By Hedge Fund Insight staff

The data discussed here has been compiled by the SEC from Form PF. Form PF is filed by SEC-registered investment advisers with at least $150 million in private funds assets under management to report information about the hedge funds and private equity funds that they manage. The SEC collates the data into a quarterly Report on Private Funds and the investment advisors to the private funds. From 2010 the SEC required all advisors to private funds to register with the regulator. Advisors are exempt from registration if they have assets under management in the United States of less than $150 million. This requirement applies to advisors based outside the United States as much as advisors incorporated within it. So CTAs Systematica (Swiss) and Winton Capital Management (British) are registered with the SEC, as is Chinese fund giant Hillhouse Capital Management.

The exemption kicks in in some surprising cases. Macro fund Quantedge Capital Pte Limited manages around $2bn but the Singapore-based entity is an exempt reporting advisor with the SEC, meaning it gives the SEC little data apart from contact details, because it manages less than $150m of American-sourced capital. Historically Quantedge did not take much capital from institutional investors and none at all from funds of hedge funds. Most of the external capital it manages comes from UHNWIs and family offices with only 15% of total AUM from institutions. As at April last year (the last filing point with the SEC) Quantedge Global Fund (US) had $128,000,091 of capital drawn from investors in 22 American states. Quantedge has an investment office in New York, and Quantedge Capital USA Inc of Delaware is registered as a broker-dealer.

That written, most overseas hedge fund advisors of substance and all major American hedge fund groups are registered with the SEC and have to file the source document here, Form PF. The United States is home to 3,319 of the world’s 5,383 active hedge fund managers, and between them the American managers look after three-quarters of the industry assets^. Most of the commercial universe of hedge funds (individual hedge funds of at least $500m, see below*) is included Qualifying Hedge Funds. The information derived from the SEC’s data here is therefore more thorough than surveys conducted with a sample of even large (or dozens of) hedge funds.

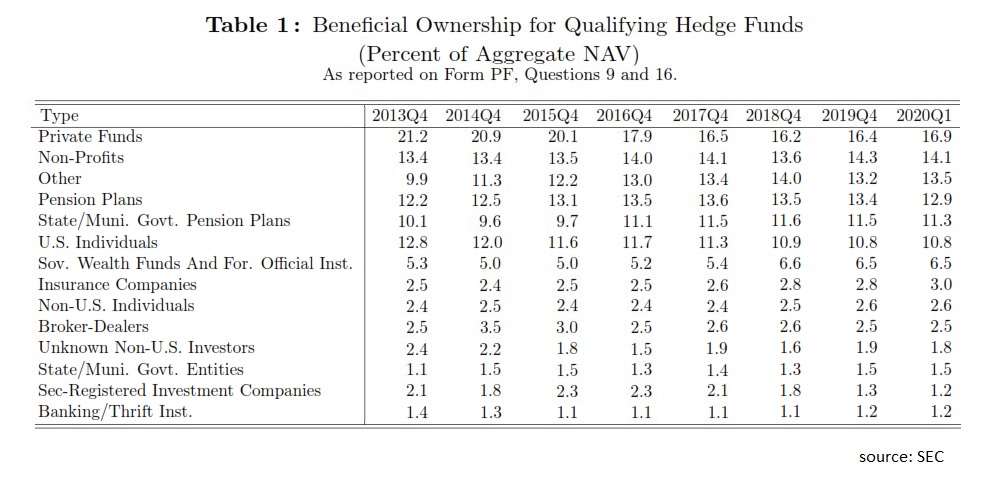

SEC started receiving forms with more detail from larger hedge funds in 2012. Table 1 contains the most recent data (published 1st December 2020), referring to the latest data point of 1Q 2020.

Over the last six years the most significant change to the owenership spectrum of hedge funds in Table 1 above has been in the designation “Private Funds”. The Form PF definition of “Private Fund” is hedge fund, liquidity fund, private equity fund, real estate fund, securitized asset fund, or venture capital fund. Some corporate liquidity is invested in hedge funds directly, but liquidity funds do not invest in hedge funds, and neither do the other categories of “Private Fund” given above. The only investor in hedge funds in the designaation “hedge fund”, as funds of hedge funds have been around for nearly as long as single-manager hedge funds. The label for row one “Private Funds” can be taken as a proxy for funds of hedge funds.

Funds of Hedge Funds

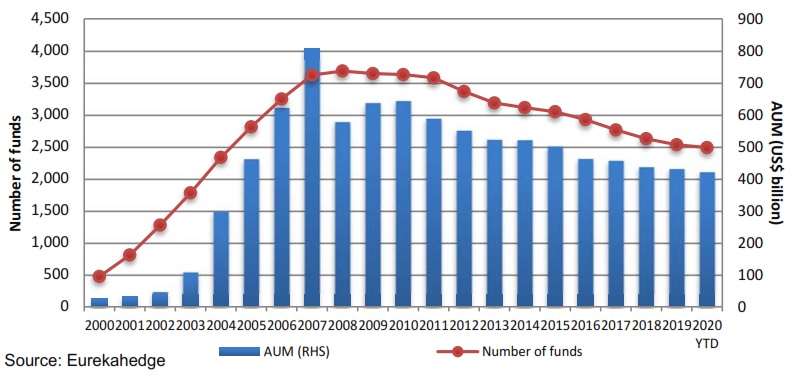

Funds of hedge funds have been in relative decline as investors in hedge funds since institutionization took hold at the turn of the millennium. Funds of funds peaked as providers of capital to hedge funds in 2007. The long-term trend of diminution continued in the period covered by Table 1 with funds of hedge funds contributing 16.9% of single-manager capital at the end of the 1Q this year, down from 21.2% at the end of 2013. The absolute decline of multi-manager hedge funds is shown in graphic 1 below.

Graphic 1. Funds of Hedge Funds AUM and Number of Funds

According to database Eurekahedge funds of hedge funds had $422.4bn under management at the end of April 2020, down from the peak of $826.2bn in March 2008. Although assets-under-management of FoFs were down Y-0-Y in 2018, 2019 and 2020, AUM were also down in the universe of single-manager hedge funds in 2018 and 2020. So the stability of the percentage contribution of funds of hedge funds to single-manager funds in the last three years (Table 1) is no cause for celebration as it may represent at best a slower rate of fall in AUM.

US- and Non-US Individual Investors

Over the SEC’s data-window for ownership of large hedge funds (2013-2020) the proportion contributed by U.S. Individuals has fallen from 12.8% to 10.8%. In absolute Dollar terms the capital invested by wealthy American individuals actually rose from $307bn to $316bn over the period, with a peak of $357bn in 3Q18. The ability to write a $20m ticket would put an investor in an $800m hedge fund in the “U.S. Individual” category above, but if one was to invest $1m via a wire-house or wealth manager into a multi-strategy behemoth then that would appear under another heading. Rich American individuals will have been the underlying investors contributing to several categories of investor given in Table 1. – Broker-Dealers, SEC-registered Investment Companies and Banking/Thrift Institutions. The time-series compiled by the SEC (Table 1) shows that U.S. Individuals with the ability to write a large ticket have been a stable source of capital to hedge funds in the last six years, though declining in percentage terms.

The same thought process could be applied to the category Non-U.S. Individuals in Table 1. They represent a growing/stable source of capital over the period reflected. In percentage terms Non-U.S. Individuals contributed a small (2.6% last) but consistent component of capital. In absolute Dollars they contributed $76bn to hedge fund coffers in early 2020, up from $52bn in 1Q13.

Putting together the categories U.S. Individuals and Non-U.S. Individuals: in terms of individual investors investing directly in medium and large hedge funds, the very wealthy have contributed less of hedge funds’ capital than they used to as a proportion. In absolute Dollars the capital has been stable.

