By Daniel Stern, Cliffwater LLC There has been much speculation this year on the difficulty equity long/short managers have been having shorting stocks. In fact, a number of managers tracked by Cliffwater have commented on the challenges of shorting stocks with high short interest which have dramatically outperformed the broader markets. Goldman Sachs maintains a […] Read more »

Graphic of The Day – Regional Relative Performance of Long/Short Managers

By Simon Kerr, Publisher of Hedge Fund Insight The returns of equity long/short managers are under examination here, and how the managers have performed relative to their regional indices. It is no surprise that European long/short managers have produced returns year to date closely in line with the STOXX Index – the aggregate stock selection […] Read more »

The Hedge Fund Year So Far In Two Graphics

By Simon Kerr, Publisher of Hedge Fund Insight, As for any period since the end of 2009, so far this year the hedge fund industry mostly has been about what has happen in North America. That is where the managers who are attracting most assets are based, and that is where the flows coming into […] Read more »

European Hedge Fund Industry Joins In The Growth

By Simon Kerr, Hedge Fund Insight From immaturity around 1997 through the mid 2000’s the European hedge fund industry grew faster than that of the country which invented the concept, the United States of America. For the period since the Credit Crunch the European industry has been a lot less vigorous than the American scene, […] Read more »

Normalisation of Correlation and Dispersion Gives Hedge Funds Opportunities

By Jeanne Asseraf-Bitton, Head of Cross Asset Research, Lyxor Asset Management Risk assets are set to generate positive returns for the remainder of 2013 driven by a slowly expanding global economy and ultra accommodative monetary policy. We believe that the familiar pattern from the last three years of 2Q data disappointment and consequent risk […] Read more »

Half Of UCITS Hedge Flows Into Fixed Income

By HFI Staff Writer Last year UCITS hedge funds assets under management (AUM) increased by 20% to reach a new high of €140 billion. The latest quarterly European research on the UCITS hedge funds industry published by Alix Capital, the Geneva-based provider of the UCITS Alternatives Index (UAI) family of indices, reveals that more than […] Read more »

Opportunities Widen For Equity Long/ Short

By Simon Kerr, Publisher of Hedge Fund Insight Equity long/short managers have done okay in 2012. With the S&P500 up 15.0% in 2012 US based equity long/short managers were up 7.0% to the end of November according to the Greenwich Hedge Fund Index. Given the risk on/risk off market environment through 2012 that is a […] Read more »

Specialist Manager Series – Selecting Healthcare Stocks with Rhenman & Partners

Selecting Healthcare Stocks: “Hedge Fund Insight” features a series of articles to share the expertise of specialist equity managers. The second looks at the approach taken by Rhenman & Partners Asset Management AB of Stockholm, which specialises in healthcare shares in the hedge fund format. The requirements of institutional investors in hedge funds can […] Read more »

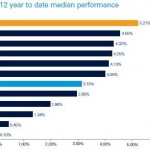

European Equity Managers Adding Value From Bottom Up

According to Deutsche Bank the median return of European-based hedge funds in the first 4 months of the year was 3.15%. Just looking at Equity L/S strategies, over the same period global L/S funds were up 4.25%, and European Equity L/S were up 4.13% on a median basis. For comparison the STOXX 600 was up […] Read more »

The Big Hedge Fund Stories from 2011

Although individual news items can have can have historical significance (such as story 1 below) the effort here is more to point to the themes and trends at work in the hedge fund industry last year. Here are my top stories for 2011: Bruce Kovner 1. Big Name Retirements – two of the best known […] Read more »