From Credit Suisse Asset Management

The Appeal of Alternative Investments

Hedge fund managers generally have a different focus and objective as well as access to a broader set of portfolio management tools compared to traditional fund managers, including:

- Focus on absolute returns

- Broader investment universe

- Ability to go short

This flexibility is part of what makes hedge funds a valuable component when constructing balanced portfolios. Some of their key benefits include:

- Higher risk-adjusted returns

- Capital preservation

- Protection from rising interest rates

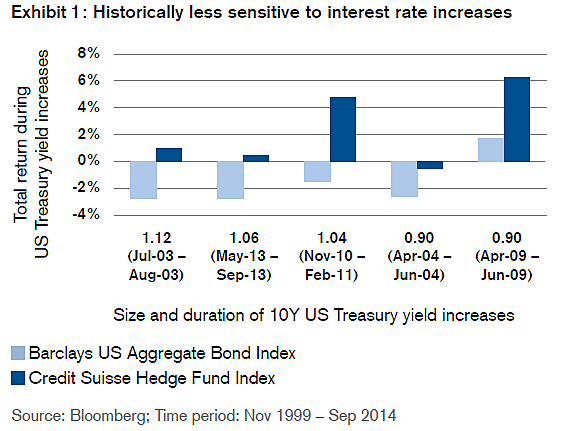

Declining equity markets are not the only scenario that investors should be concerned with. Interest rates are close to their lowest level in recorded history and at some stage are expected to rise. When interest rates rise, prices of existing bonds generally fall and investors may experience a capital loss. Exhibit 1 illustrates that hedge funds historically have had a lower sensitivity to interest rate increases, a potentially valuable attribute as the U.S. Federal Reserve winds down its bond purchase program.

Sources of Hedge Fund Returns

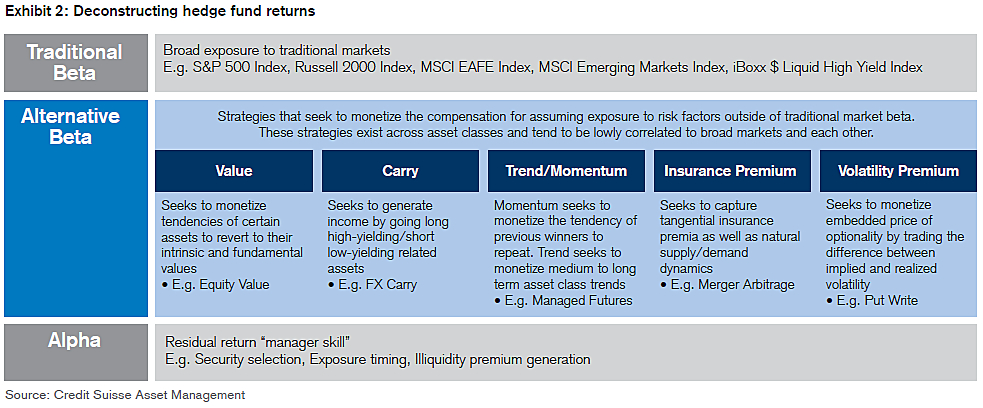

Hedge fund returns can be broken down into three distinct components: Traditional risk premia (i.e., market beta), alternative risk premia (i.e., alternative beta) and Alpha.

Traditional Risk Premia (Traditional Beta)

These can be captured with passive exposure to traditional markets such as stocks, bonds, commodities and currencies. Exposure to traditional risk premia can be gained efficiently using index mutual funds or exchange traded funds. While traditional risk premia are a component of many investments, certain hedge fund strategies (e.g., long/short equity) also exhibit sizeable but varying allocations to such traditional investments.

Alternative Risk Premia (Alternative Beta)

These are the returns earned for taking risks in alternative investment strategies. Examples include the deal risk premium inherent in merger deals, the insurance risk premium embedded in certain option prices, and the value premium in equity markets. Alternative risk premia, like their traditional counterparts, are persistent risks that you should expect to be compensated for; however, they differ from traditional risk premia in that they require investment expertise and infrastructure to extract.

Alpha

This is the return that cannot be accessed by simple allocation to traditional or alternative risk premia. It is the return generally associated with investment skill resulting from, but not limited to, security selection, market and strategy timing as well as sizing. It can also represent the illiquidity premium related to investments in hard-to-source assets.

Benefits of Liquid Alternatives

Deconstructing hedge fund returns into the components shown in Exhibit 2 provides us with a framework for understanding how traditional and alternative risk premia can potentially provide benefits similar to hedge funds when incorporated into a portfolio. However, this framework requires sophisticated analytical tools to assess how various risk premia tend to perform in different market environments as well as how they interact with each other when combined within a portfolio.

(click on Table to see enlarged image)

(click on Table to see enlarged image)

Alternative Liquid Trading Strategies (ALTS™) is a specialized investment boutique within Credit Suisse Asset Management that leverages its intimate understanding of hedge fund strategies to determine how individual risk premia can be incorporated into a portfolio and the varying roles each strategy can play over time.

Investments in portfolios of liquid alternative risk premia potentially offer the following benefits:

Strategy diversification – Broad exposure to various hedge fund-like strategy returns.

Fee-efficiency & liquidity – Daily liquidity with low overall fees and generally lower fees than a direct investment in hedge funds.

Convenience – Low investment minimums and tax reporting similar to traditional investment vehicles.

Transparency – Full position level transparency, generally on a quarterly basis.

Credit Suisse Asset Management for Liquid Alternatives

Credit Suisse Asset Management is one of the largest alternative investment managers globally, with over a decade of experience managing and investing in hedge funds. Credit Suisse boasts a combined network of investment teams and intellectual capital that sets us apart as one of the industry’s largest, most established and innovative hedge fund solution providers. The Credit Suisse ALTS™ team, comprised of investment professionals with extensive experience in research, investment strategy development, portfolio management, and trading, manages multiple liquid alternative portfolios for institutional, retail and private clients worldwide, helping them to achieve their investment goals.

The team leverages Credit Suisse’s expertise in managing alternative strategies and has exclusive access to the Credit Suisse Hedge Index database, one of the industry’s largest proprietary hedge fund databases. The Credit Suisse Hedge Fund Index is an asset-weighted hedge fund index which tracks over 400 hedge funds and seeks to be representative of the overall hedge fund universe. For more information, please contact us directly at cs.alts@credit-suisse.com.