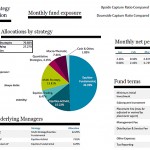

By Simon Kerr, Publisher of Hedge Fund Insight The Florida State Board of Administration runs the $141bn Florida Retirement System Pension Plan through an Investment Advisory Council. As a public body it’s papers are available online, and an exploration of the material gives an insight into the way large pension plans, and State sponsored plans in […] Read more »