By Deutsche Asset & Wealth Management’s Hedge Fund Advisory team

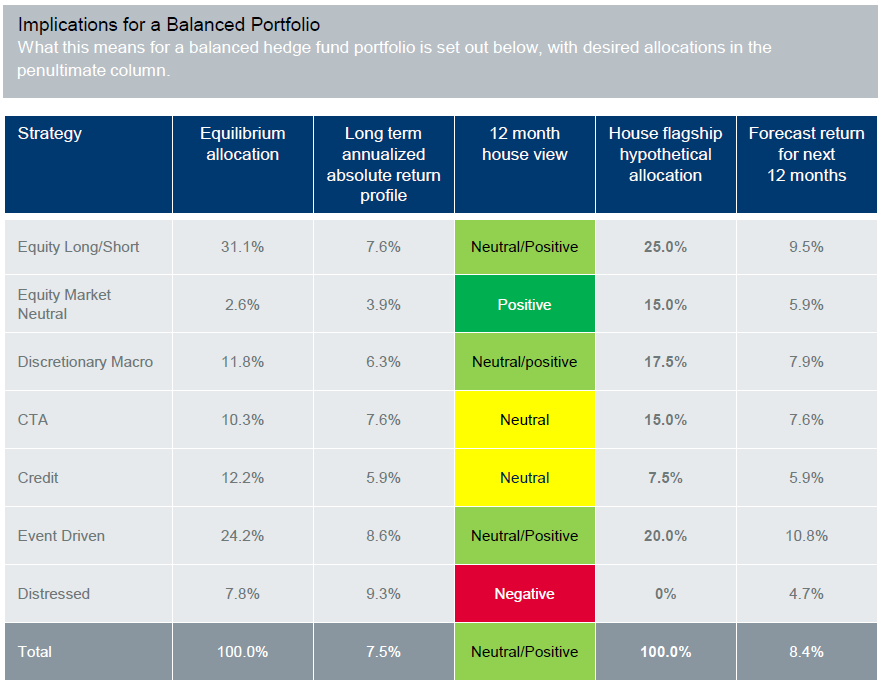

Our 12 month hedge fund performance forecasts are derived from our market outlook to the end of 2015, which in turn is anchored by the forecasts from the Deutsche AWM CIO Office. They are based on the following expectations:

- We expect global economic recovery to stay on track in 2015 with US economic growth picking up pace in the coming year

- The Fed is likely to ease up interest rates during Q3 of 2015.

- Expansionary monetary policies in the Eurozone and Japan will continue

- Expected ECB action should feed further monetary policy divergence

- Expectations of a Fed rate hike in 2015 will support the US dollar

- Lack of inflationary pressure is limiting the rise in bond yields

- Negative real interest rates continue to fuel equity markets

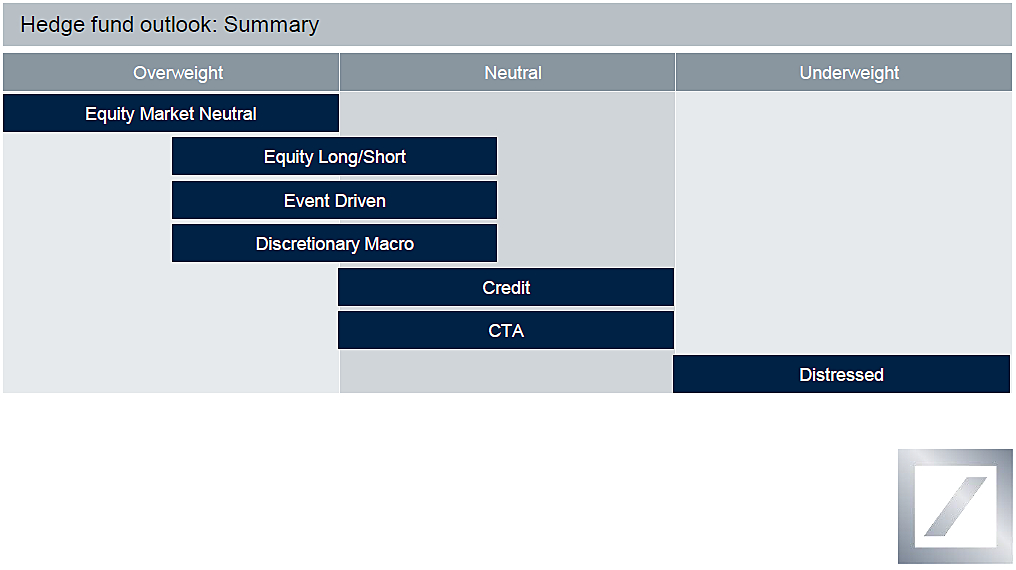

Hedge Fund Outlook: Summary

We have raised our outlook for CTA strategies to Neutral, and reduced our outlook for both Equity Long/Short and Event Driven from outright Overweight to Neutral/Overweight.

