By Simon Kerr, Publisher of Hedge Fund Insight,

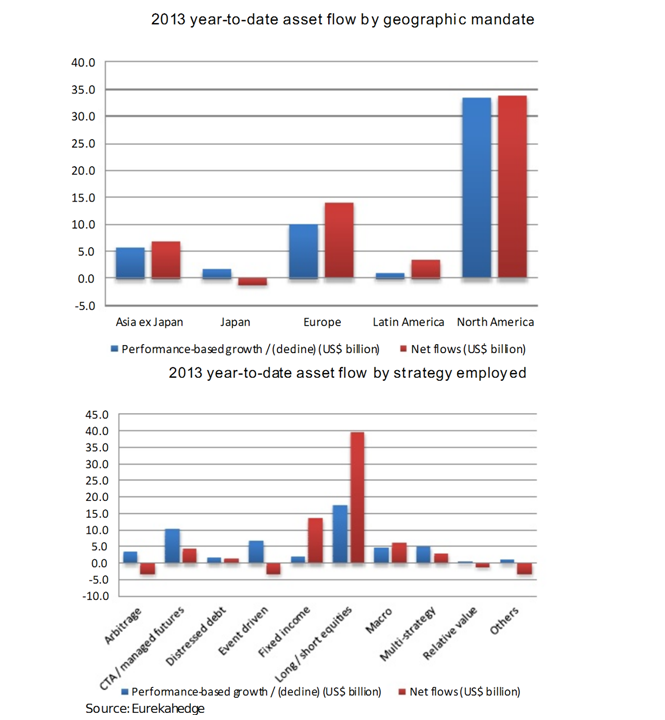

As for any period since the end of 2009, so far this year the hedge fund industry mostly has been about what has happen in North America. That is where the managers who are attracting most assets are based, and that is where the flows coming into the industry have been sourced. The European end of the hedge fund industry has also had positive flows this year – inflows of $14bn in the year to date, and net subscriptions in each month too. Flows to Asian hedge funds have been positive for the year, but Asian hedge funds (including those in Japan) had net outflows last month, as risk appetite for Greater China seems to be under review.

The second graphic here reflects the pick up in risk assumption this year – when markets have gone up, investors in hedge funds allocate to strategies with a net long bias, and particularly to long/short equity managers. It is to be hoped that the flows to fixed income hedge funds have come about because investors recognise that hedge fund managers have a shot at avoiding some of the pain of a reversal in monetary policy across large parts of the world.