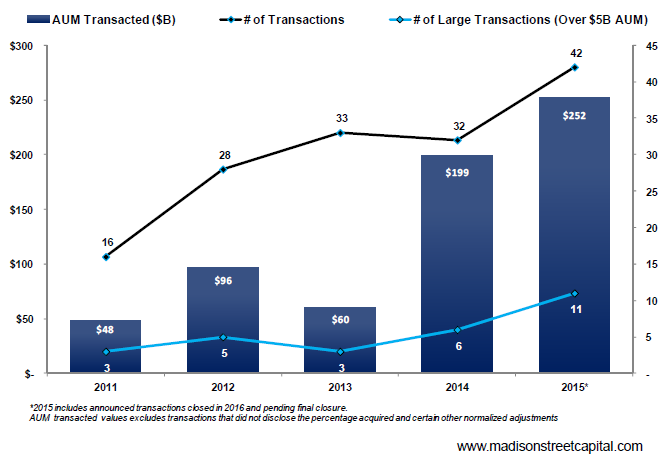

2015 was an active year in terms of M&A transactions in the hedge fund industry. Comparable to 2007, which many consider a high point for hedge fund M&A activity, in 2015 the industry saw 42 transactions, up approximately 31% from last year. Additionally, the aggregate disclosed transaction volume of AUM (excluding transactions related to an IPO) was $252 billion and $199 billion in 2015 and 2014, respectively, up 27% year over year. During 2015, larger diversified asset management companies dominated the acquisition landscape, buying or making minority stakes in smaller high quality shops with the objective of expanding their product mix and suite of strategies that can be offered to institutional investors. The most active players were Man Group GLG (MAN), Aberdeen Asset Management, Affiliated Managers Group (AMG), Blackstone and Dyal Capital Partners (Dyal).

Number of Transactions and AUM Transacted 2011-2015*

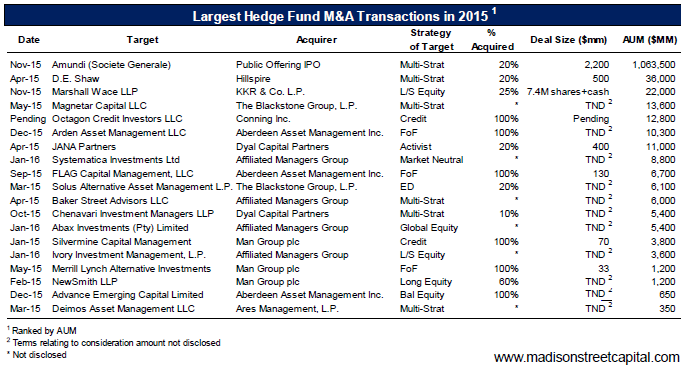

Key Players & Notable Transactions in 2015

Key Players & Notable Transactions in 2015

Man Group (MAN)

Man had three significant acquisitions in 2015. Man acquired 100% of Connecticut based Silvermine Capital Management, a leveraged loan manager with $3.8 billion of funds under management across nine active CLO structures. Man paid $23.5 million up- front cash with earn out potential of up to another $46.5 million ($16.5 million after first year and up to $30 million after five years). Silvermine will complement Man’s existing US credit business and global CLO footprint providing the necessary scale to become a significant player in the US CLO market. Silvermine will benefit from Man’s existing infrastructure, while at the same time allowing Man to gain higher exposure to credit trading strategies in the US. Following this acquisition, in February, Man took a 60% stake of the $1.2 billion long equity fund NewSmith LLP. NewSmith’s investment management business will further expand Man’s equities business, strengthen Man’s growing long-only platform and add Tokyo based Japan long/short equity strategy to Man’s product line, enhancing Man’s presence in a key market. In May, Man bought the investment management contracts of Bank of America Merrill Lynch Alternative Investments LLC’s $1.2 billion FoF. The BAML FoF portfolio further expands Man’s footprint in the US. An upfront payment of $2.9 million was paid at the close of the transaction and 35% of the net management fees generated annually by the portfolio will be payable annually for five years; however, total earn-out payments cannot exceed $30 million.