Equity Long/Short: While we believe that markets could move forward during the year this will be at the expense of greater volatility. In the US rate cycle will turn and the equity market is more fully valued than a year ago. In Europe political risk in 2015 is expected to be more elevated than in 2014.

Event Driven: While we expect to see an environment of elevated take-over activity again in 2015 the volume of deals is expected to be lower than witnessed during 2014.

CTA: The positive change of significance is for CTAs which we have raised to Neutral from Neutral/Underweight. This is due to expectations of greater divergence and de-correlation among asset classes which lead us to predict a better environment for the sector going into 2015.

Equity Long/Short: Neutral/Overweight

While our central case is that equity markets willbe supported by a relatively benign global liquidity environment we expect greater equity market volatility during 2015. This is because the first interest rate hike in the US will, in all likelihood, be upon us within 12 months. We therefore suggest accessing both managers operating with a low net exposure book and managers seeking alpha from a reversion of the relative sector valuation adjustment which has arisen due to the unexpected fall in long-term interest rates during 2014.

The US equity market rally of 2014 has been led by a relatively select number of companies within the main indices. At the risk of generalising, these companies reside in the health care, utilities and technology sectors. In contrast cyclicals and those other sectors most aligned with a US recovery have largely missed the rally in 2014.

Given that our central case is for US economic outperformance associated with a rise in interest rate expectations, we would expect a revaluation of these industries by market participants relative to secular growth and yield alternative sectors.

In Europe markets would be expected to be helped along by further action from the ECB early in 2015. Expectation of QE and in lieu of the recent stress tests our managers are finding stock-picking opportunities within financials – banks and insurance companies in particular. Consolidation continues in the telecommunications sector creating further opportunity.

Positive developments in corporate governance in tandem with significant domestic asset allocation decisions into equities should be supportive for Equity Long/Short strategies in Japan.

We are wary of an overweight allocation to the typically longer biased Emerging Market strategies. Historically, Emerging Market equities in aggregate have underperformed during a stronger US dollar/weaker oil price cycle which we are currently experiencing.

Equity Market Neutral: Overweight

Fundamental Equity Market Neutral strategies have fully recovered from the hiccup in March/April this year and are delivering consistent positive performance through both rising and falling equity market months. This is because fundamentals are reasserting themselves as a determinant of company valuations in equity markets. We believe this dynamic, allied with a relatively uncrowded operating environment, will be supportive for fundamental Equity Market Neutral returns.

We remain wary of the vulnerability of some approaches to elevated take-over activity as backward-looking models are likely to be short target companies that are subject to speculative price pressure.

While equity market volatility remains one of the cheapest asset classes we expect Statistical Arbitrage managers to benefit from its intermittent rise. After these spikes, strong returns can be made as correlation drops in tandem with rising stock price dispersion.

Discretionary Macro: Neutral/Overweight

We maintain a Neutral/Overweight expectation for returns for Macro managers with our conviction reinforced by developments during the last quarter of 2014. In summary we see opportunities for the sector in three areas, foreign exchange, rates and equity markets.

In FX one very popular trade, which has reaped dividends for the strategy recently, is the long US dollar trade. As the ECB contemplates outright QE we now see the US exiting QE3. Meanwhile, Japan as an economy is still seeking escape velocity from structural deflation. However the actual real appreciation of the US dollar versus its trade-weighted partners to date has been very limited. Certainly when compared to the relative performance of equity and fixed income markets over the past 5 years.

For six years in interest rate trading, zero or near zero rates in the US and Europe have severely limited the number of opportunities for Macro managers to trade the short end. However, with the US cycle turning this will allow managers to trade different scenarios covering both the speed at which the US reaches its terminal nominal interest rate and just what that rate will be post the Global Financial Crisis (GFC).

From conversations with managers, relative value trading between the US and European equity markets is popular. Style selection and sector leadership within markets can create opportunities particularly given the lack of breadth in the US rally during 2014. Finally market capitalisation relative value positioning is interesting in the US as large caps are expected to outperform small caps as interest rates rise.

