By Jean-Marc Stenger, CIO for Alternative Investments, Lyxor Asset Management

Macro Themes: After navigating between Scylla and Charybdis in 2015 amid growth and deflation scares, 2016 should provide some limited relief. The sturdy, yet aging, expansion in the US should warrant the inception of monetary policy normalization this December. However, all the concerns – EMU and Japan’s early reflation processes, China’s structural slowdown, global trade halt, broad EM vulnerabilities, historical oil glut, US high-risk borrowers’ leverage – identified en-route to the Fed’s hike remain acute. The coming great monetary divergence (whereby ECB and BoJ are still forcefully injecting liquidity) will have to walk a thin line as US growth is currently running on one engine: household consumption. We nevertheless expect G3 recoveries to consolidate progressively thanks to re-leveraging in the Eurozone and Abe’s reforms gaining traction in Japan.

Inflation may be the wildcard of 2016 as it would take an eventual stabilization of commodity prices for base effects to lift prints and help global reflation. Meanwhile EMs will remain under pressure from weak fundamentals and external headwinds in Q1, but should eventually find a trough.

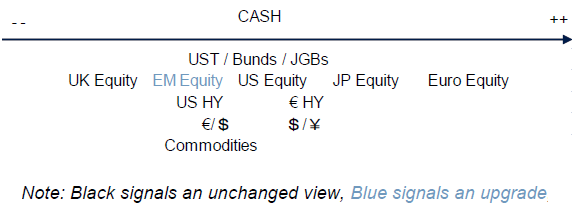

Asset Classes: Years of historic monetary reflation have inflated assets but have had disappointing effects on real economies. Globally, while bonds and equities look fully valued, activity and inflation remain lackluster. This atypical backdrop should stretch over 2016, allowing only for low returns. The Fed will likely implement a dovish normalization, thus widening the divergence with the ECB and BoJ, embarked on aggressive QE. This shift, combined with increased geopolitical disorder and uncertain oil prospects, should heighten volatility.

In fairly- to fully-valued equity markets, we focus on earnings. We remain neutral on US stocks amid subdued profit growth and overweight on Eurozone where we foresee further margin expansion. Solid earnings momentum warrants a slight overweight in Japan. With commodity prices likely to stabilize over 2016, we upgrade our long-term stance (not our short-term view) on EM to neutral. Deteriorating fundamentals and fat tail liquidity risks keep us underweight on US high-yield. We prefer European credit that benefits from solid corporate health and investors’ crave for yield.

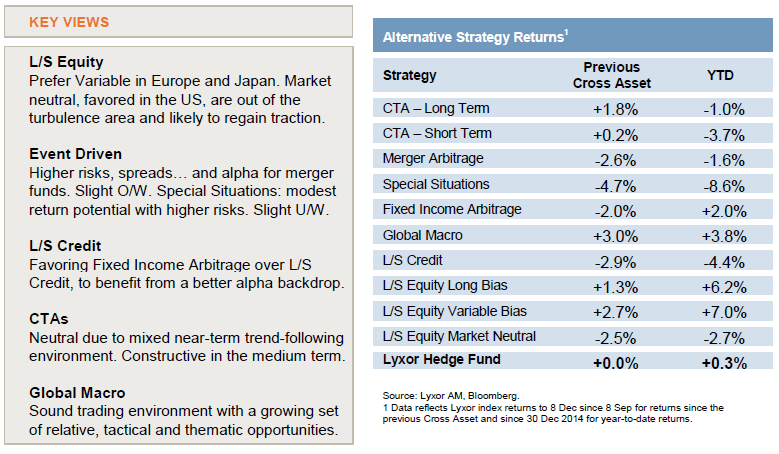

Alternative Strategies Summary: The recovery from the summer sell-off is complete, putting an end to our

tactical directional stance. We enter 2016 with the same slow, fragile, asynchronous cycle, with contradictory macro policies. It applies conflicting forces on markets and volatility. Those supporting volatility and dispersion should prevail – though unevenly across assets – with frequent rotations and markets overshooting fundamental changes. Hedge funds are attractive relative to traditional assets, expected to deliver modest and riskier returns. We focus on relative value approaches, with increased selectivity. In that context, we favor thematic & tactical variable L/S Equity funds in Europe and Japan, market neutral in the US. Merger arbitrage is appealing, presenting higher risks, deal spreads and alpha potential. Multi-credit Fixed Income Arbitrage funds would benefit from a growing pool of dislocated trades. A higher volatility regime and themes in FX and global yields would support Global Macro funds, in particular the ones making room for relative value and tactical allocations. In contrast, we would reduce allocation to the longest bias L/S Equity and Special Situations funds. We are tactically neutral CTAs until the formation of new trends emerges.

