Lyxor Hedge Fund Index Commentary For April

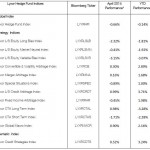

From Lyxor Asset Management The Lyxor Hedge Fund Index was down -0.7% in April (YTD -0.1%). 6 out of 12 Lyxor Indices ended the month of April in positive territory, led by the Lyxor L/S Credit Arbitrage Index(+1%), the CTA Long Term Index (+1%) and the Lyxor Global Macro Index (+0.9%). Data published in […] Read more »

Skill-Based Investing Being Squeezed Out Of The Hedge Fund Industry

By Peter Douglas of GFIA, with an introduction by Simon Kerr When Richard Hills wrote “Hedge Funds: An Introduction to Skill-based Investment Strategies” in 1996 the hedge fund industry consisted of relatively few firms dominated by the idiosyncratic talents of their seasoned leaders. The landscape today is very different – many of the investment […] Read more »

Commodities To Roll Over One By One

By Richard Edwards, Managing Director of HED Capital As reported, the main commodity index that we follow made a weekly-scale top extension a few weeks ago. Here is an update: We have commented several times that this will probably lead to a rolling over of commodity prices as one by one they stall and fall. […] Read more »

The Hedge Fund HOT 100 2014

By Staff Writers of Hedge Fund Insight, led by Simon Kerr Welcome to the second edition of The Hedge Fund Hot 100. As last year the aim is to capture what is emerging and trending and growing in the hedge fund industry. The absolute is interesting, and it is covered elsewhere in […] Read more »

Global Macro & CTA Outlook For 2014 Is A Mixed Bag According To NB

By Neuberger Berman Alternative Investment Management Introduction Macro-focused investing is broadly defined as profiting from changes in market prices that arise from any number of factors, including turning points in macroeconomic cycles, changes in the outlook for economic growth or inflation and market price reactions stemming from the actions of policymakers. In Figure […] Read more »

Event Driven Strategy Outlook: Looking Beyond Merger Arb

By Alex Gavrish, Etalon Investment Research and author of “Wall Street Back To Basics” Credit Suisse recently released its Annual Hedge Fund Investor Survey. The survey, produced by Credit Suisse’s Capital Services Group, is one of the most comprehensive in the industry, with over 500 respondents – including pension funds, endowments, consultants, family offices […] Read more »

A Case For Convertible Bond Arbitrage In 2014

By Paul Sansome, Ferox Capital LLP Part One of this article discusses the main reasons to own convertible securities in the current environment. Part Two looks at why convertible bond arbitrage is an attractive investment strategy now. Part One We see four main reasons to own convertibles: 1. Strong new issuance 2. Dispersion in […] Read more »

Investors Should Carry Out Their Own Research On Smaller Hedge Fund Managers

By Donald A. Steinbrugge,Managing Partner Agecroft Partners, LLC Average hedge fund performance has been mediocre at best over the past five years, which is not surprising because most of the asset flows have been concentrated in a small percentage of firms with the largest assets under management. Many of these firms have morphed into […] Read more »

FRM Commentary On Long/Short Managers

From FRM Investment Management Despite January being a negative month for equity indices Equity Long-Short managers benefited from single stock dispersion to end the month roughly flat; European managers finished the month marginally positive, while the US was flat in aggregate. In Europe, managers suffered in the sharp sell offs, which were highly correlated and […] Read more »