By Simon Kerr, Publisher of Hedge Fund Insight

The investment strategy allocation of portfolios of hedge funds is a function of the target return and drawdown tolerance of the end investor over a multi-year period. The pension plans of the Ford Motor Company are part way through a five-year de-risking process – the U.S. plans are 77% in bonds. So the hedge fund component is a small risk-assuming component.

Typically a pension plan as an investor will have a fixed central tendency for the strategy allocation of the hedge fund strategies around which there are tactical bands. The central tendency allocations (e.g. 25% to Equity Hedge, 25% to Macro and CTAs) should prevail for 3-5 years, and should be aligned with the contract term of the hedge fund advisor.

Manager selection should also, for the most part, be a medium-to-long term decision. The part of manager selection that is to do with fund or sub-fund choices can be a 12-18 month horizon investment decision – this is often to do with, say, being in the leveraged form of exposure to the factor or being in the market-neutral version of the strategy.

Returns to some hedge fund strategies are cyclical in nature, all are time-varying. Hence there is a strong motivation to change exposures at the margin on a tactical basis, which in this context is with at least a 12-month investment horizon for the changes.

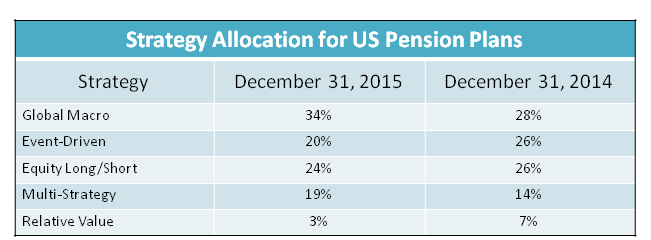

Hedge Fund Insight has picked up the strategy allocations of the Benefit Plans of the Ford Motor Company. The first Table shows for Ford’s U.S. plans (which had assets of $41.9 billion as of Sept. 30), the strategy allocations of funds investing in diverse hedge fund strategies at the last two year-ends.

Source: Ford Motor Company FORM 10-K

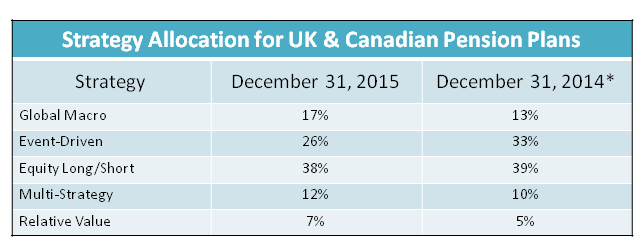

Source: Ford Motor Company FORM 10-K

After a year of returns like 2015 it is highly likely that the difference in allocations from year to year shown above are due to active decision making. In the case of Ford’s US pension plans, under CIO Kathleen Gallagher, there has been a move away from outright equity risk assumption (through Equity Long/Short and Event-Driven) to the discretionary taking of market exposures in Global Macro and Multi-Strategy funds.

Allocations to Global Macro are often viewed as increasing the hedging of equity market risks and give potential for outright shorts of currencies and commodities. That is Macro (and CTAs) are seen as hedging of the whole portfolio of hedge funds, and increasing allocations are often a response to perceptions of rising market risk ahead.

Giving more capital to Multi-Strategy managers allows the whole portfolio to be more reactive to market opportunity. Multi-Strategy managers have the responsibility of allocating between their own teams, and are therefore very mindful of handling cyclical market opportunities. For example moving away from outright market exposure to credit or equities to market-neutral exposure. The classic rotation in Event-Driven is from merger arbitrage to distressed investing and Multi-Strategy firms usually have an Event-Driven team(s), so that rotation has to be managed in M-S. Multi-Strategy managers may also have stat arb, CB arbitrage, Relative Value, and Fixed Income Arb teams, and quant strategies like pairs-trading. Many multi-strategy firms have grown out of specialist bond-related investing so are used to handling the consequences of changes in interest rate and credit environment specifically. Hence the changes to allocations at the U.S. Benefit Plans of Ford make sense for the changes in market environment of the last year.

Source: Ford Motor Company FORM 10-K

Source: Ford Motor Company FORM 10-K

The second Table above shows the hedge fund allocations for non-U.S. plans of Ford Motor Company, the assets of which total $25.7 billion. The pension funds outside the U.S. investing in diversified portfolios of underlying hedge funds are for the employees of the British and Canadian subsidiaries of Ford.

The starting allocations of the latter two pension plans of Ford are much more equity biased than the allocations of the U.S. pension plan, perhaps reflecting vestigial equity bias in the case of the U.K. plan. The strategy allocation changes of the two plans changes are the very similar to those of the U.S. pension plan – towards Macro and Multi-Strategy, and away from Equity Long/Short and Event-Driven. The changes to strategy allocation make as much sense for the non-U.S. plans as they did for the U.S. pension plan as they all face the same global market environment subject to slowing global growth and changes to central bank policy related to QE and interest rates. That is all the pension plans of Ford with hedge fund allocations are effectively dialing down the equity exposure and in aggregate increasing the exposure to managers with discretion.