2016 Alternative Strategies Outlook: Executive summary

We are entering 2016 with the same slow, fragile, heterogeneous global cycle, with contradictory policies. This is applying conflicting forces on markets and volatility, on which the hedge fund outlook depends. We expect volatility and dispersion to continue rising, though unevenly across asset classes. The trading backdrop would be similar to last year, with frequent rotation, volatile capital flows, and markets overshooting fundamental changes.

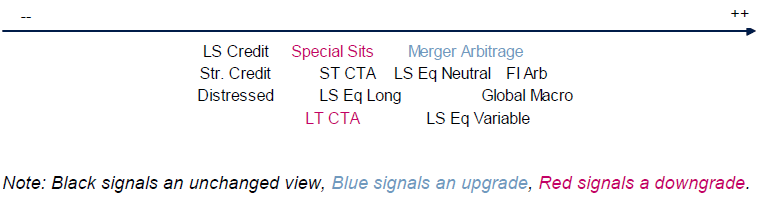

In that context, hedge funds remain attractive relative to traditional assets, expected to deliver modest and riskier returns. This is leading us to favor relative value approaches – but not blindly, and more opportunistically. Macro and fixed income arbitrage, neutral and variable L/S Equity are presently attractive, as well as merger arbitrage.

Conversely, we would reduce allocation to long bias L/S Equity and Special Situation funds.

We expect a positive but moderate contribution to L/S Equity returns. While not yet stellar, the alpha backdrop improved since the summer. We favor thematic & tactical Variable in EU and Japan, Market Neutral in the US.

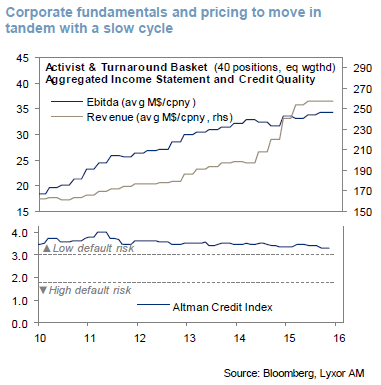

Within Event Driven, we favor Merger Arbitrage. M&A is not yet at peak, but late cycle patterns are emerging. As a result, risk, spreads but also the alpha potential are higher for Merger funds, upgraded to a slight O/W. Activism is probably peaking. Both the fundamental progress and prices of other corporate situations would move in tandem with a tame business cycle. We expect a modest return potential for Special situations, with elevated risks. We further downgrade the strategy to a slight U/W.

Credit markets remain under significant pressure, with thin liquidity and deteriorating commodity-linked issuers. The cautious positioning maintained by L/S Credit funds limits the downside, but also any potential upside. We keep the strategy in a slight U/W, with a preference for European vs. US funds. We see greater opportunities for cross-credit Fixed Income Arbitrage funds, likely to benefit from a growing pool of dislocated trades to exploit.

The near-term trend-following backdrop is mixed, with limited overall directionality (except in a selective set of assets). Until the formation of new trends emerge, we would be neutral on CTAs. In the medium-term, a higher volatility regime will be supportive. Among Global Macro funds, we see more opportunities for relative value styles, which should benefit from themes in FX and global yields, as well as tactical risk-on/risk-off allocation.

2015 Review: Overall for last year, hedge funds produced a strong alpha relative to traditional assets until Q4, when they lost about half of their advance during the rally episode (measured elative to our Global Asset Allocation index – see chart). On our side, we appropriately took a selective directional stance early 2015, before turning more cautious, with a tilt on macro players. We downgraded Event Driven to a neutral stance during the Summer, and regret not too have been more aggressive – they were the main performance detractors this year. We adequately stepped away from market-neutral funds during the rally and our tactical more aggressive stance moderately paid off.

The underperformance of Event Driven and the partial participation of hedge funds in the year-end rally leave a bitter-sweet taste and hide a strong alpha production for most of the year: while hedge funds outperformed traditional assets, they finish the year with unimpressive returns.

Selective Relative-Value positioning

Tame vs. Late cycle forces at play

We expect to start 2016 with the same slow, fragile, asynchronous cycle, with contradictory policies. Indeed, the global cycle is slow, running sub-par, with limited gears, and mainly domestic driven. It is fragile, dominated by uncertainties from the Fed’s normalization, the Chinese transition, and HY credit concerns, which are keeping central banks in accommodative mode. It is asynchronous, late in the US, under reflation in EMU and Japan, in structural transition in EM.

This cycle also goes with contradictory macro policies. Tighter regulations, implemented after the 2008 crisis to restore confidence, are strengthening the financial system, but locking liquidity within banks and drying out that of markets. In contrast, record low yields due to monetary injections are spurring corporate releveraging, a risk that is no longer fully compensated because of the reflation wealth effect on valuation. In addition to these above undesired side effects, the local efforts to reignite growth were neutralized by the wave of monetary easing or competitive devaluations also implemented in many other countries.