CTA: Neutral

The strategy’s recent recovery from a sustained period of underperformance has been driven by trends in commodities and long-term interest rates, in particular during Q4 2014.

CTAs have struggled to perform during what many commentators term an extended period of regime change post the GFC. Normally this type of regime change happens quite quickly and during a period such as this, CTAs typically struggle to perform. However in the current case it has been an extended five-year period. As we exit the cycle with the end of QE in the US, expectations of greater divergence and de-correlation among asset classes lead us to predict a better environment for the sector going into 2015.

At the same time the trend-following industry has not been idle during the lean times for performance. Research has focused on developing multi-model funds that can identify and take advantage of different market environments. In addition systems have developed risk management techniques to reduce exposure to highly popular trends in order to minimise drawdowns on trend breaks.

For these reasons we have decided to upgrade our outlook for CTAs to Neutral.

Credit: Neutral

With high yield markets generally recovering during Q4 in the US, much of the potential return from spread contraction appears to be elusive, although opinion is divided on this. The sharp sell-off in crude oil has had a knock-on effect on credit valuations in the oil and gas sector however the remainder of the sector appears to be well supported by liquidity and valuation.

However, given the low absolute yield/carry across non-investment grade credit, generally we prefer credit strategies focused on relative valuation between secured debt such as bank loans (long) and unsecured debt as high yield bonds (short), both within companies and within industries.

While Credit Long/Short strategies continue to benefit from the improved conditions for fundamental approaches, bonds trading above par are exposed to call risk, loans are also trading close to par and new loan issuance is increasingly associated with poor creditor protection.

There continue to be select opportunities for longer-term strategies in structured credit. In mortgage derivatives, rising interest rates would reduce prepayments. However improvements in the US housing market are priced into securities forcing investments further down the capital structure.

Within Convertible Arbitrage, higher equity markets have materially increased new issuance, creating opportunities in secondary markets which is a traditional source of return for these managers.

Event Driven: Neutral/Overweight

We believe that Event Driven strategies will perform marginally better than average for the following reasons:

M&A volumes continue to run at elevated levels albeit at lower volumes than during 2014. US targeted M&A volumes are at a record USD 1.6 trillion in 20141 . This has been driven by healthy corporate balance sheets, improving confidence, access to cheap credit and the prospect of rising rates. Companies continue to seek to acquire earnings, vertically integrate or geographically diversify.

Recent spread widening on previously announced deals has created interesting entry points for managers to re-engage new positions where the underlying fundamentals are unchanged. Typical spreads now for friendly non-controversial deals are as wide as 8%-9% annualised vs. 3%-5% before Q4 2014.

Corporate simplifications are on the increase as firms with a diversified business model are being pressured to simplify. Division sales and large payouts can generate significant increases in share price.

Equity Special Situation managers are increasingly focused on opportunities thrown up by financial engineering priorities from companies such as such as ‘yieldcos’ in the renewable energy sector and MLPs in the pipeline industry.

Key industry themes include: Insourcing through acquisition of research and development by larger healthcare companies, combinations in the telecommunications/media sectors to both alleviate price competition and provide a comprehensive media solution to consumers, and consolidation in the energy sector which now faces significant revenue pressures.

Distressed: Underweight

The headwinds for the strategy performance wise are: 1) Full valuations in credit; 2) The proportion of performing credit trading at ‘distressed’ and ‘stressed’ levels is low hence few opportunities; 3) The default rate is likely to stay low in the US; 4) There is significant money chasing the opportunity particularly in Europe.

Pockets of opportunity exist for example in Europe, where bank deleveraging in a weak macroeconomic growth environment, fiscal austerity and stress tests for Financials may catalyse some opportunity.

If the oil price stays low for longer then opportunities may arise in various components of the energy sector.

The Hedge Fund Advisory team is part of the Alternatives & Fund Solutions division of Deutsche AWM. The Hedge Fund Advisory team provides hedge fund advisory and discretionary portfolio management services to a range of clients. The views presented in this Outlook are exclusively those of the Hedge Fund Advisory team and not any other division of Deutsche AWM. They are provided for information purposes only and do constitute investment advice. Investments in hedge funds may not be capital protected investments and investor capital is at risk up to a total loss. Hedge funds are complex investments that may not be appropriate for all investors. Past performance is not a reliable indicator of future performance. Projections are based on a number of assumptions as to market conditions. there can be no guarantee that the projected results will be achieved.

1 Source: Dealogic

Related articles: