By Hedge Fund Insight staff

In 1994 the Cayman Islands Monetary Authority introduced a registration regime for mutual funds established on the islands. Many Cayman Islands mutual funds are offshore versions of domestic (US) hedge funds (LLPs). As the concept of hedge fund strategies was adopted elsewhere Cayman became the global offshore hub.

Twenty years later the total number of mutual funds has reached just over eleven thousand. Cayman Islands mutual funds are in several categories with the regulator. In size order they are Registered Funds, Master Funds, Administered Funds and Licenced Funds. Master Funds were segregated as a regulatory category as recently as 2012, so we will concentrate on the longest established mutual funds, which are all classified as “Registered Funds”.

The management group with the longest-registered Cayman Islands hedge fund is III Capital Management (fka III Offshore Advisors, “III” is pronounced “Triple Eye”). III, which was founded by Cliff Viner and Warren Mosler, registered their first Cayman fund -III Fund Ltd. – in March 1993. III registered a second fund, III Global Ltd., in March 1994. These registrations were so early on that both have two digit licence numbers (III Global’s number is 46). The funds invest in fixed income securities and derivatives utilizing a relative value approach as they have since their 1993-94 registration.

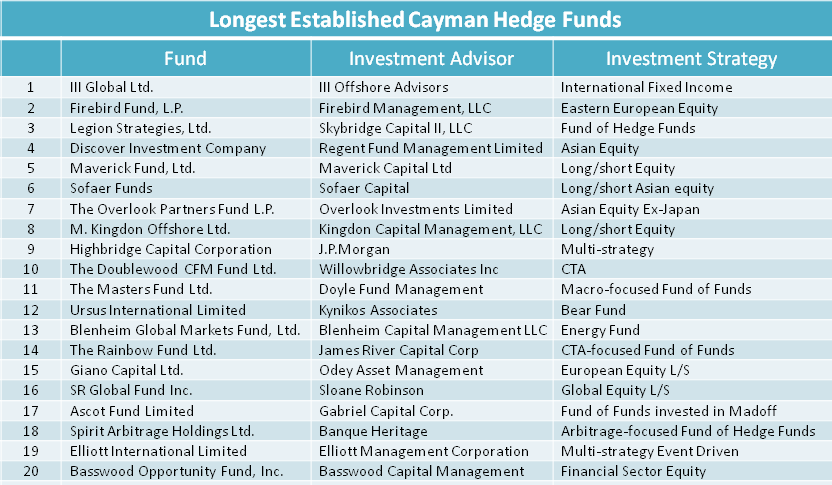

The twenty management groups with the longest-registered hedge funds are given in the table below, in order of registration.

There are five funds of hedge funds in the most-tenured list. The sponsors of those funds, like Banque Heritage and Skybridge Capital, reflect that the source of money for hedge funds in 1994 was wealthy individuals and those who looked after it for them. Even the Ascot Fund, effectively in limbo because of its links to Madoff, reflects the sources of capital at the time of registration. The funds of hedge funds listed have survived over twenty years through specialisation. The Banque Heritage product is arbitrage focused; the James River fund of funds is CTA-focused, and the Doyle fund Management fund is specialised in global macro managers. Even as recently as 1994 global macro was the hedge fund investment strategy with the most capital invested in it.

The twenty hedge funds are, given they are present only because on their age, a well-diversified bunch, and would themselves make an interesting fund of funds portfolio. There are US equity long/short funds like Lee Anslie’s Maverick Fund and Mark Kingdon’s Kingdon Offshore Fund. There are some geographically positioned funds, like Regent’s Discover Investment Company (Asia) and Giano Capital (Europe). Sloane Robinson’s Global Fund, run from the City of London was designed at the outset as an EAFE fund to invest in non-US equities.

As one would expect there are some niche and specialist strategies in this list of long-lasting Cayman hedge funds. Going back to 1994 means going back to a time when international diversification of American long-term asset pools was a growing theme for the asset management industry. Hence the launch/registration of geographically specific (long-only) funds like Firebird Fund (Russian Equities) and Overlook Partners Fund (Asian Equities ex-Japan).

Amongst the specialist early registrants was Jim Chanos’ Kynikos Associates. Whilst there remain many cynics in the hedge fund industry (kynikos being Greek for cynic), there are few bear funds that were around in 1994 and still here today. In the hypothetical fund of funds of these twenty managers and funds Kynikos International makes a great diversifier. As do the two sector funds listed. Wim Kooyker’s Blenheim is a commodity manager with a bias to energy trading that at one point grew to $9bn AUM. The next member of the twenty longest-established Cayman hedge funds is Basswood Opportunity Fund, which is a financial sector specialist. To still be around having been through 2008 net long shows some insight in the sector – Basswood’s Cayman fund was down only 7.67% in 2008 due to a 10% loss in October of that year.

Offshore hedge funds have long included systematic investment strategies. So it is unsurprising that CTAs are present in both fund of funds (James River) and single manager form (Willowbridge). The Doublewood CFM Fund was registered in July 1994 by Willowbridge Associates and the investment advisor is still running managed futures programs today.

Before 1994 event driven strategies were more limited than they are today in terms of capital allocations and available investment strategies, and few have tenure to this point. Indeed of funds that registered in Cayman in the two years after 1994 there are very few event driven funds that are still in business today – WCM and HBK are among them. But one of today’s titans of event driven was around in 1994 and registered a Cayman vehicle in 1994. Elliott International Limited was the offshore version of the domestic Elliott Associates. Although described as multi-strategy, at the time of registration the firm had come from investing in convertible arbitrage and was focused on distressed investing. In 1994 the markets were awash with the detritus of the aftermath of the high yield boom and bust of the late Eighties. So Elliott Management Corporation was in a good spot at the time of registration of the Elliott International fund.

Nearly 900 Cayman Island Mutual Funds were registered in 1994. Only 39 of those are still in existence today. The twenty hedge funds listed here are therefore very unusual in the context of the offshore hedge fund industry, and a testament to their respective managements.