Forces supporting volatility will prevail

These characteristics are keeping markets subject to conflicting forces, some consistent with a tame cycle, others reflecting an aging and asynchronous cycle. Which of these forces prevail is the key question for

hedge funds.

There is a case arguing for lower volatility, as a result of subdued economic volatility, abundant monetary support and rich valuation compressing dispersion.

However, we believe that heavier forces will support higher volatility and asset dispersion regimes. The Fed’s normalization, the Chinese transition wildcards, and tail risks from the weakest EM economies will keep an elevated perception of risk. The advanced corporate releveraging, particularly in the US, and the deterioration of the energy sector will also support volatility. Besides, we anticipate capital flows will remain volatile, chasing opportunities amid rich asset valuations. Divergent developed vs. EM cycles will continue to keep elevated asset dispersion.

Regulations will contribute to drying out dealers and market liquidity.

Relative Value opportunities, but not blindly

The trading environment should therefore remain under the constraints of poor market-makers’ liquidity, the rising share of non-fundamental players (including algorithmic trading), the increased use of indexed products (which alters idiosyncratic differentiation and market rationality), the prevalence of macro drivers, and a propensity for crowded trades given the lack of attractive opportunities. Rich valuations could also accelerate flow rotations. As a result, asset pricing should remain prone to substantial variations regardless of the amplitude of fundamental changes.

One favorable factor is that asset correlations are now more in line with their historical equilibrium, and few relative trades are showing a stretched momentum. Fresh trends will be ready to shape up once new themes have emerged.

In that context, we expect:

– Frequent asset rotations and alternating risk-on and risk-off phases

– Global drivers to continue dominating, but a lighter post-Fed monetary agenda would favour fundamental differentiation

– Modest and riskier traditional asset returns

– Hedge funds to be more attractive than traditional assets

– Tactical positioning to be a more significant source of returns

– Tactical positioning to be a more significant source of returns

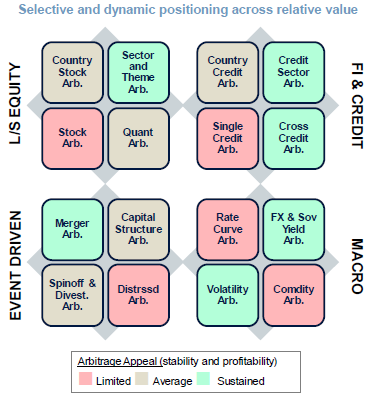

Within the hedge fund space, these observations are leading us to focus on Relative-Value, Trading-oriented and Macro styles.

However, we expect that selective and dynamic allocation will be increasingly required. The volatility regime will progress, but unevenly across assets: not all relative value will work.

As illustrated on the right, among the various mainstream relative value arbitrages, thematic investment seems most promising in the L/S Equity space, multi-credit and sector credit arbitrage are preferred in the fixed income world. We would focus on merger arbitrage in Event Driven. Within macro styles, FX/Global yield and volatility arbitrage seem attractive. Accordingly, we would favor funds making room for these types of arbitrage.

L/S Equity: Focus on alpha styles

Positive but modest beta contribution

At the beginning of the last quarter, we tactically recommended favoring the longest bias funds, with a view to benefit from a post-sell-off rally. Meanwhile we anticipated that market neutral funds would go through a temporary phase of turbulence. We also stressed that, past this rally phase, we would focus on market neutral and true variable bias. We believe that we have now reached this point.

Equities have regained the ground lost since the summer. Performances should be mainly driven by EPS growth from now on. We expect a positive but modest beta contribution for L/S Equity funds, with regional preferences for Europe and Japan.

This argues for a balanced geographical exposure – US funds tend to be over-represented in portfolios. This is also leading us to focus on strategies most likely to produce alpha. There again, the natural tendency to overweight L/S Equity in diversified portfolios no longer seems justified.

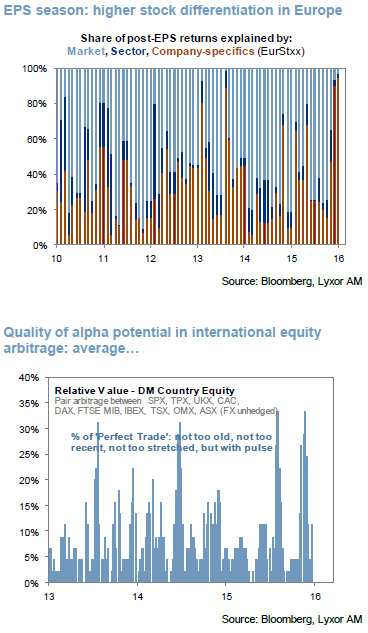

How we spot alpha potential

Our aim is to measure the alpha opportunities that managers could theoretically exploit. A strong alpha environment, as we see it, requires some potential, some stability, and some rationality in the arbitrage. It finally requires arbitrages to stand at a reasonably early stage of their trend.

