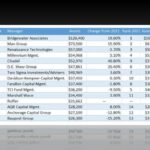

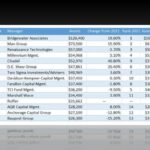

Hedge Fund Managers ranked by discretionary assets managed in hedge funds worldwide, in millions, as of June 30, 2022, unless otherwise noted. Data are from a company source such as a spokesman, website or financial report. Read more »

Incisive Views from Professionals

Hedge Fund Managers ranked by discretionary assets managed in hedge funds worldwide, in millions, as of June 30, 2022, unless otherwise noted. Data are from a company source such as a spokesman, website or financial report. Read more »

From Eurekahedge The graphic below shows how hedge fund returns have varied across fund sizes. For June 2017 year-to-date, medium sized hedge funds (US$100m – US$500m) posted the best returns with 3.53% gains, while small and large hedge funds were up 3.40% and 2.64% respectively. Over the past year, small sized hedge funds posted the best […] Read more »

From Ernst & Young This is the Executive Summary of the 2016 Global Hedge Fund and Investor Survey Shrinking returns and escalating investor demands. Downward pressure on fees and unrelenting requirements to have robust operating models. This year, competing forces came together to culminate in the perfect storm. In a year marked by lackluster performance and rising investor expectations, one inevitably […] Read more »

By Simon Kerr, Publisher of Hedge Fund Insight Fee pressures are ubiquitous in the hedge fund industry. Pre-Credit Crisis there were fee pressures, but some large and very large managers with capacity-constrained funds and closed to all new capital could not be bullied or argued into fee concessions. In the aftermath of the Credit […] Read more »

By David Frank, CEO & Managing Partner, Stonehaven, LLC Over Stonehaven’s 14 year history we have witnessed and played a role in many shifting dynamics across the alternative investment industry. We are well-positioned in the marketplace to see trends with a 26 person platform representing over 20 asset managers to the global investment community. […] Read more »

By Peter Douglas of GFIA I recently chaired a Bloomberg discussion, targeted at small or growing hedge funds, offering advice on what investors are looking for. My panellists all had at least 10 years’, and in one case 20 years’ experience in the hedge fund or institutional asset management industry, in senior positions. The […] Read more »

By Simon Kerr, Publisher of Hedge Fund Insight The Cayman Islands Monetary Authority produces regular statistics on the numbers of active financial businesses in its jurisdiction. Offshore banking and reinsurance are significant to the Cayman Islands, but the Cayman Islands are also home to more offshore hedge funds (Cayman Island Mutual Funds) than any […] Read more »