Aberdeen Asset Management (Aberdeen)

Aberdeen Asset Management acquired 100% of both Flag Capital Management and Arden Asset Management, both FoF strategies, with $6.7 billion AUM and $10.3 billion AUM, respectively. The two acquisitions will take Aberdeen’s alternative platform to more than $30 billion and represents Aberdeen’s commitment to diversifying its overall business and to growing its alternatives platform. Aberdeen also acquired 100% of Advance Emerging Capital Limited, an equity balanced fund with $650K of AUM.

Affiliated Managers Group (AMG)

AMG was an aggressive investor in 2015, making investments in four hedge funds. Three transactions closed in January 2016, including minority investments in Ivory Investment Management, a research-intensive fundamental value long/short fund with $3.6 billion in AUM, Abax Investment (Pty) Limited, a South African equity and fixed income manager with $5.4 billion in AUM and a majority investment in Systematica Investments, Ltd., an innovative technology-driven firm focused on applying science and technology to the investment process (aka a CTA) with $8.8 billion in AUM.

Blackstone

Blackstone raised more than $3 billion for a specific fund to take minority stake investments in hedge funds. In 2015, Blackstone made two notable minority investments in Solus Alternative Asset Management L.P. and Magnetar Capital, LLC Solus Alternative Asset Management L.P. is an event-driven fund with $6.1 billion AUM and Blackstone’s stake allowed two of the fund’s founders to cash out and exit. Blackstone’s investment in Magnetar Capital, LLC, a multi-strategy fund with $13.6 billion in AUM, provides a catalyst that will help the hedge fund achieve its strategic objectives, including continuing to attract and retain key talent.

Dyal Capital Partners (Dyal)

Dyal was the most active minority stake investor in 2015, completing four notable transactions with sizeable funds Dyal disclosed its 20% stake in both EnCap Investments, a PE fund with $27.5 billion AUM and Jana Partners, an activist hedge fund with $11 billion AUM. The transaction values disclosed were $700 million and $400 million, respectively. Dyal’s attraction to Jana is their collaborative approach to activist investing and this transaction will allow Jana to invest in opportunities not otherwise possible. In July, Dyal made an undisclosed minority investment in Vista Equity Partners, a PE tech focused fund with $14 billion AUM and in October Dyal made a 10% investment in Chenavari Investment Managers, a multi-strategy hedge fund with $5.4 billion AUM. Vista will benefit from Dyal’s investment to increase its network of global investors, scale the business and expand its product offerings through investment opportunities in the software, data and technology-enabled services sectors. Chenavari is well positioned to benefit from the opportunities related to European banks’ de-leveraging and opens investment opportunities in credit and private debt markets.

Other Notable Transactions in 2015

Other Notable Transactions in 2015

In April, the family office of Google Chairman Eric E. Schmidt, Hillspire, bought the Lehman Estate’s 20% stake in D.E. Shaw ($36 billion AUM) for $500 million. In October, Legg Mason, Inc. acquired 75% of Rare Infrastructure Limited for $205 million. Rare is an infrastructure equity hedge fund with $9.3 billion AUM. In November, KKR acquired a 25% stake in Marshall Wace LLC, a $22 billion AUM long/short equity fund, for 7.4 million in shares + up-front cash. Also in November, Amundi (over $1 Trillion AUM) issued 20% of its shares in a public offering for a transaction value of $ 2.2 billion.