Our aim is to measure the alpha opportunities that managers could theoretically exploit. A strong alpha environment, as we see it, requires some potential, some stability, and some rationality in the arbitrage. It finally requires arbitrages to stand at a reasonably early stage of their trend.

We first spot the segments offering an attractive potential and determine the nature of the style required to play them (thematic, fundamental, macro driven). To that effect, we measure the dispersions and correlations both in prices and in valuations. We then check that within these segments, opportunities trade with some rationality. We monitor

how they drift away from their historical equilibrium, and how prices react to EPS announcements.

We finally monitor the freshness of these opportunities. We calculate the density of “Perfect Trades”, that are neither too old, nor too recent, nor too stretched, but with some

The alpha backdrop is rebuilding…

With only a modest expected beta contribution to returns, the identification of approaches most likely to generate alpha is all the more pressing. The alpha backdrop deteriorated since the summer with a notable spike in equity correlations, consistent with dominant macro drivers (China, oil, deflation fears and central bank activity). Dispersion remained substantial over the period. However, it derived from a few obvious segments (the energy and the healthcare meltdown especially). A constrained alpha was also witnessed during the EPS season, in the US and Japan in particular, when most post-EPS announcement performance could be explained by market, not by company specific developments.

Since then, the alpha environment has rebuilt. While persistent risk aversion kept decent equity dispersion, easing concerns about China and deflation contributed to bring correlations down. The time for pure idiosyncratic fundamental pair trading is not at hand, but, with a wider set of market movers, sector and thematic investing are once again appealing.

Since then, the alpha environment has rebuilt. While persistent risk aversion kept decent equity dispersion, easing concerns about China and deflation contributed to bring correlations down. The time for pure idiosyncratic fundamental pair trading is not at hand, but, with a wider set of market movers, sector and thematic investing are once again appealing.

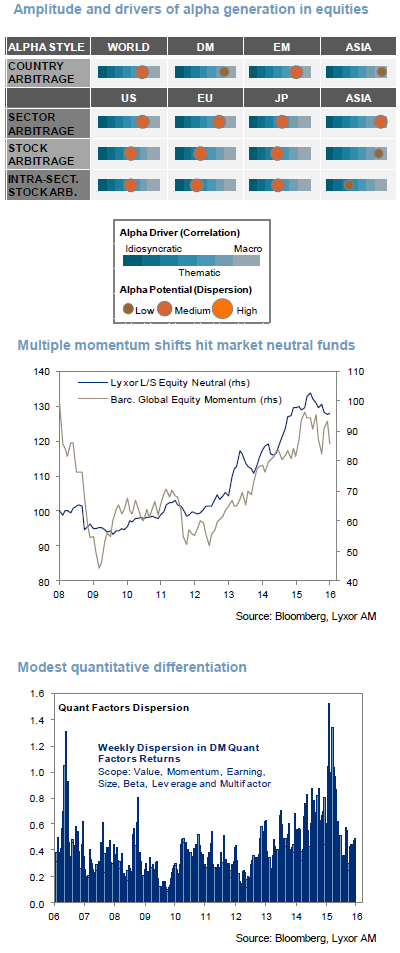

The right hand table is a representation of the amplitude and drivers of alpha generation. It orients us in areas displaying the strongest potential (the first step of our search for alpha). As an example, a large circle (elevated dispersion) positioned at the extreme left of the scale (very weak correlation) would indicate a strong ‘pure alpha’ potential.

The analysis of the market structure in these market segments suggest that the highest alpha potential is now in the US and Europe. By contrast, the potential seems very poor in Asia, with a fading China driver. Interestingly, we are seeing an increasing differentiation within sectors. Consumer, Energy/Material, Telco and Utilities are offering

attractive arbitrage opportunities.

… but is not yet running at full speed

Over the recent months a limited set of themes, correlated one to the other, have dominated equity moves. The changing stance over the Chinese transition, its impact on EM, commodities and inflation, and on the monetary outlook has determined most of the market and sectors trends. There have only been a few other side themes, including M&A, the healthcare pricing power.

With the concerns about the Fed and the Chinese transition both gradually easing, a fresh load of new ideas have yet to emerge by next year. The lack of portfolio rotation bears witness to aging themes. We suspect the implications from deteriorating credit markets and oil to be greater differentiators, while opening value opportunities.

We expect 2016 to start with a lighter monetary agenda, with a deeper focus on fundamentals, while factoring in a lower uncertainty premium. This would be supportive for alpha generation.

Looking for more tactical approaches

As detailed in the introduction, the trading backdrop would remain constrained by liquidity, algorithmic trading, indexed products, volatile capital flows. An environment prone to regular rotation with variations easily overshooting the actual fundamental changes.

