by 50 South Capital Advisors, LLC.

INTRODUCTION

After a volatile first quarter of 2016, global equity and bond markets regained their footing and finished in positive territory for the year. European equities were the regional exception, with the MSCI European Index posting negative returns through November. Although markets overall generated positive returns for investors in 2016, the path to achieving those returns was bumpy. The value of active management continued to be debated for much of the year, as passive indices outperformed in the early months. More recently, it appears that active managers – both long only and hedge funds – have had the upper hand.

In 2016, most of our managers navigated the challenging landscape extremely well with strong security selection and dynamic risk management. Because 50 South Capital focuses on identifying talent early,

many of our managers have a smaller asset base, giving them a wider opportunity set and allowing them to nimbly navigate the risks associated with crowded trades and poor market liquidity. We believe our managers’ ability to dynamically shift risk is a key differentiator in our program.

2016 STRATEGY REVIEW

2016 was a challenging year for the hedge fund industry, but we are pleased with our programs. Further analysis reveals that we generated value both through strong manager selection and allocation decisions.

Due to a number of global uncertainties, our 2016 forecast called for range-bound markets with higher volatility. Concerns were broad-based and included an economic slowdown in China, uncertainties in the European Union with the Brexit vote, Greek debt relief, Spanish elections and Italian bank recapitalization. In a number of countries, including the U.S., populist political movements were reshaping the political and economic landscape, leading to impacts we believe will affect capital markets for years to come.

While we were incorrect in our belief that equity markets had limited upside, combating higher volatility served us well throughout the year. Our event managers led the way as we shifted a portion of our equity event-oriented strategies towards credit early in the year based on wider spreads and an improved opportunity set. Our second-leading strategy was equity long/ short. A shift towards lower beta and more opportunistic trading-oriented managers stood out as differentiators. And while our healthcare specialists faced challenges as a result of election rhetoric, this was offset by strong performance coming from energy specialists. Overall, we were pleased with stock selection and active risk management from our equity managers. Investments in Latin America, Asia and Canada contributed to our macro and relative value strategies. Although we typically view these strategies as risk dampeners or diversifiers, they proved to be additive in 2016.

It is important to note that our growing high-quality investor base has allowed us to play offense when many of our peers have been playing defense. This has given our business a meaningful competitive advantage. Often, when investment managers are faced with a poor short-term run of performance that leads to investor outflows, they must alter the way they take risks in their portfolios and businesses. In contrast, the stability of our investor base has proven attractive to the long-term investment focus of hedge fund managers. This has allowed us to be opportunistic in allocating to unique opportunities throughout the year and has helped us negotiate capacity, better fees and fair terms with underlying managers.

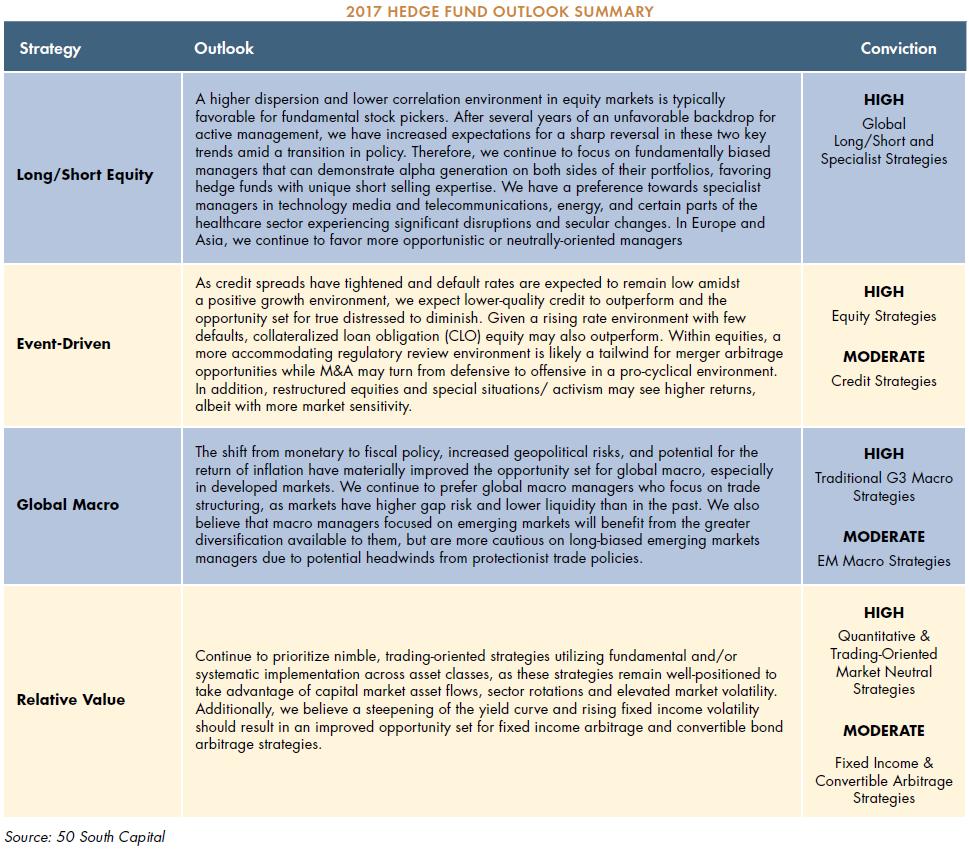

2017 ALLOCATION OUTLOOK

As we prepare for 2017, we continue to focus on many of the same risks that affected markets in 2016. Global growth is likely to gain momentum, albeit unevenly around the world. U.S. consumption remains robust, and positive U.S. data gives the Fed the scope to raise interest rates in 2017 at a pace faster than forecasted just six months ago. Global monetary policy, while less dovish than in years past, should remain very accommodative. What has changed is the pro-growth fiscal platform described earlier. While in the long term we believe this will be positive for the U.S. and global economy, specific policy is still undefined. Until the size and pace of U.S. fiscal policy initiatives are better outlined, we will continue to focus on opportunistic and more neutrally oriented managers that can add value on both the long and short sides of their portfolios in equity, event and relative value strategies.

We are likely to take a pause in building our credit allocations further. Spreads tightened considerably during 2016 and, given that we are not expecting significant defaults in the near-term, we plan on waiting patiently for a better entry point. However, we believe that a pro-business administration in the U.S. and an accelerating economic growth environment will contribute to opportunities in equity event situations. Therefore, we are evaluating the potential for increasing event equity exposure, including post-restructured and select merger arbitrage situations.

The last notable change could come in the global macro sector. As readers of our newsletters, you are aware that, over the last two years, we have made a distinct shift from developed markets to emerging market macro strategies, a decision that has been additive to returns in 2016. With populist political movements shaking the status quo in the U.S., Europe and Latin America, we believe the opportunity set could improve for developed market macro managers. A stronger U.S. dollar and greater trade protectionism could serve as a headwind for long-biased emerging market strategies. As a result, we are shifting our macro-sourcing priorities from emerging markets to developed markets. However, macro managers that can take advantage of dislocations in emerging markets from both the long and short sides will still have a valuable role in the portfolio.

We are excited for the opportunities we see ahead. We believe our team, process and culture give us an edge in allocating to the hedge fund managers designed to take advantage of these opportunities.

The opinions expressed are as of the date set forth herein, are subject to change at any time without notice. 50 South Capital Advisors, LLC of Chicago, Illinois. If you have any questions contact the Investor Relations team:IR@50SouthCapital.ntrs.com

© Northern Trust 2017