Graphic of the Day: Consistent Flows to Medium-Sized Hedge Funds

By Hedge Fund Insight staff The global hedge fund industry has attracted US$342.1 billion of net asset flows since January 2013, out of which billion dollar hedge funds accounted for US$206.9 billion of these net capital allocations, while funds with assets under US$500 million collectively recorded net asset inflows of US$49.3 billion over this period. There […] Read more »

Size Effect On Performance Still Applies To Hedge Funds in 2017

From Eurekahedge The graphic below shows how hedge fund returns have varied across fund sizes. For June 2017 year-to-date, medium sized hedge funds (US$100m – US$500m) posted the best returns with 3.53% gains, while small and large hedge funds were up 3.40% and 2.64% respectively. Over the past year, small sized hedge funds posted the best […] Read more »

Fee Pressures Are a Hot Button

By Simon Kerr, Publisher of Hedge Fund Insight Fee pressures are ubiquitous in the hedge fund industry. Pre-Credit Crisis there were fee pressures, but some large and very large managers with capacity-constrained funds and closed to all new capital could not be bullied or argued into fee concessions. In the aftermath of the Credit […] Read more »

Top Alternative Investment Trends for 2015

By David Frank, CEO & Managing Partner, Stonehaven, LLC Over Stonehaven’s 14 year history we have witnessed and played a role in many shifting dynamics across the alternative investment industry. We are well-positioned in the marketplace to see trends with a 26 person platform representing over 20 asset managers to the global investment community. […] Read more »

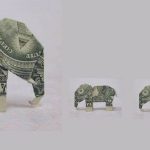

Exploiting The Hunger Premium Of Emerging Managers

By Najy Nasser, Chief Investment Officer of HeadStart Advisers Ltd According to the English proverb: ‘hunger is the best sauce.’ In investment terms, those with the most to gain from strong performance, will work hardest to achieve it. Hunger can, therefore, be one of the best sources of return. When it comes to harvesting the […] Read more »

Investors Should Carry Out Their Own Research On Smaller Hedge Fund Managers

By Donald A. Steinbrugge,Managing Partner Agecroft Partners, LLC Average hedge fund performance has been mediocre at best over the past five years, which is not surprising because most of the asset flows have been concentrated in a small percentage of firms with the largest assets under management. Many of these firms have morphed into […] Read more »

Concerns for Managers in the Build-up to AIFMD

By Roger Ganpatsingh, Director, Throgmorton The 22nd July looms large in the eyes of the hedge fund community with implementation of the Alternative Investment Fund Managers’ Directive (AIFMD) almost upon us. With the drop-dead- date less than two months away, large swathes of the Directive’s requirements and consequences remain clouded by the mists of […] Read more »