As fund managers get used to these characteristics, we expect to see more efforts to generate P&L out of tactical allocations, and more contrarian or anti-momentum investment. Over the recent months, the contribution from active market timing has not been significant. We would favor funds making room for these approaches.

Market Neutral out of the recent turbulence area

After a difficult period since the summer, hit by multiple rotations and breaks in momentum, we believe the

environment for Market Neutral has normalized. In particular, shorting conditions improved (off equity lows). Besides, the main key policy decisions in store are likely to be behind us in the coming quarter (which should spur less volatility hedging). Difficult to factor in, these speculative catalysts are typically adverse for these strategies.

A lack of quantitative factor differentiation and stock movers persists. As few relative value trades display a

stretched momentum, we expect the strategy to gain traction as new themes emerge.

Our take on L/S Equity

- The recovery from the summer slowdown is nearly complete. We expect positive but modest beta.

- We would balance portfolios across regions. Overweighting L/S Equity in portfolios doesn’t seem justified.

- We remain selective on regions and styles, driven by the beta catalysts (EU and Japan reflation are our – consensual – favorites) and the quality of alpha potential (stronger in US & Europe than in Asia).

- In the US, we favor market neutral funds. While not expecting stellar returns yet, the improving alpha backdrop is supportive for these funds.

- In Europe, we favour variable funds, especially the ones making room for tactical and thematic allocation. In Japan, variable funds also seem best fit to the market structure.

Event Driven: Favor Merger Arbitrage, further reduce Special Situations

An underwhelming recovery for Event Driven…

We downgraded our stance on Event Driven to Neutral back in June. We regret not having been even more

conservative. On signs of a market bottom, we returned to a slight overweight in October: a valuation recovery play which paid off only marginally.

The meltdown in the healthcare sector, a heavyweight in most Event Driven funds, was the main detractor, along with the cost of hedges implemented in October in Special Situation funds.

… Undermined by the healthcare meltdown

The healthcare meltdown started by the end of September. It was started by Hillary Clinton’s tweets in response to extreme price hikes in few drugs. It triggered a sudden re-assessment of healthcare revenues and M&A prospects, while factoring in further political pressure ahead of the US elections.

Beyond these extreme anomalies, the overall increase in drug prices reflects a profound transformation of the sector since 2014. Waves of pharma acquisitions of biotech and generic companies resulted in greater pricing power. Healthcare stock valuation soared in sympathy with higher expected margins and an M&A premium. Since the end of September, market valuation and profitability forecasts started to normalize at an accelerated pace.

A bottoming process started in October. Investors and fund managers acknowledge that this sector is well positioned on demography, with limited exposure to slowing Asia. Besides, EPS growth, now more in line with a more sustainable profitability regime, remains above that of other sectors.

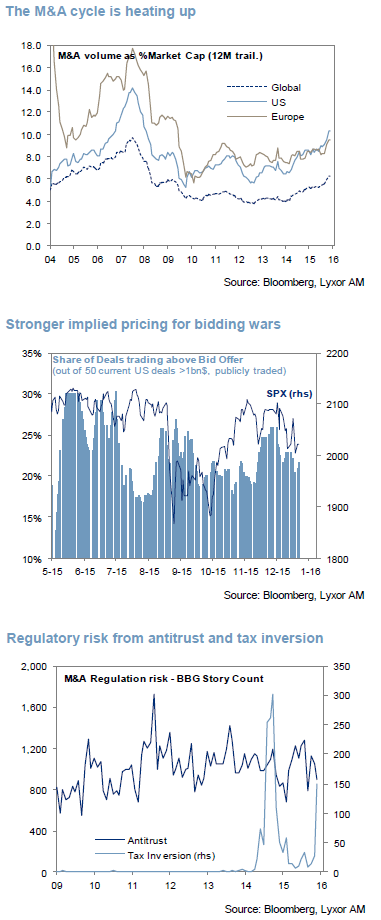

Merger Arbitrage: M&A has not peaked yet…

Merger Arbitrage: M&A has not peaked yet…

M&A activity remains strong, supported by self-feeding waves of deals: a consolidation move in a sector often

forces competitors to follow. Deals are generally driven by a lack of sales growth, cheaper commodity-linked assets, a desire to secure low rates. Sectors displaying the strongest M&A pulse include pharma, telecom, real estate, media, chemicals and semi conductors.

Executive confidence peaked in sympathy with investors’ risk appetite, but did not collapse. This suggests they are getting less sensitive to structurally lower growth and short-term volatility. Surveys emphasize political (in Europe especially) and geopolitical instability, volatile FX and commodities as the main M&A economic risks. These outrank

concerns from the Fed (and from weaker EM). It suggests they have already factored in a rising rate environment.

But late M&A cycle patterns emerge…

The volume of hostile deals and bidding wars is strengthening, which is typical of a late M&A cycle. The M&A value accounts for close to 10% of the total US market cap, a level not reached since the prior M&A boom. Premiums are robust and growing, at around 30%, up from 20% early 2015.

