By Deutsche Asset & Wealth Management’s Hedge Fund Advisory team Our 12 month hedge fund performance forecasts are derived from our market outlook to the end of 2015, which in turn is anchored by the forecasts from the Deutsche AWM CIO Office. They are based on the following expectations: We expect global economic […] Read more »

US Liquid Alternatives Had Good Flows in 2014, Unlike High Yield Funds

By Hedge Fund Insight staff Liquid alternatives had a good year for inflows in 2014. The largest part of the flows were in the American liquid alternatives funds – mutual funds (’40 Act Funds), though net sales were also positive for UCITS hedge funds. Morningstar data shows (active) liquid alternatives totaled $156bn by year-end […] Read more »

Five Quotations From The Hedge Fund Industry You Won’t Read In 2015

From Hedge Fund Insight staff Read more »

The Case for Liquid Alts from Credit Suisse Asset Management

From Credit Suisse Asset Management The Appeal of Alternative Investments Hedge fund managers generally have a different focus and objective as well as access to a broader set of portfolio management tools compared to traditional fund managers, including: Focus on absolute returns Broader investment universe Ability to go short This flexibility is part of […] Read more »

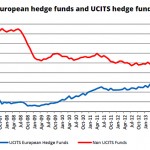

Graphic Of The Day – UCITS v Non-UCITS Hedge Funds in Europe

Source: Eurekahedge Read more »

Schroders Multi-Manager Emphasise Hedge Funds Whilst In Capital Preservation Mode

By Marcus Brookes, Head of Multi-Manager Team and Robin McDonald, Fund Manager at Schroders • Assuming global aggregate demand can continue to expand in 2015 equities will likely offer a greater short-term prospective return than fixed income. • Nevertheless, we judge equity valuations from a longer-term perspective, particularly in the US, to be on the […] Read more »

Multi-Strategy Under The Gun As European Hedge Funds Lag

From Hedge Fund Insight staff The latest flow data from Eurekahedge for the hedge fund industry show net outflows from Europe-focused hedge funds. Only two investment strategies could possibly accommodate the scale of monthly redemptions from European funds – fixed income and multi-strategy (Table 1/Figure 2). So it is highly likely that the biggest outflows […] Read more »

Hedge Fund Performance Fees – A Growing Problem

By FundCalcs/ Global Perspectives Introduction Hedge funds’ performance fees are a key component of every fund’s Net Asset Valuation calculation. Since the economic crisis of 2008, hedge fund performance and incentive fees have become more complex. The standard “2 and 20” fee model is often not the case anymore. This has meant calculations on […] Read more »

Macro Returns Positive In October As Event Driven Turns Negative For the Year

From Global Asset Management Global markets were volatile in October with equities, credit and bond yields broadly selling-off in the first half of the month before reversing course and rallying into month-end. This volatility and choppiness proved challenging for many investors, including hedge funds, with most cutting their risk by mid-month and therefore not […] Read more »

Event Driven Funds Give Back in October

Simplify Mid-Month Pulse 780 Funds Reporting as of October 17 2014 Strategy Return Macro – Discretionary Down (2.41%) Macro -Systematic Up 3.68% Macro – Commodity Down (1.15%) Emerging Markets Down (2.28%) Fixed Income – Rel Val Down (3.29%) Asia Long-Short (ex-China) Down (6.05%) Europe Long-Short Down (3.36) China Long-Short Down (1.9) Event Driven – Special […] Read more »