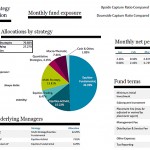

By Simon Kerr, Publisher of Hedge Fund Insight The investment strategy allocation of portfolios of hedge funds is a function of the target return and drawdown tolerance of the end investor over a multi-year period. The pension plans of the Ford Motor Company are part way through a five-year de-risking process – the U.S. […] Read more »