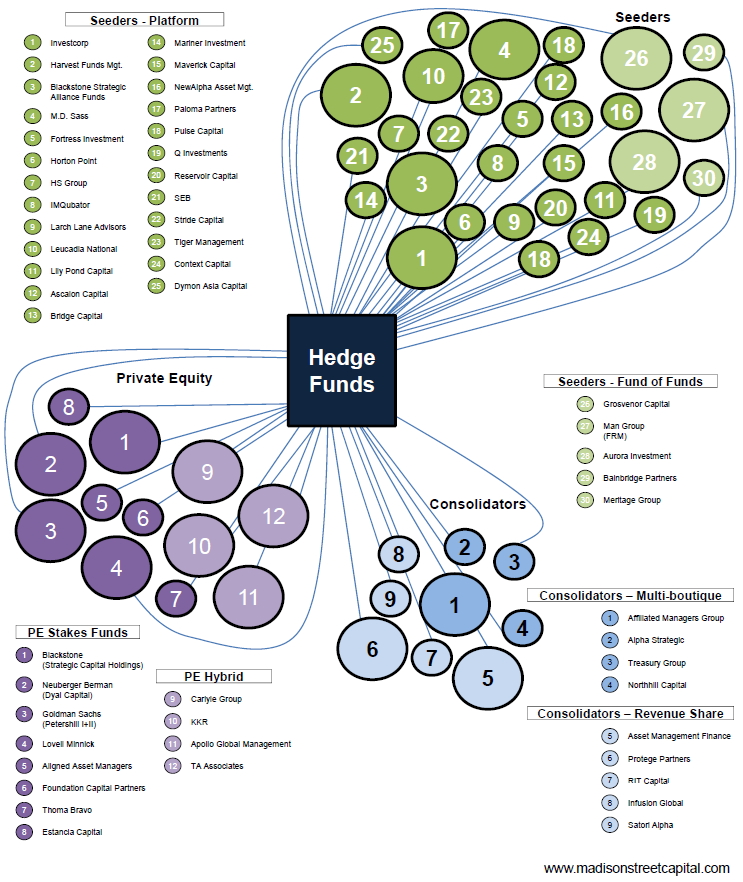

Seeder/Consolidators/Incubators/PE Stakes

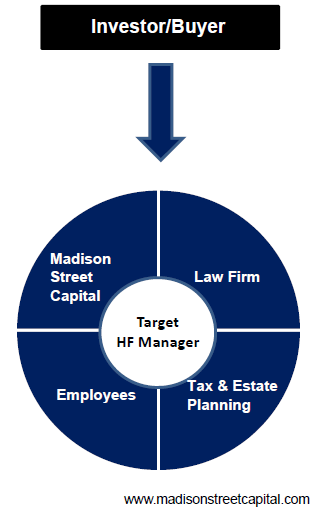

An increasingly popular trend has been minority interest transactions where a hedge fund sells a portion of the management company’s equity without relinquishing control. Unlike a few years ago, where there were not as many options for this general category of transaction, now there are a myriad of ways that firms are completing these types of deals. For start-up funds or smaller funds seeking acceleration capital, there are different types of investors with an appetite to provide the essential infusion that ignites the manager’s path to a successful launch or rise to a more optimal AUM to increase a funds strategy capacity. Seeders can be platform investors that provide start-up or incubation capital or in some cases, the investment may come from a FoF. Seed deal activity from FoF’s like Grosvenor, FRM (Man), and Aurora are rising perhaps indicating FoF’s are diversifying their product mix. Additionally, consolidators and PEG’s are increasing their exposure to hedge funds via minority stake deals. AMG is the biggest consolidator globally, while Strategic Capital Holdings (Blackstone), Dyal (Neuberger Berman) and Petershill I+II (Goldman Sachs) dominate the PE stake fund category. PE firms such as Carlyle, KKR, Apollo and TA Associates are also non-majority investors through a hybrid structure. The key players in this space are summarized and separated by category in the graphic below.  Buyers and Sellers