Wealthy individuals can also use intermediary businesses to access hedge fund startegies, as minimum initial subscriptions are usually at least $1million for investing directly in hedge funds. It makes sense too for an individual to get diversification via a fund of hedge funds (“Private Funds” above) or an SEC-registered Investment Company that takes hedge fund exposures on behalf of others. SEC-registered Investment Companies as investors in hedge funds have fallen away a bit in the last couple of years, from 2.3% to 1.2% of capital.

Larger Broker-Dealers have built and others are linked to fund platforms which allows ready access and switching. Hedge funds are part of the mix on a fund platform and have been since 2002/3 for Broker-Dealers and earlier for the likes of HSBC Republic (as was). In absolute Dollars Broker-Dealers peaked as investors in hedge funds at the end of 2014 when they had $93bn invested. In the 1Q20 Broker-Dealers had $73bn invested.

Endowments and Foundations (Non-Profits)

Non-Profit organisations were large backers of hedge funds two decades ago. The thought-leading endowments of colleges were amongst the earliest institutional investors in hedge funds. The same thought-leaders moved capital at the margin from hedge funds to private equity 15-20 years ago. Medium-sized and small endowments have tended to increase their allocations to hedge funds even as their larger bretheren were scaling back.

Aggregated data from Form PF submitted by hedge fund managers shows that Endowments and Foundations under the category Non-Profits in Table 1. Non-Profits had $322bn invested in Qualifying Hedge Funds at the end of 2013 and $410bn early last year. Over the course of the six years covered the percentage contribution increased by half-of-one-percent to just over 14% of total AUM of hedge fund.

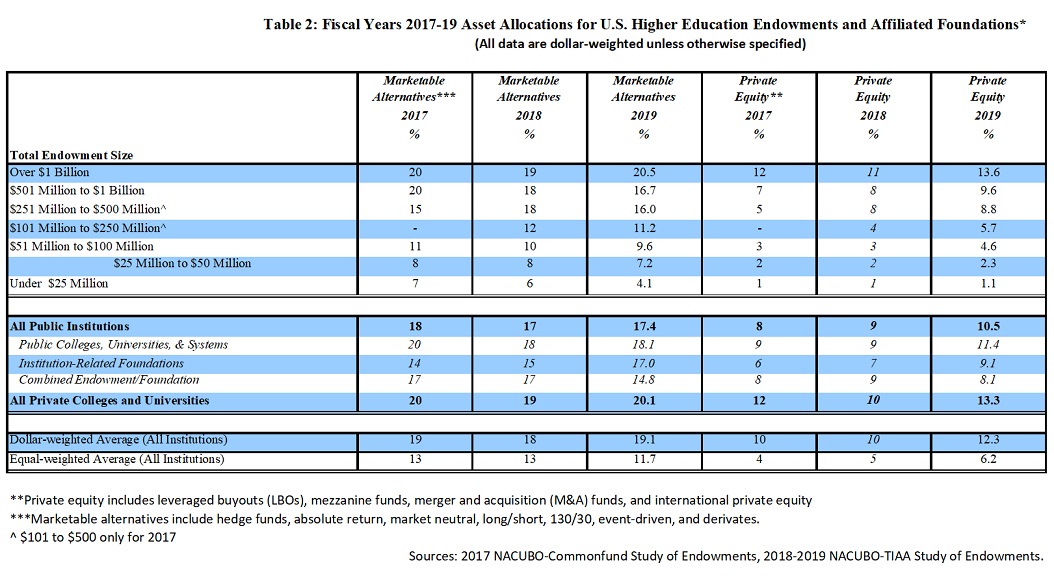

That Non-Profits did not make significant shifts in asset allocation to or away from hedge funds in the last few years is confirmed from a second source, The National Association of College and University Business Officers (NACUBO). The NACUBO Endowment Study is an annual survey that provides comprehensive analysis of investment returns, asset allocations, and governance policies and practices at higher education institution endowments and affiliated foundations, representing over $630 billion in endowment assets. The allocations analysed in the study are as at mid-year. Table 2. shows college allocations to hedge funds and private equity over the last three years. The Dollar-weighted average allocation data in the second-to-last row confirms the SEC data that U.S. colleges in aggregate have maintained allocations to hedge funds, even as allocations were raised for private equity.

