From Grant Williams‘ commentary Things That Make You Go Hmmm In years to come, when financial historians look to pinpoint the precise moment in time when the excesses of Quantitative Easing reached their apex, I suspect that November 15th, 2017 may well be the date upon which they settle. On that Wednesday, on opposite sides of […] Read more »

Some Dangerous Signals Appear in Financial Markets

By Stewart Richardson, Chief Investment Officer of RMG Wealth Management We held our quarterly investment meeting last week (please let us know if you would like to receive a copy of the chart pack), and as you would expect, in both preparing for the meeting and in discussion during the meeting, we thrashed out […] Read more »

Fed Ploughing a Deep Furrow of Confusion

By Marc Ostwald, Strategist at ADM Investor Services International Limited If the FOMC’s objective was to convey confusion, it has succeeded, thereby ploughing a deep furrow of instability and destabilization, and shining a very bright light on the large debt and liquidity trap it and other G7 central banks have spent 7 years crafting. […] Read more »

Fed Rate Rise To Be Catalyst For Last Phase of EM Underperformance

By Jawad Mian, Managing Editor Stray Reflections The inefficiencies that are at the heart of macro investing are permanent, as they relate to the inherent uncertainty of the future. The vast majority of the data required is publicly available. The differentiating factor is the ability to analyze and thematically organize the information into coherent […] Read more »

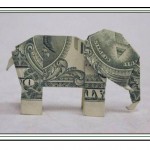

The US Dollar – Novus Ordo Seclorum

By Neil Azous Managing Member of Rareview Macro LLC Most of us hand over dollar bills every day without ever really looking at them very closely. They are too familiar. But if you pause to look closely at the one dollar bill, you will see, right below the one-eyed pyramid, the Latin phrase “Novus […] Read more »

Bond Market Bubble? More Like A Central Bank Bubble

By Ben Bennett, Credit Strategist at Legal & General Investment Management As US quantitative easing draws to a close, there is increasing nervousness that the bond market bubble may be about to burst. But the market’s high prices and low yields are not just a problem for bonds, they are a symptom of broader problems […] Read more »

The Pace Of Tapering By The Fed Under New Leadership

By Colin Cieszynski, Senior Market Analyst, CMC Markets Following the decision to commence tapering at the last meeting, this article looks what the possible outcomes from the forthcoming FOMC meeting could mean for market participants this year. The article addresses: The key questions following the Fed meeting in December Why QE may be trimmed […] Read more »

Flat US Equities and Falling Yields Could Signal a Change in Markets

By Stewart Richardson, Chief Investment Officer RMG Wealth Management With the exception of last week’s US employment report, the US economic data released in recent weeks has been better than expected. Conventional wisdom would have us believe that if the US economy is improving and the Fed is withdrawing stimulus, then bond yields should definitely […] Read more »

Time to Fold the Fed

By Karim Taleb and Marc Fiani, of Robust Methods LLC The effects of the Federal Reserve’s on-going policy of artificial money creation are well documented by now. For a quick recap and as the saying goes: A picture is worth a thousand words. We clipped this chart below from the web, and which is self-explanatory; […] Read more »