By Hedge Fund Insight staff

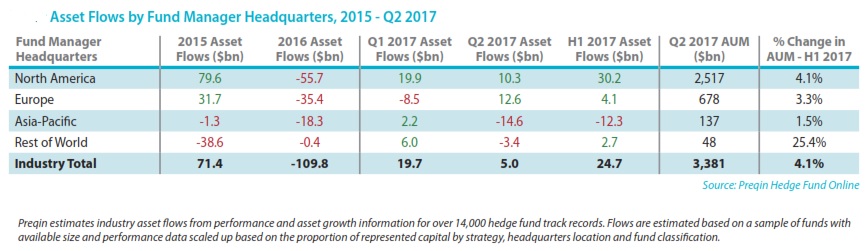

Only hedge funds based in North America had positive flows in both the first and second quarters of this year, according to data from Preqin. Net net hedge funds in Europe had positive flows in the first half of the year and hedge funds based in Asia-Pacific had net outflows in the 1H. In the case of Asia-Pacific hedge funds the year started well with net inflows equivalent to 1.4% of AUM in the first quarter (North American hedge funds had inflows equivalent to 0.8% of AUM (based on Preqin data)).

The second quarter was disappointing for Asia-Pacific hedge funds as they experienced outflows equivalent to 9.6% of total AUM. It has to be recognised that the outflows may be a function of strategy allocation rather than geographical allocation, as equity hedge has had outflows and event driven lesser inflows in the first half of 2017. Within the proportionately big flows into and out of hedge funds based in Asia there was a lot of churn.

The eVestement database has a slightly different footprint from that of Preqin, and their definition of Asia excludes Oceania. The publicly available flow information from eVestment goes up to July 2017 and includes an analysis of flows by fund size and segments it by prior-year performance. This breakdown of flows shows that last years losers in performance terms in Asia were used as a source of capital for new subscriptions in the region. Of course this always happens within portfolios of hedge funds – the laggards are sold and the proceeds re-allocated – but the scale of that sell-to-buy amongst Asian hedge funds is striking.

In the first seven months of this year $3.74bn of capital was redeemed from Asian hedge funds that recorded a loss last year. Over the same period $7.33bn of subscriptions were made to Asian hedge funds that returned more than 5% last year. To put the flows into perspective $3.74bn represents nearly 6% of the region’s hedge fund capital according to eVestment. For comparison last year’s underperformers (making losses) from North America and Europe that were sold this year represented 1% and 2% of hedge fund assets managed from those regions.

The $7.33bn of subscriptions to Asian hedge funds is equivalent to 11.4% of the hedge fund assets managed within the region, according to the eVestment database. So 6% of the total Asian assets were sold to add the equivalent of 11% of the region’s AUM in only seven months. These figures add to the suspicion that Asian hedge funds are treated as a non-core diversification for when markets are doing well. Investors seem much more willing to change holdings of hedge funds in Asia than they would be for hedge funds managed from the Western hemisphere.

The beneficiaries of the positive flows have been large hedge funds in Asia, according to eVestment. Asian hedge funds managing more than a billion Dollars had net subscriptions of $2.21bn in the first seven months of this year. In the year-to -date to July Asian-based hedge funds managing less than a billion Dollars took in a net $1.32bn of new capital. There should be no surprise that investing in Asian hedge funds follows the global pattern established over multiple decades – in the hedge fund industry the big tend to get bigger.