By Simon Kerr, Publisher of Hedge Fund Insight

Fee pressures are ubiquitous in the hedge fund industry. Pre-Credit Crisis there were fee pressures, but some large and very large managers with capacity-constrained funds and closed to all new capital could not be bullied or argued into fee concessions. In the aftermath of the Credit Crunch only investing institutions were net investors in hedge funds, and as a consequence all terms of business were subject to review and change across the board. It turns out that a lot of the industry developments of the last 5 years have reinforced the pressure for change.

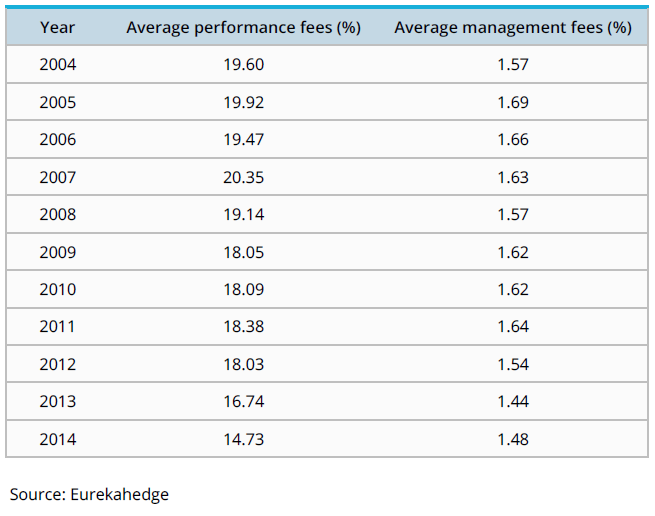

There has been a bias towards putting fresh capital in large, branded funds. It has become increasingly difficult to launch a new hedge fund management company. It is far easier to launch a fund under an existing regulatory umbrella and share fees. The absolute costs of systems, compliance capability, headcount and office space has made independent launches less frequent. The corollary of the difficulty of raising day one capital is in the fees charged by new hedge funds shown in Table 1.

Table 1 details the average performance and management fees charged by North American hedge funds based on their year of inception. Historically hedge fund performance fees were close to 20% p.a. and the average management fee at launch was somewhere between 1.5 and 2%. Falls in both those types of fees have accelerated in the last two years, to the extent that the average performance fee is now less than 15% and the average management fee in the most recent year was less than 1.5% for new North American hedge funds.

Launching a hedge fund is a competitive activity, as new funds compete with each other to attract capital. Since 2008 in North America there have been 1260 launches of long/short equity funds, of which 238 came in the last year. The number of launches has an impact on the average level of fees that can be charged. It is particularly competitive for long/short equity hedge funds in North America, so that the Table is focused on the combination of geography/strategy where the pressures are greatest.

How important are the fees to investors in hedge funds?

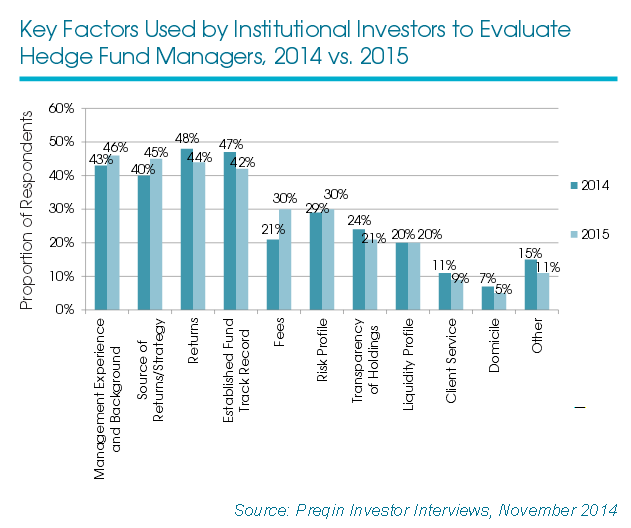

Fees are an important factor in looking at potential investments in a hedge fund, but by some way less important than the return history of the manager. That fees are a secondary factor was reflected in the Preqin survey of investors conducted last November. As shown in figure 1 there were four factors given ahead of fees in importance by the 134 institutional investors in the survey.

As a medium-to-long-term trend, the constant commercial discussions around management and performance fees between managers and investors in hedge funds is having an effect which investors consider positive. Three-quarters of investors in the Preqin survey noted an improvement in this area over the previous year. That is, the topic is pervasive and investors are seeing change.

One of the reasons for change is the growth of capital into hedge fund strategies in the mutual fund format. There is some growth in UCITS hedge funds in Europe, but much greater growth of capital flows is occurring because of the availability in the United States of hedge fund strategies from brand name managers in ’40 Act Funds. When investors can access the investment strategies of successful managers like Winton Capital Management, Highbridge, AQR and Joel Greenblatt’s Gotham Asset Management in an onshore regulated format like a ’40 Act Fund it has impacts on offshore funds and onshore investment partnerships and their fees.

’40 Act Funds are not allowed to charge performance fees, and management fees are a standard 1%. The fees and the fact that the funds are regulated has attracted capital not just from retail investors in hedge fund strategies. There is a lot of evidence that institutional investors are switching to mutual fund versions of the hedge fund strategies they invest in, and are now seeking ’40 Act solutions to the new capital allocations they have.

The availability of mutual fund versions of hedge funds also applies to multi-manager hedge funds, or funds of funds. It makes an easy strategic move for a provider that already has an extensive range of mutual funds and is a manager of funds of hedge funds to implement the latter in the former format. So it make a lot of sense for the likes of Blackrock and AllianceBernstein to offer funds of funds as a Registered Investment Company. However, these are products that are bought mostly by retail customers (or at least the mass wealthy) and so do not bring additional fee pressures for hedge fund managers that single manager hedge funds in a mutual fund wrapper do.

Another pressure on the fees charged by single manager hedge funds is the issue agenda of the regulators. The SEC has a number of current topics including valuation policies and procedures of hedge fund, and fee transparency. In previous growth phases of the industry (pre-Credit Crunch) some hedge fund managers charged various operating expenses to the fund rather than taking the cost through their own P&L. The costs allocated this way have included travel and other marketing expenses, costs of research, and all I.T. costs. The dominance of investing institutions has tempered the practice of hedge fund management companies routing some of their operating costs to their funds. So called “all-in” fees have become the standard, but there are a few legacy arrangements still around. The SEC when visiting a hedge fund management company will specifically investigate for the presence of hidden costs, and as hedge funds come onshore (and are increasingly regulated) the practice should die out.

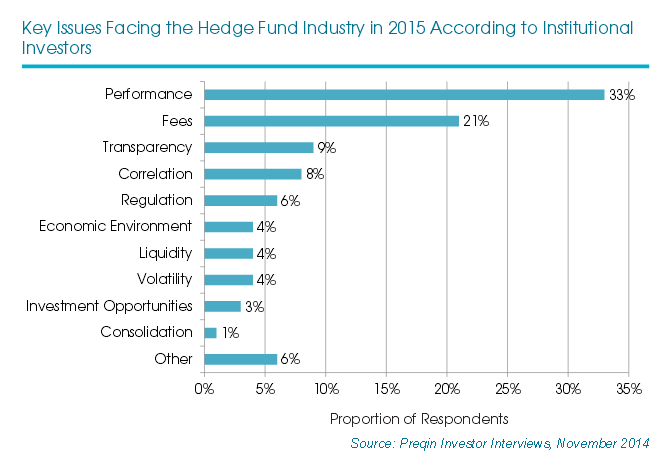

The same Preqin survey referred to earlier asked institutional investors what they saw as the key issues facing the hedge fund industry in the year ahead (2015 at that point). The aggregated responses are shown in figure 2.

So looking forward, and consistent with the results of figure 1., returns of hedge funds in 2015 is the issue of most concern to investors. However fees are expected to be the second most significant issue of concern to investors this year. Investing institutions are far from passive on the issue, with 68% of investors in the Preqin survey still seeking improved management fees over the next 12 months.

We started this fee review by stating that large, branded hedge funds with closed funds were able to resist fee pressures in the era before the Credit Crunch. That is no longer true. It has become public knowledge that for a large institutional mandate (say $100m or more) public pension plans can extract some fine terms from hedge fund management companies. They can achieve full transparency, enhanced liquidity terms and even contractually oblige the principals of hedge funds to conduct a regular dialogue. Fee pressures are here to stay even for the increasingly dominant elite of the industry. When Och Ziff, one of the few large and publicly Listed alternative investment groups, has conceded a management fee of well less than 100bps you know that the shoe is on the other foot.

THIS ARTICLE ORIGINALLY APPEARED IN NORDIC HEDGE AND IS REPRODUCED WITH KIND PERMISSION