By Richard Edwards, Managing Director of HED Capital

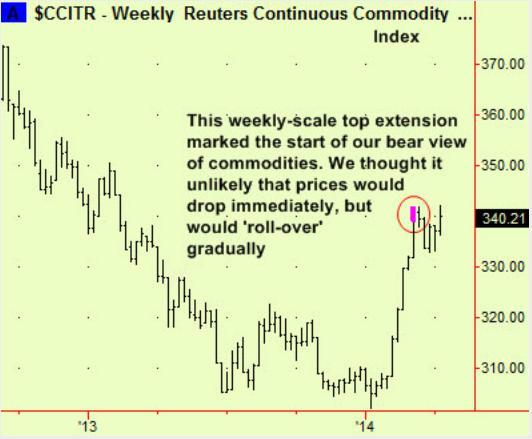

As reported, the main commodity index that we follow made a weekly-scale top extension a few weeks ago. Here is an update:

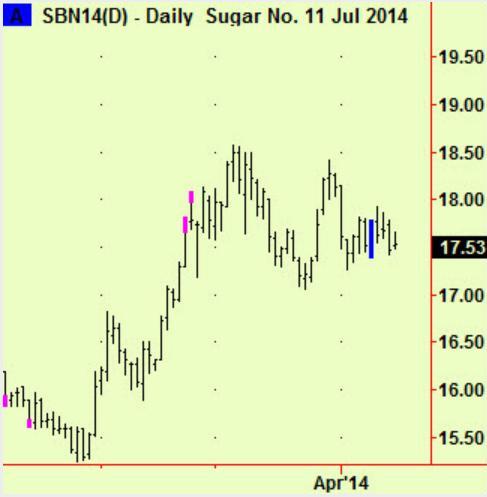

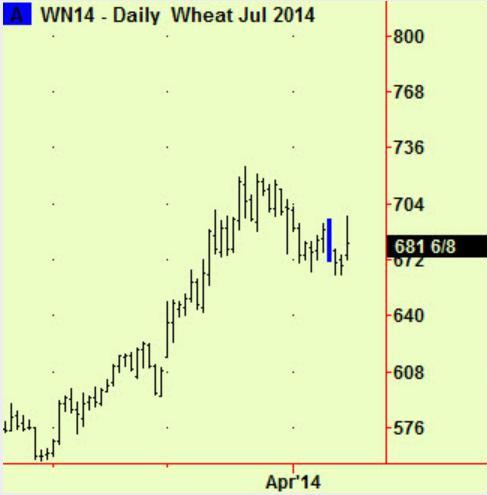

We have commented several times that this will probably lead to a rolling over of commodity prices as one by one they stall and fall. We now have two more candidates – sugar and wheat, both of which have compressed:

A closing break of these compressions would be a signal to sell short either or both markets. We expect more such sell-signals in the near future so we advise trading accordingly.

Commodity prices do not generally move in a closely correlated manner day-to-day but do so over the medium to longer term. That means we should expect groups of commodities to provide sell signals at various times in the weeks to come. We hope that we will be able to rotate positions out of one group into another at the appropriate time, but it is possible that we there will be occasions when we have outstanding short recommendations in too many markets to hold positions in all these markets, given our trading rules.