Pension Plans

It may surprise some, given headlines about CalPERs or New York City Employees’ Retirement System, that Pension Plans, both private and public sector, are slightly bigger percentage contributors of capital to hedge funds now than seven years ago. Together Pension Plans are the largest investors in hedge funds, and separately corporate Pension Plans are the fourth biggest contributor of capital to hedge funds and State & Muni Pensio9n Plans are the fifth biggest. In 1Q 2013 public and corporate pension plans contributed a combined $469bn to hedge fund capital. At 1Q 2020 Pension Plans had $707bn commited to hedge funds. Pension plans currently make up nearly a quarter of total hedge fund capital, and the peak in absolute Dollars for both sectors was late 2019, near the last data point for Table 1.

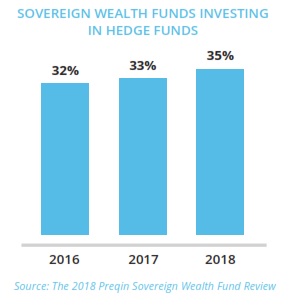

Most Sovereign Wealth Funds (SWFs) are immature – they are still  accumulating capital rather than distributing it, in contrast to some Pension Plans. It is therefore no surprise that SWFs as investors in hedge funds could be seen as a stable source and one that has grown where there have been changes. About 1-in-3 SWFs invest in hedge funds (source:Preqin, right). Data provider Preqin has information on 66 SWFs. So at least 22 SWFs invest in hedge funds, including the world’s top three SWFs (Norway’s Government Pension Fund Global (the renamed Petroleum Fund), China Investment Corporation and Abu Dhabi Investment Authority (ADIA)). The exposures to hedge funds of the first two named are small, while Abu Dhabi Investment Authority (ADIA) with total AUM of around $600bn, currently has a policy range of 5-10% of its assets allocated to hedge funds, giving a minimum capital commitment of $30bn. SEC data shows SWF investments in hedge funds adding up to $191bn (1Q2020), up from $107bn invested in hedge funds in 1Q 2013.

accumulating capital rather than distributing it, in contrast to some Pension Plans. It is therefore no surprise that SWFs as investors in hedge funds could be seen as a stable source and one that has grown where there have been changes. About 1-in-3 SWFs invest in hedge funds (source:Preqin, right). Data provider Preqin has information on 66 SWFs. So at least 22 SWFs invest in hedge funds, including the world’s top three SWFs (Norway’s Government Pension Fund Global (the renamed Petroleum Fund), China Investment Corporation and Abu Dhabi Investment Authority (ADIA)). The exposures to hedge funds of the first two named are small, while Abu Dhabi Investment Authority (ADIA) with total AUM of around $600bn, currently has a policy range of 5-10% of its assets allocated to hedge funds, giving a minimum capital commitment of $30bn. SEC data shows SWF investments in hedge funds adding up to $191bn (1Q2020), up from $107bn invested in hedge funds in 1Q 2013.

Insurance companies

HFI has written about insurance companies as investors in hedge funds here and here. It has been clear that U.S. Insurance Companies have been disinvesting from hedge funds for the last five years as tracked by AM.Best. Returns, fees and regulatory capital issues have all fed into less appetite for hedge funds from rated American Insurers. It is not that there are no American insurers that have committed fresh capital in recent years. In 2019 Prudential, Mass Mutual and Nassau Life between them put half-a-billion Dollars into hedge funds. But there has been more capital flowing out than in from rated American insurers. SEC data shows that the Insurance sector contributed $50bn of capital to hedge funds in 2013, $78bn of capital at the end of 2017 and $89bn of capital at March 2020. To date there has been little sign of captive insurers or offshore insurers investing in hedge funds. Japanese life insurers were early investors in hedge funds (pre-2000) but have substantially disinvested by 2020. That leaves European insurers as the marginal source of capital. Table 3 shows the top five European insurer investors in hedge funds, whose investments total over €20bn.

