Selecting Healthcare Stocks: “Hedge Fund Insight” features a series of articles to share the expertise of specialist equity managers. The second looks at the approach taken by Rhenman & Partners Asset Management AB of Stockholm, which specialises in healthcare shares in the hedge fund format.

The requirements of institutional investors in hedge funds can be taxing. They can dictate the terms of business to a hedge fund; they can take nine months of exhaustive due diligence, and large investors have raised the bar across the industry in terms of the rigour of infrastructure and reporting standards they need.

Although survey evidence suggests that the largest American pension plans are considering investing in funds in the $500m-$1bn category, there is not much sign of the capital flows there yet. Investing with smaller, less-well resourced fund management companies will usually require a compromise on standards in some area for an institution. Why would a large insurance company or Endowment go to the bother of having to lay out the inevitable caveats in the proposal to the in-house investment committee?

The answer in one word is performance, in two words is alpha generation and in three words is pattern of return. Investing institutions need to tap into the higher return available from younger, smaller hedge funds, and for which academic studies provide good evidence. The security of management companies’ operating systems is a necessary hygiene factor in hedge fund investment programmes, but they do not justify the effort of investment consultants, funds of hedge funds, advisors, due diligence out-sourcing companies, third-party risk assessors and the dedicated internal investment professionals working on behalf of a state pension plan. Helping to meet the plan desired return target does.

One of the hedge fund investment strategies that give flexible utility to large investing institutions is sector long/short equity funds. The products of sector hedge fund managers can be used in core/non-core structures, in funds split along active/passive line, and where alpha generation is explicitly separated from beta exposures to markets/asset classes. A specialist technology long/short fund could augment a large cap or small cap allocation in a pension fund, or be a substitute within a number of domestic/global equity mandates. Also the investment processes of sector funds should be culturally acceptable to institutional investors as they are always dominated by the application of fundamental research, which meets the preferred bias of the big investors.

A good example is the Rhenman Healthcare Equity Long/Short Fund run by Rhenman & Partners Asset Management AB of Stockholm. Although the managers give these reasons to invest in the Fund:

•Rhenman & Partners are specialists in healthcare, a very complicated, dynamic and fragmented industry representing 10% of global equity markets

•The sector is expected to show high earnings growth

•Sector growth is very stable – driven by many factors

•Emerging markets are an important contributor to stability of growth

•Fund focus on fast growing companies which typically are underrepresented in regional and global equity funds

•Growth in healthcare niches will always occur, and globally health budgets are expected to expand for decades

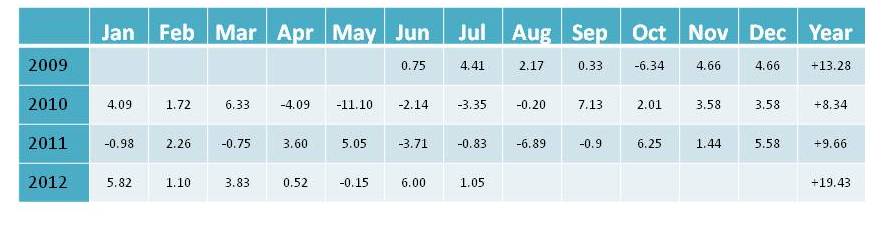

The real reason for a potential investor to have a look at the fund is the return series. The monthly track record is shown below in Table 1.

Table 1. Net Returns of Rhenman Healthcare Fund (IC1 (EUR))

A number of points emerge from looking at this data: 61% of monthly returns are positive, the largest absolute number is a big negative, there is a frequent occurrence of 5%-plus up-months, and there is a seasonal pattern to returns (negative in the middle of the year). However the stand out point is in the last column – for the 37 months of returns in the hedge fund format each of the returns on a calendar year basis are nicely positive – an absolute return track record!

Many of the elements of structure and process that go into producing these stand-out returns are seen in other funds, but there are few unusual ingredients in there too. The stated aim is to produce returns of 12%-plus, and there is a good fit in the alpha source, portfolio structure, and risk management to produce that level of return.

Alpha Source

Firstly the alpha source is in the combination of the portfolio manager, Henrik Rhenman, and the Scientific Advisory Board of the Fund. Henrik Rhenman has experience of the real world beyond finance, having worked for Pharmacia and Alfa Laval, but his financial sector experience is very apt for a specialist portfolio manager. He has been the portfolio manager for the SEB Pharmaceutical Fund (based in Europe), and been a PM at a specialist investment house (S.G. Cowen) based in Boston. So he brought a wide geographical and market experience to bear when he went on to run the Carnegie Healthcare Funds for the Scandinavian Carnegie Investment Bank AB for more than nine years. Over the relevant period Rhenman racked up top-ranking returns with the Carnegie Global Healthcare Fund, producing an 8-fold gain when the benchmark index (the MSCI Healthcare Index) was up just 20%.

It was whilst managing the Carnegie Global Healthcare Fund that Rhenman began working with an external Scientific Advisory Board. That means that the 54-year old has used this input to his management process for more than 15 years, though the composition of the Board has varied through time. The current Board has four professors on it, three of whom hold positions at the prestigious Karolinska Institutet which is one of the largest medical universities in Europe with roughly 4000 employees and 6000 students.In 1895 Alfred Nobel entrusted Karolinska Institutet with the responsibility of awarding the annual Nobel Prize in Physiology or Medicine. The Board works to highlight the potential and risks in clinical developments through a quarterly formal meeting, but the members also give input to Henrik Rhenman by constant informal contacts through the year. The manager himself compiles a large compendium of relevant academic medical papers for the meetings to review and discuss – this goes out 10 days before the meeting.

The inference is that one of Rhenman’s key skills is to identify which clinical areas and papers to address in his research process. To illustrate the scale of the task, Rhenman notes that there were 4,500 abstracts for the papers for the American Society of Clinical Oncology’s annual conference. “I try to find papers to make the meetings interesting for the Advisory Board members,” he says.

The Scientific Advisory Board does several things. First it helps weed out potential investments that are at too early a stage to invest in. These are companies that the manager can and will go back to. Henrik Rhenman comments that “the professors get to know the companies I have invested in. We build this puzzle together over many years.” Second, the Board helps Rhenman handicap various events such as the release of results of clinical trials, and thirdly the Board helps him to stop repeating one of the biggest mistakes in biotech investing, which according to the manager is selling out of positions too early. “After a 50% gain in a position, it is just too easy to sell out of it completely. The Board helps me look at a company for the ten year prospects of its products,” says Rhenman.

To the manager the Scientific Advisory Board is an active and systematic way to get a broader view of markets for medicines. If you like it is a tool to help assess scientific risk. For example, the Board would help the Manager understand the impact of a certain side effect profile on a drug’s potential market size. The extra number of pairs of eyes and shared discussions on the same universe allows Rhenman & Partners to actively follow the science of a larger number of quoted companies than they would do otherwise. The large universe is 500 companies, and the active universe is more like 300 companies.

The second element that goes into producing the desired level of return is the portfolio structure. Graphic 1 shows a schematic representation of the typical portfolio shape. The fund is long-biased with a range for net exposure of 70-150%. This is a higher net exposure than a typical diversified European, American or global equity long/short fund. Sector funds often have bigger gross exposure than generalist long/short funds, and it is more common to find a constrained net exposure (close to market neutral) amongst sector funds than hedge funds with broad equity market exposure. Most sector funds structure their portfolios to drive returns from relative risk taking. It is fair to say that the Rhenman Healthcare Equity Long/Short Fund takes more absolute risk than most sector specialist hedge funds. This is reflected in the value-at-risk measures of overall risk assumption. The maximum 1-day VaR that the Fund can take is 3%, but it is quite usual to observe a VaR for the Rhenman Healthcare Fund greater than 2% (at a 95% CI).

Graphic 1. Archetypical Portfolio Shape Of The Rhenman Healthcare Equity Long/Short Fund

source:Rhenman & Partners/Hedge Fund Insight

The Fund generally runs with 60-80 active positions (“I sleep very well with 75 positions,” says Henrik Rhenman). A more concentrated portfolio would have to limit the size of the small (and mid) cap positions, and it is these positions which can drive the differential return of the Fund, with their idiosyncratic risk. As is the case for all hedge funds which aim to be diversified (the exception being concentrated or conviction L/S equity hedge funds), there is some clustering by theme or factor impact within the portfolio. To be clear though, the risk assumption is intended to be much more idiosyncratic (bottom up) than systematic (thematic and top-down).

There can often be paired positions too – recent examples were Universal Health Services v. HCA, and Roche v. Novartis – but typically there are only a few pairs at any one time. In terms of types of companies invested in, the majority (roughly 80%) of companies are cashflow positive; they are all public companies, and they all have a market cap greater than $200m.

There are some elements of diversification built into the other top-down shape measures. Approximately two-thirds of the portfolio is invested in the U.S.A., and one-third in the rest of the world (mainly Europe). The portfolio is split roughly equally between small-, mid- and large-cap companies. There is also substantial diversification brought into the structure of the portfolio through spreading the Fund across the four sub-sectors of healthcare – Pharma, Biotech, Medtech, and Services. To state the obvious, the shares of a large cap device or hospital management company do not act like the shares of a small or mid-cap biotechnology or medical data systems company.

Shaping the Downside Risk Characteristics

If the first two components that go into producing the desired return (the alpha source and portfolio structure) potentiate the upside of the return series, the third component, risk management, helps shape the downside characteristics of the return stream of the Rhenman Healthcare Fund. There is a portfolio-level risk discipline in place which helps with the desired curtailment of observations on the l-h-s of the distribution of monthly returns. After a 6% loss to Fund NAV there is a big bias to take portfolio risk down significantly.

The extent of shorting is also a factor in constraining losses at the Fund level. The manager takes a (medium term) cyclical view on the amount of shorts, and, given the low valuations currently, he is minded to have a low level of shorting. This will of course change when valuations are getting stretched. There is an important role for large-cap healthcare stocks on the short side. Shorts have to be liquid shares to enable efficiency when the Manager has to buy-to-close. The large pharmaceutical stocks give some reasons to make them (periodic) fundamental shorts. It is well recognised that many of their big sellers are near the end of their patent protection period, and that they have struggled in recent history to develop a pipeline of new drugs that can sell enough to replace the mature products. Big Pharma companies have also tended to address the same therapeutic areas and disease groups. They can compete with each other as well as with generic drug companies and biotechnology companies. Drugs to address narrow, niche medical conditions are not subject to pricing pressures in the same way as those that treat disease groups affecting large numbers of people, but Big Pharma does not find it commercially worthwhile to research drugs for niche conditions. So Big Pharma can make reasonable short candidates on occasion, despite being shares with good yields.

The Rhenman Healthcare Fund uses Pharma and Biotech ETFs to reduce the net exposure at the portfolio level. The big-picture portfolio question the manager asks himself constantly is “how defensive do I want to be?” To make the portfolio more defensive Henrik Rehnman adds more Big Pharma names and adds to the healthcare service sector exposure. This is analogous to an oil stock fund manager reducing upstream exposure (drilling and production companies) and adding vertically integrated international oil stocks. There is a limited use of derivatives in the Fund, and not at all to manage portfolio level risk. The manager occasionally overwrites existing positions with call options to alter the risk profile of the individual position by, say, increasing the stand-still return.

Amongst the more important risk controls are those that apply at the level of the single position. There is the usual liquidity constraint applied – in this case individual equity positions cannot represent more than 25% of ADV (average daily volume) for 75% of the portfolio – and there is a stop-loss discipline. The application of an appropriate stop-loss is usually important in equity long/short risk management. The key question is how much can the Fund lose before the manager knows there is a good chance he is wrong on a position? The answer in the case of the Rhenman Healthcare Fund is 1%. When the loss to the Fund NAV hits 1% the position is reviewed. This is an auto-scaling stop-loss as it takes less percentage change in a large position to cause a 1% loss than a small position. A typical large-cap position may be 3-5% and a volatile small-cap name might be sized at 1-3% of the NAV.

The portfolio manager and founder also takes “farm team” positions in his fund. These are tiny positions that keep him engaged in a stock. A recent example is Swiss company Lonza which does custom manufacturing for the pharma/biotech industry. Lonza shares have come down from CHF 160 to about 35, and the shares discount no growth in future, according to Rhenman. This has enabled him to buy a position of less than half of one percent of NAV – enough to keep him engaged and psychologically balanced if the shares rise in the interim whilst he carries out his full research/due diligence on the company, including meeting management of Lonza. In total Rhenman typically partakes in 200 company meetings per year, 100 analyst meetings, plus attending industry conferences.

The emphasis on fundamental inputs is reflected in a long–term investment horizon. Dozens of positions are held on a multi-year basis. But Rhenman Partners approach also encompasses active trading: the non-core positions may be sold quickly if they appreciate with a haste that can’t be maintained. To generalise the firm has a trading-oriented investment philosophy. “After a market set back, I try to sense when other investors are starting to come back into the market,” explains Rhenman. “So after a 10% fall I’m looking to see which stocks bounce the most, though there must be (trading) volume as well.” The manager also likes to look for breakouts to new highs, and breakouts after a prolonged accumulation pattern. His experience of the latter is that they can move a long way on high volume.

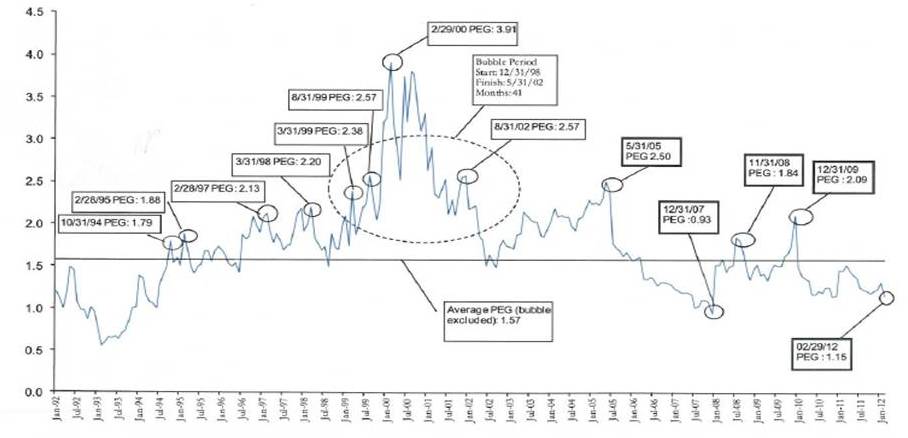

The combination of the alpha source, portfolio structure and risk management give Rhenman Partners a good chance to make the desired return of greater than 12% p.a. These are the things which are within their control. But exogenous factors also impact returns – equity managers surf the markets, and the underlying companies have a business environment to operate in. Until recently the stock market was under-appreciating the more risky part of Rhenman’s universe, in biotech. Analysis by Stifel Nicolaus, the middle-market investment bank, showed that the inherent growth of biotech companies could be picked up at relatively low P/Es. Their time series for PE to Growth Rate is shown in Graphic 2. Note that by the middle of the year the discount of the current PEG to the typical PEG for biotechs had narrowed considerably, reflecting good momentum for the sector in the stockmarket.

Graphic 2. PEG Ratio Analysis of Profitable Biotechnology Companies

Broader Environment More Positive For Healthcare

Another element of the broader environment which has turned more positive for Rhenman Partner’s speciality is that acquisitions are on the increase in the healthcare sector: Express Scripts takeover of Medco is the largest acquisition, but Pfizer is selling its infant-nutrition business to Nestle in a $9bn deal, and, demonstrating that Big Pharma will still look to acquire a promising pipeline, AstraZeneca is buying Ardea Biosciences. A significant uncertainty to be resolved later this year is the outcome of the American Presidential election – should Romney win, the Obamacare Act will be repealed and a whole new set of winners and losers will emerge in the healthcare sector.

With only €50m under management (though soon to be €70m) and the investment process relying on one key investment person (apart from the Scientific Advisory Board), Rhenman Partners have to have a lot going for them in outcomes to justify having an institutional class of shares (which they do in Euros and SEK). However, when Paul Sinclair’s Expo Capital Management LLC (with nearly half a billion dollars under management in healthcare stocks) was losing 8.7% last year Henrik Rhenman made 9.6% for his investors. This year over the period when Sinclair was down 6%, Rhenman was up over 11%. If caveats on hygiene factors can only be overlooked for reasons of exceptional performance then these are absolute returns which justify at least a cursory glance towards Stockholm. As Paul Sinclair has wound down his healthcare fund, maybe his investors should consider giving that attention to Rhenman Healthcare Fund?

CONTACT INFORMATION: E-mail info@rhepa.com Website www.rhepa.com