By Hedge Fund Insight staff

Liquid alternatives had a good year for inflows in 2014. The largest part of the flows were in the American liquid alternatives funds – mutual funds (’40 Act Funds), though net sales were also positive for UCITS hedge funds.

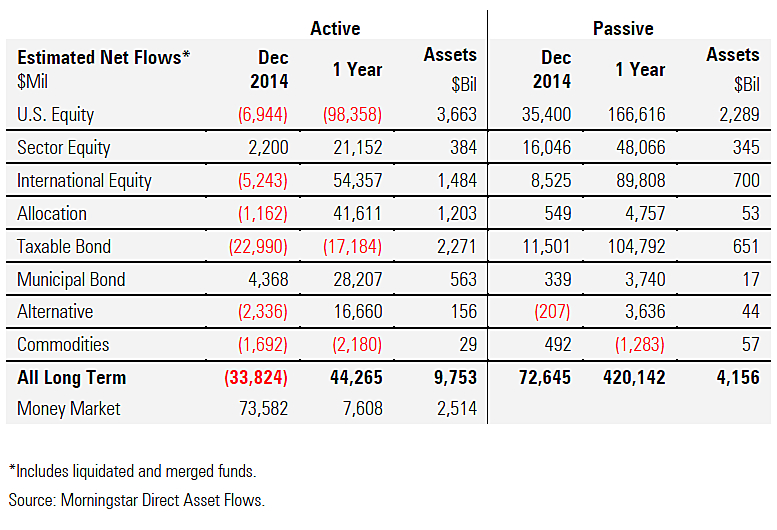

Morningstar data shows (active) liquid alternatives totaled $156bn by year-end after net flows of $16.6bn during the year:

The outflows in December for alternatives can wholly be put down to one fund. The MainStay Marketfield Fund started the year with $19bn under management. It finished 2014 as a $9.1bn fund, and had outflows of $2.566bn in December. Excluding that one fund liquid alternatives would have had an inflow of more than $23bn in 2014.

The outflows in December for alternatives can wholly be put down to one fund. The MainStay Marketfield Fund started the year with $19bn under management. It finished 2014 as a $9.1bn fund, and had outflows of $2.566bn in December. Excluding that one fund liquid alternatives would have had an inflow of more than $23bn in 2014.

It may also be significant that High-Yield Bond Funds in the mutual fund format had significant outflows. Through the year $17.5bn left High Yield Funds, a majority of it towards the back end, leaving a year-end total of $267bn.

One Response to “US Liquid Alternatives Had Good Flows in 2014, Unlike High Yield Funds”

Read below or add a comment...