HFI has written about insurance companies as investors in hedge funds here and here. It has been clear that U.S. Insurance Companies have been disinvesting from hedge funds for the last five years as tracked by AM.Best. Returns, fees and regulatory capital issues have all fed into less appetite for hedge funds from rated American Insurers. It is not that there are no American insurers that have committed fresh capital in recent years. In 2019 Prudential, Mass Mutual and Nassau Life between them put half-a-billion Dollars into hedge funds. But there has been more capital flowing out than in from rated American insurers. SEC data shows that the Insurance sector contributed $50bn of capital to hedge funds in 2013, $78bn of capital at the end of 2017 and $89bn of capital at March 2020. To date there has been little sign of captive insurers or offshore insurers investing in hedge funds. Japanese life insurers were early investors in hedge funds (pre-2000) but have substantially disinvested by 2020. That leaves European insurers as the marginal source of capital. Table 3 shows the top five European insurer investors in hedge funds, whose investments total over €20bn.

Conclusion

There have been some reassurances taken in the analysis of data from the SEC collected via Form PF. Yes the secular decline in the fund of hedge fund sector continues, but that is unsurprising. The pattern of capital commitments of Pension Plans and Endowments and Foundations have been more positive than expected. UHNWIs remain a major source of capital though not dominant as they were three decades ago. Access for the single-digit millionaires via platforms is still there but the mass affluent are neither a significant or growing element of hedge fund capital. In recent years the redemption of capital by American insurers has been more than matched by subscriptions by European insurers, though in the context of the hedge fund industry insurance companies are not a big source. SWFs provide more than one-in-twenty Dollars of hedge fund capital, and that is expected to increase.

Notes on Form PF Filers and their Funds

The amount of information an adviser must report and the frequency with which it must report on Form PF depends on the amount of the adviser’s private fund assets and the types of private funds managed. SEC-registered investment advisers with at least $150 million in private fund assets under management are required to file Form PF. Not all Form PF filers report on a quarterly basis. Smaller private fund advisers and all private equity fund advisers file Form PF on an annual basis, while larger hedge fund advisers and larger liquidity fund advisers file

the form quarterly. As a result of the difference in reporting frequency, information in reported here related to funds that are reported annually may be dated by several months.

*A Qualifying Hedge Fund is a hedge fund advised by a Large Hedge Fund Adviser (an adviser that has at least $1.5 billion in hedge fund assets under management) that has a net asset value (individually or in combination with any feeder funds, parallel funds, and/or dependent parallel managed accounts) of at least $500 million as of the last day of any month in the fiscal quarter immediately preceding the adviser’s most recently completed fiscal quarter.

^source: Research and Markets

Definition of Hedge Fund used by the Risk and Examinations Office of the SEC: Any private fund (other than a securitized asset fund): (a) with respect to which one or more investment advisers (or related persons of investment advisers) may be paid a performance fee or allocation calculated by taking into account unrealized gains (other than a fee or allocation the calculation of which may take into account unrealized gains solely for the purpose of reducing such fee or allocation to reflect net unrealized losses); (b) that may borrow an amount in excess of one-half of its net asset value (including any committed capital) or may have gross notional exposure in excess of twice its net asset value (including any committed capital); or (c) that may sell securities or other assets short or enter into similar transactions (other than for the purpose of hedging currency exposure or managing duration). The definition of a hedge fund for Form PF purposes also includes any commodity pool an adviser reports on Form PF.