Interestingly, about a quarter of the spreads of the 50 current US deals that we monitor now trade above the bid offer. A pattern which usually implies greater odds for bidding wars. Meanwhile we expect acquisitions to remain supported by banks, as a means to offset their lower trading revenues and weak loan margins.

Which goes with higher risks…

We expect arbitrageurs’ risks to remain elevated in 2016, consistent with a maturing cycle. A number of large transactions announced since 2014 are waiting for US and non-US antitrust decisions. This concerns deals across sectors, including energy, healthcare, tech, media and consumer. For 2016, these include: Halliburton-Baker Hughes, Staples-Office Depot, Charter-TWC-Bright House, Aetna-Humana, Anthem-Cigna, Teva-Allergan, Dell-EMC,

WestDigital-Sandisk, Intel-Altera, AB InBev-SABMiller, Walgreens-Rite Aid, Marriott-Starwood. Antitrust decisions are a key milestone in deal spreads, with three possible outcomes: the deal gets an approval, needs to be altered (usually going with asset sales), or gets rejected.

Tax inversion concerns will also remain a drag for cross-border operations. Pressure on this highly political topic intensifies ahead of the US elections. So far, hedge fund managers have been successful at avoiding large exposure on the deals most at risk. Moreover, the political uncertainty ahead of the US elections may impact activity in a few sectors, including healthcare and defense.

In the same vein, volatile commodity prices may alter the economics or challenge the rationale of deals sensitive to this factor. Amid rising corporate leverage, the uncertain implications from the Fed’s normalization, rising rates, and deteriorating credit markets are also increasing merger risks.

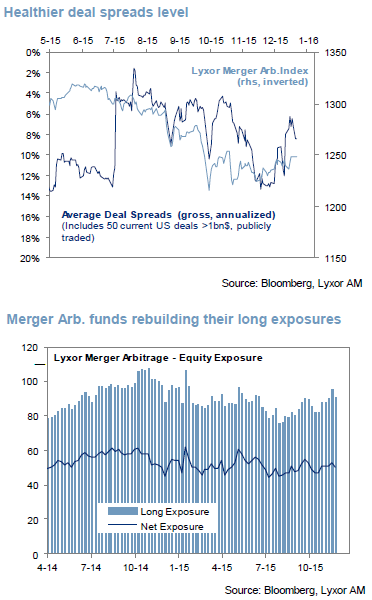

More generally, the appeal of some acquisitions may decrease amid rich valuation in most DM markets. We note that, since a majority of deals are funded by cash (with or without stocks), the merger funds’ long exposure is higher. Let’s not forget, though, that the market beta of the target stock, anchored to the bid offer, is much lower: not a key risk.

… And a higher alpha potential

… And a higher alpha potential

As a result of all the above developments and risks, we observe a far more heterogeneous spread landscape than a few months ago. When most opportunities concentrated on a handful of mega deals, today, a greater number of operations are offering decent return potential.

It is no surprise to see merger fund managers starting to rebuild their long exposures. Meanwhile, concerns about arbitrageurs’ concentration have eased. We see more alpha to generate, though with higher risks. We favor Merger Arbitrage over Special Situation funds, respectively upgraded at a Slight O/W and downgraded at a slight U/W.

Special Situations: peak in activism?

2015 was a very strong year for activism, with 178 campaigns vs. 165 in 2014 (YTD as of November). Campaigns also targeted larger companies, including DuPont, AIG and GE. The tech sector accounted for about a third of the US targets. These companies tend to hold large cash reserves, low debt, but smaller dividends than in other sectors.

We expect activism to decline in 2016. Hedge funds inflows have already started to peak. Activists’ assets under management dropped by a symbolic $10bn in Q3 from $130bn in Q2, as calculated by HFR. With fewer and riskier attractive targets, the ample funding yet to deploy will tend to crowd positions. Meanwhile, the recent volatility curtailed the ability to launch new campaigns.

The classic balance sheet re-leveraging strategies are getting less rewarded. This will limit the range of activists’ strategic proposals. Instead, we anticipate a greater focus on asset disposal.

Constrained returns potential…

Constrained returns potential…

The valuation recovery, which followed the Summer debacle, in both activist and other situations is nearly over. These securities rallied on par with markets. At fund level, Special Situation funds’ returns lagged. Along with the healthcare meltdown, the hedges implemented in October proved costly. With limited market upside left to capture and challenging volatility hedging, we expect the pricing of corporate operations to be more driven by their

fundamentals.

We monitor these fundamentals through a basket of the top positions held by the largest special situation funds. In aggregate, we observe that their assets are high-quality (decent credit robustness and cash flow generation). But we also note that their fundamental progress slowed: the pace in sales and revenues growth is plateau-ing. We expect the prices of special situation positions to move in tandem with a tame economic pulse.