Buyers and Sellers

Proper deal structure can narrow the gap between expectations

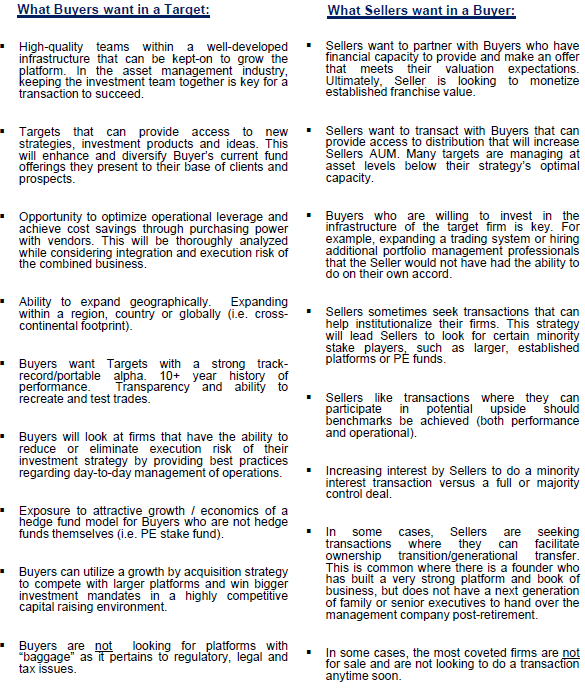

Overall, asset manager M&A transactions are complex. Given that there has to be agreement between both the Buyer & Seller that is predicated with the highest degree of trust – it can be difficult to protect against every scenario through a contract. It is important to balance incentives across all constituents and create a structure that retains this alignment as best as possible post-transaction. For a Buyer, they need to ensure interest remains sufficiently aligned with any selling equity holders who remain key to managing the business and/or crucial to investment function. As with most successful deals, a true partnership exists at the senior-most level of each business. Below are key deal elements that should be considered, and in some cases, need to be carefully designed in order to achieve success: Earn outs Staged sales/ Delayed or contingent payment of purchase price Employment contracts/ Multi-year commitments post-transaction Retention payments Compensation plans Revenue-Share Put &Call Options Equity grants Separate treatment of management and incentive fee streams Amount of retained equity in business by seller Reinvestment of after-tax proceeds in the business Consideration about day-to-day management /control of business

Given the complexity of these type of deals it is wise to have proper representation with regards to selecting investment bankers, attorneys, accountants and other professionals.

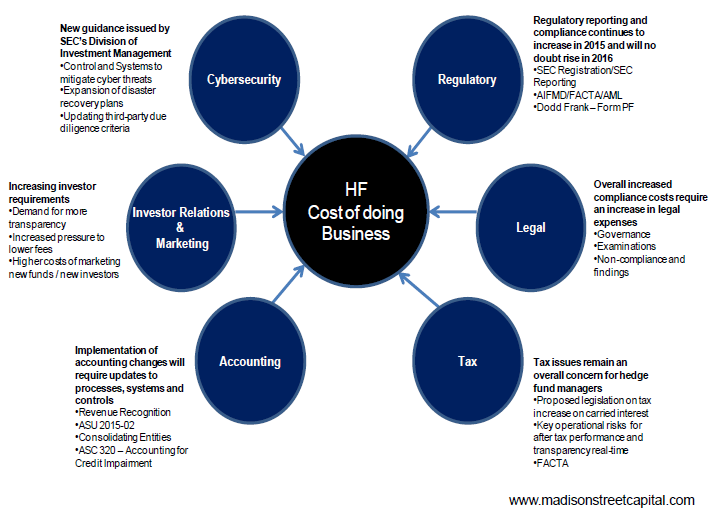

Future M&A Drivers Increasing Costs of Doing Business

For established fund managers, the rising costs of compliance are squeezing margins whereas smaller funds are paying the price for increased regulation and compliance costs, which are only expected to increase. Ongoing compliance requirements and new compliance and regulation consume a large amount of time and resources. Furthermore, complexity of regulations adds to the increasing costs of compliance as well. The increased costs of compliance are related to enhancing risk management and increasing transparency due to pressures from regulators, investors, and the public and media. New regulations and compliance increases company operational costs and require larger investments in middle and back office infrastructure. Larger firms have the advantage of economies of scale and can afford to make these investments and leverage scalable infrastructure to comply with increased requirements. Smaller and medium sized firms may choose to outsource these costs such as trade operations, data storage, and disaster recovery and system integration/maintenance. As more regulation and compliance rolls out, these outsourced costs will continue to increase for smaller and medium sized firms.

