By Hedge Fund Insight staff

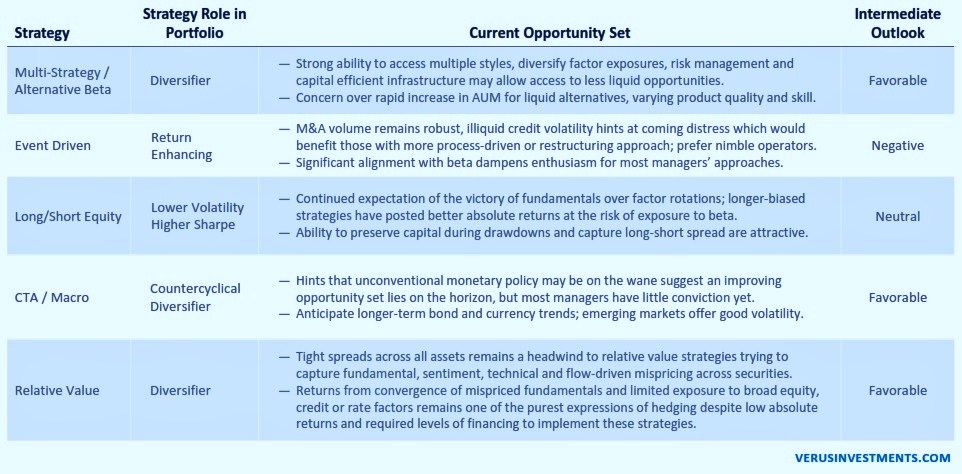

In a recent report Verus, the investment consultant created out of the combination of Wurts and Strategic Investment Solutions, was constructive on the outlook for three out of five hedge fund strategies. The consultant gave forward-looking views across the broad hedge fund investment strategies as shown in the table below.

In the opinion of Verus equities are driven by dispersion of fundamentals, operating margins and general M&A activity in addition to volatility in the market. It observes that short borrow rates have come down over the past 12-18 months as more funds use ETFs and futures baskets to hedge portfolios. Consequently Verus has a preference for managers who focus on individual short alpha rather than broad beta hedging, despite observing the negative impact of crowded shorts on equity hedge returns last year. In addition, the large number of managers and assets competing for opportunities in North America inclines the consultant to have a bias for equity hedge investment strategies beyond that region. Given the pluses and minuses Verus is Neutral on Equity Long/Short.

According to Verus Event Driven strategies are driven by M&A volume and deal spreads, debt maturities leading to defaults, credit availability, the level of activism and general corporate activity. Commodity price volatility is expected to contribute to an uptick in distress and defaults in 2017, though a balancing item is that there is plenty of capital on the sidelines in this strategy. This may present an opportunity to negotiate more favorable fee concessions going forward.

The market sensitivity of Event Driven returns is dominating the idiosyncratic returns available in the strategy. For example the three year correlation to the S&P500 for returns from activism is 0.80 and for special sits investing is 0.73. Hence Verus’ outlook for returns from Event Driven on an intermediate time frame is Negative.