… Asymmetric risks in 2016

While we anticipate a modest upside potential, risks are likely to remain elevated in 2016:

– Macro concerns will keep the strategy under pressure. We expect frequent volatility spikes

– As observed this year, efficient hedging strategies will remain challenging to implement

– Liquidity risk will resurface regularly

– Sector risk will persist, especially in the ones offering the greatest valuation appeal: energy, material and healthcare

– Substantial concentration risk will remain a factor of volatility, amid few attractive opportunities

We believe the special situation strategy is in transition between two phases of the cycle. The volume of cheap turnaround opportunities has vanished.

Meanwhile, the distressed cycle is still at a very early stage, with unstable prices and high odds to get squeezed. A few months of consolidation might be needed to restore the appeal and depth of the opportunity set. This will probably happen when the distressed cycle has heated up for good.

We would seek to further reduce the Special Situation allocation to a slight U/W. We would focus on funds most exposed to spinoff and asset sales.

Our take on Event Driven

Merger Arbitrage. M&A activity hasn’t reached its peak yet. But late cycle patterns are emerging. This results in more heterogeneous and higher spreads. We see higher alpha potential with elevated risk. We upgraded the strategy to a Slight O/W.

Special Situations. The valuation recovery is nearly complete. We expect activism to weaken in 2016 and other corporate situations to move in tandem with a tame economic cycle. The return potential would therefore be modest in the face of persistent and elevated risk. This leads us to further downgrade the strategy to a Slight U/W.

Distressed. We remain too early in the cycle. But opportunities at more reasonable risk will start to emerge more noticeably in the coming months. We maintain our Slight U/W.

Credit & FI Strategies: Prefer Fixed Income Arbitrage to L/S Credit

Fixed Income Arbitrage funds are likely to benefit from a larger set of opportunities in the US

In a context in which the Fed is reversing monetary accommodation, we believe the set of opportunities is expanding for relative value players in the fixed income arbitrage space. Such strategies tend to exploit arbitrage opportunities

and deliver returns that are consistent (i.e. low volatility) and quite de-correlated from traditional markets. As a result, investors seeking to diversify their returns from risk on/risk off phases are likely to find value in such strategies.

However, fixed income arbitrage is a wide and heterogeneous space, which trades a broad range of instruments. Within that universe, we have a clear preference for those managers that invest in liquid instruments with low to moderate credit risk. That includes sovereigns and agency MBS in the US, for instance.

While relative value managers should be somewhat sheltered from Fed rate hikes due to their “market neutral” features, some strategies such as Fixed Income and MBS arbitrageurs are likely to benefit from such an environment. In effect, higher Fed fund rates are likely to reduce mortgage prepayment risk and cause dislocations across the yield curve, which is an important component in the performance of such strategies.

L/S Credit: Stay Underweight

We remain cautious on L/S Credit funds, in particular those managers with elevated net exposures in the US. liquidity tensions have recently resurfaced, because of the exposure of US HY to energy names and the tightening bias of the Fed. Although the widening of US HY spreads early December may present some opportunities, we remain cautious for the time being. In this context, beta conditions for US L/S Credit funds are likely to remain adverse in the near term.

Prefer European L/S Credit funds

The European HY market has been far more resilient lately. We believe this is set to continue to the extent that the ECB is likely to remain very accommodative.

Meanwhile, improving economic conditions will anchor default rates at a low level. Beta conditions for Eur L/S

Credit should remain supportive.

CTAs: Beware of trend reversals

CTAs: Beware of trend reversals

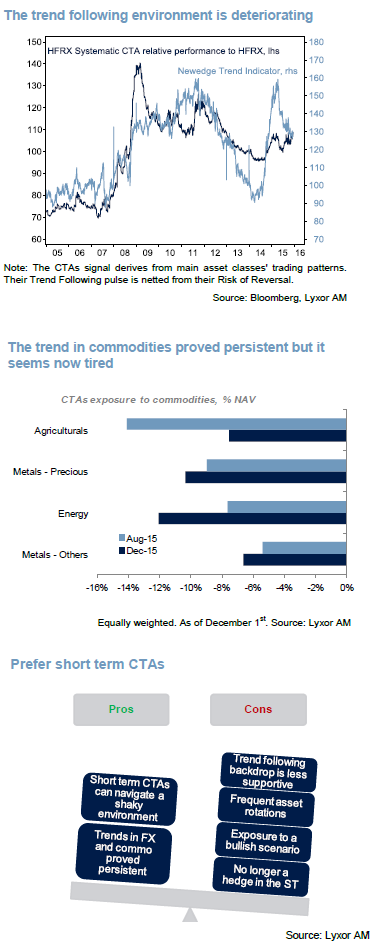

Mixed trend following environment reflecting mixed markets conditions

In aggregate, market conditions have lacked directionality and momentum for several months. Despite expectations about a Fed rate hike, markets have struggled to find a new equilibrium and asset prices experienced ample fluctuations globally in the second half of 2015. Such short cycles actually tend to be difficult to capture by long term CTAs. As long as we assume market conditions to remain unstable during the first quarter of 2016, long term CTAs are likely to remain exposed to sharp trend reversals.

The recent re-weighting of equities in CTA portfolios, as shown by the chart, is a good illustration of the difficulties that the strategy may experience going forward. Following the October equity rally, long term CTAs have tried to capture a trend that proved short-lived. Early December the equity market nosedived, hurting the performance of CTAs.

Short-term trends in the foreign exchange market have also wrong-footed CTAs recently. Early December the ECB disappointed markets by announcing easing measures that were less aggressive than expected. This gave rise to a huge reversal in the EURUSD, causing significant losses to CTAs.

There has been however an asset class where trends have proved persistent: commodities. The downward trend in commodity prices, and in particular energy, has been persistent throughout the second half of 2015. Commodities have been an important source of return for CTAs in H2-15 and in some occasions, the asset class contributed to offset or limit losses recorded on other asset classes.

However, at USD 35/barrel as of Dec. 11th 2015, the WTI price is close to the lows recorded during the global financial crisis (mid-December 2008, the WTI reached a low of USD 34/bbl). At such low levels, we fear that the downward trend in energy prices may be somewhat tired. In this environment, the short positions of CTAs on energy and more generally on commodities are at risk of a trend reversal.

Overall, it is important to note that we continue to believe that managed futures are an attractive strategy for portfolio diversification purposes. Their low correlation to traditional asset classes remains valid over the long run. However, in the near term we express a cautious stance on CTAs, in particular longterm systems. We prefer short-term CTAs because they seem more capable of navigating the current market environment.

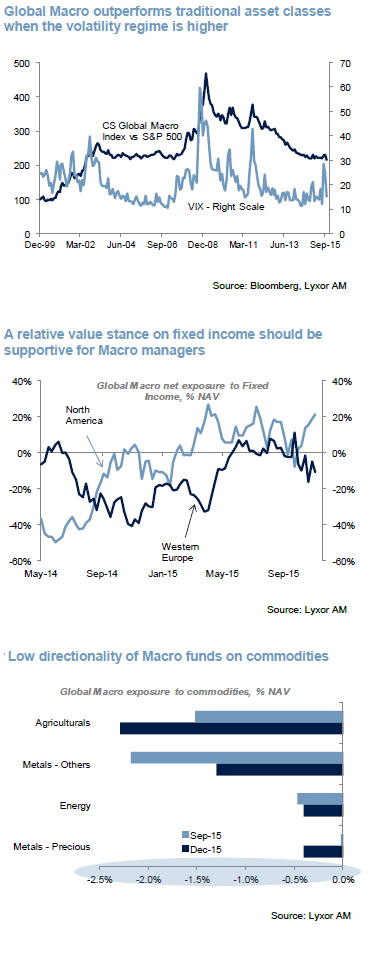

Global Macro: Their nimble approach should prove supportive

Diversified Macro funds set to outperform in 2016

Diversified Macro funds set to outperform in 2016

The Global Macro strategy combines discretionary with systematic approaches and we believe that this mix should prove supportive in the near term. Furthermore, the strategy tends to be diversified in terms of exposure to asset classes, which we favor in the current market environment.

According to the Lyxor Global Macro index, which aggregates large players in the field, the strategy is the best performing in 2015, at +4% year to date as of December 8th. Considering the fact that i) the strategy has been able to navigate such a difficult year (i.e. 2015) pretty well and that ii) we believe market conditions in 2016 are likely to be similar to 2015 (short upward/downward market cycles interrupted by sudden jumps in implied volatility across asset classes), Global Macro should remain attractive in2016. It is nonetheless important to note that the strategy is quite heterogeneous and existing indices all have biases. As a result, a bottom up approach is important when investing in Global Macro.

According to our proprietary data on hedge fund positioning, the current allocation of the strategy is in line with our recommendation: a preference for European equities versus US equities; a relative value approach to fixed income investing; long USD positions versus other currencies and low directionality on commodities, which we believe could experience a trend reversal.

Separating the wheat from the chaff

As stated above, Global Macro is a heterogeneous space. Some managers trade only FX or fixed income instruments, while others focus on EM, for instance. In 2015, some Macro managers faced difficulties due to central banks’ unexpected moves, such as the SNB’s decision to remove the cap on the Swiss Franc.

As a result, investors could face disappointment if they allocate to managers with directional and concentrated portfolios whose bets turn sour. We prefer relative value and diversified strategies. Those managers that trade several asset classes across regions and have a relative value approach should be able to outperform in 2016.

Editor’s Note: Please note that this research was published in mid- December 2015