Industry Consolidation

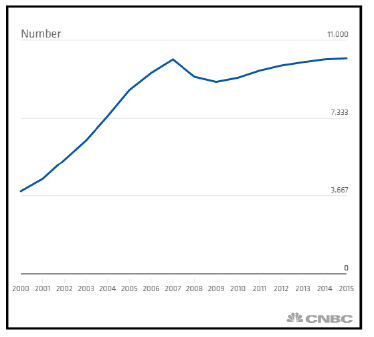

The hedge fund industry is still highly fragmented, and arguably, over-crowded, despite almost 10 years of turbulent market conditions, lacklustre fund performance, and a wave of legal and regulatory related transgressions. If for example, the Oil & Gas industry was impacted by factors of the same negative magnitude, it would surely cause a significant compression. However, we have not seen a mass exodus of hedge fund managers exiting the business or closing down funds. In fact, there are more hedge funds now than there were prior to the credit crisis. In 2015, 829 new funds launched while only 695 hedge funds closed down.

No. of Hedge Funds (annual count 2000-2015)

Furthermore, as uncertainty increases and big trading swings are expected to continue with today’s volatile market conditions, fund launches may continue to increase as investors seek tactical options that provide capital protection. As mentioned before, these options may include investing in L/S equity, distressed credit, managed futures and certain global macro fund strategies. Despite the increasing number of hedge funds, it does not take away from the fact that large does not take away from the fact that large institutional investors no longer select managers based purely on talent, but more so on infrastructure, size and sustainability. As the industry evolves, investors are decreasingly seeking trendy “soup-du-jour” strategies that can provide high rewards at the risk of being short-lived – but instead focusing on allocations to firms where they can get higher transparency, real-time reporting and collaboration. Furthermore, given size minimums set by investment policies most pensions and other large institutional investors are restricted from allocating to smaller funds, even if smaller fund managers have a robust infrastructure in place. This has created a dynamic where the vast majority of institutional hedge fund allocations are being directed to the largest hedge fund managers, which represent approximately 10% of the 11,000 total funds. Smaller firms operating at sub-optimal AUM levels are fighting an uphill battle in terms of profitability, especially in this low performance environment. Even smaller firms that are achieving respectable returns above their benchmark and earning performance fees are not able to earn significant profits given the fact that today’s cost structure is significantly higher than it used to be ( see previous section). Another challenge for smaller firms is the ability to obtain real scale from a strategy and operational leverage perspective. In order to obtain the maximum return from a firm’s infrastructure, the portfolio size has to be adequate to optimize the intended return mechanism. For larger platforms, they face the inverse challenge since they have access to multiple channels of distribution and institutional assets, but they lack the depth of products and at times, diversity of portfolio management expertise. The bigger players are seeking to leverage their more than robust platforms and will continue to be opportunistic in pursuing acquisitions that enhance their institutional value. Institutional investor demand will no doubt drive consolidation in the industry. The asset-liability mismatch that face pensions is a global issue and will be prevalent in this low rate and rising cost environment. Over the next cycle, traditional investment strategies will not be able to generate the alpha needed to address this dilemma, and that will only increase additional allocations to the alternative asset sector. Only hedge fund firms can truly take advantage of the upcoming periods of volatility and uncertainty by leveraging their experience, infrastructure and specialized expertise. Remember – Money never sleeps.

ABOUT MADISON STREET CAPITAL the firm provides an integrated, full-service approach to both strategic and financial advisory that provides solutions to clients across the globe. Our industry specialists advise a wide array of Asset Managers on the entire spectrum of corporate issues including M&A Advisory, Portfolio Valuation (ASC 820 and IAS 39 compliant), Financial Restructuring and Financial Sponsor Coverage We cater to the following types of clients: Hedge Fund Managers, Private Equity Firms, Mutual Funds, Family Offices, CLO Managers, Business Development Corporations (BDCs), Specialty Finance, Asset Management Arms of Financial Institutions, Pension Funds and Endowments

To see the whole of the 19-page Report of which this is an extract please contact Karl D’Cunha, Senior Managing Director at Madison Street Capital, at kdcunha@madisonstreetcapital.com or on (312) 529-7029. © Reproduced with the kind permission on the authors.

POSTSCRIPT:

April 18, 2016: On March 2, 2016, 50 South Capital Advisors, LLC, announced that it had reached an agreement to acquire the investment management business of Aurora Investment Management LLC, a wholly-owned subsidiary of Natixis Global Asset Management, subject to customary closing conditions. After careful consideration, the parties have mutually agreed to terminate the agreement.

Related articles: