From Eurekahedge

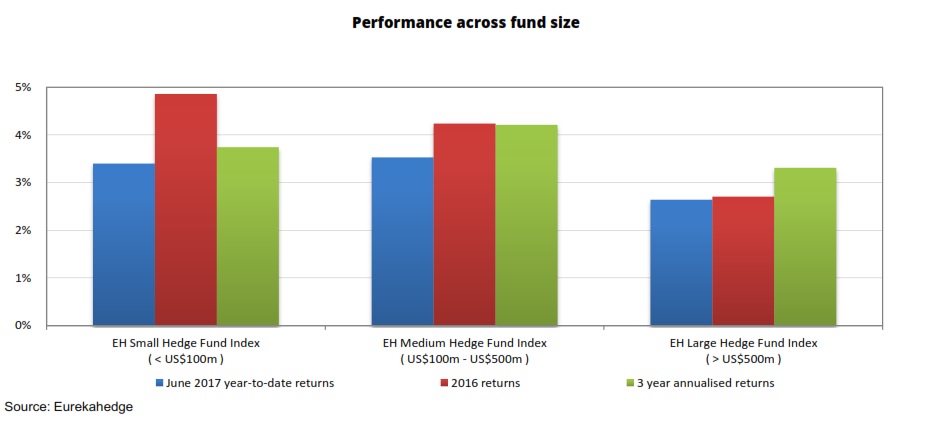

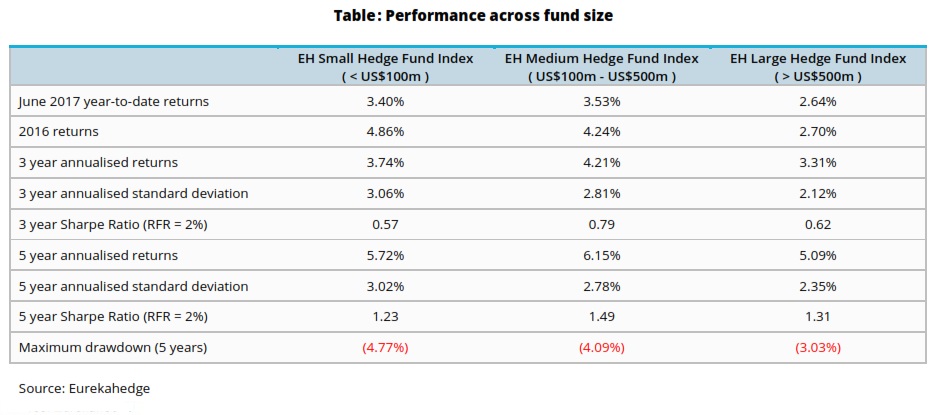

The graphic below shows how hedge fund returns have varied across fund sizes. For June 2017 year-to-date, medium sized hedge funds (US$100m – US$500m) posted the best returns with 3.53% gains, while small and large hedge funds were up 3.40% and 2.64% respectively. Over the past year, small sized hedge funds posted the best gains among fund sizes and were up 4.86%, while large sized hedge funds come in close with 2.70%. In terms of three year annualised returns, medium sized hedge funds led the table and were up 4.21% followed by small and large sized hedge funds which were up 3.74% and 3.31% respectively.

There is a balancing item in the risk measures by fund size, as shown in the Table below. The standard deviation of returns over 3 and 5 years is lower for large hedge funds than for medium sized and smaller hedge funds. The maximum drawdown over five years for large funds is better at -3.03% than for medium sized (-4.09%) and smaller funds (-4.77%).

related content: