By Simon Kerr, Publisher of Hedge Fund Insight

Quantedge Capital Pte, the Singapore-based quant management company, has received some coverage this week as the firm has joined the small number of Asian hedge fund managers overseeing a billion dollars. The firm, run by Kah Shin and Chua Choong Tze and are to be congratulated on hitting such a significant milestone as a business.

However, in some ways the firm is a overdue in hitting a billion dollars under management, by their own and others expectations.

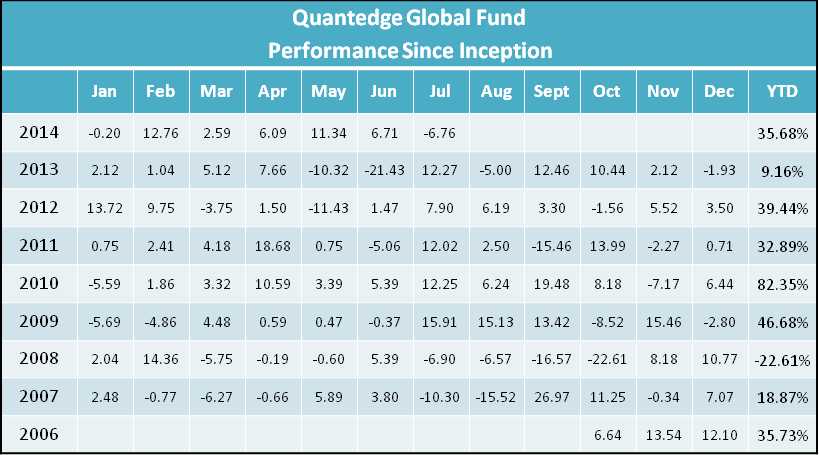

source: hedge fund database/Hedge Fund Insight

source: hedge fund database/Hedge Fund Insight

From the scale of the returns, both monthly and annual, it is clear that this fund assumes significantly more risk than most hedge funds. The fund managers aim to outperform the major risky asset classes by more than 20% per annum in the medium term and to generate annualized returns of 30% in the long term. They have succeeded on both counts. The annualized return over the last 5 years is 46.34%, and the total return since inception is a huge 816%. The standard deviation of the annual returns is also huge by hedge fund standards at around 30%.

The absolute returns, percentage winning months (at 57 %), and the average size of winning months to average losing months, and downside risk characteristics make this a very interesting prospective investment for anyone investing in hedge funds.

I was in contact with the firm 19 months ago. Then they expected to reach $1bn in AUM by the end of 2013. That was a big ask, given that the asset base at that time (February 2013) was $550m, but it was certainly achievable given the business momentum they had. In fact, one of the reasons I approached them was to satisfy my curiosity about why they were not running more assets, as the returns were of the order and distribution that one would usually find in a business running significantly more than a billion dollars. It was a case of “what is wrong with this picture?”

I found out.

No Marketing

If you look the firm/fund up on a hedge fund database you will not see a marketing contact listed. This is what the firm says about marketing:

- Our principals do not travel to Europe for marketing purposes.

- We do not carry out active marketing nor do we engage third party marketers.

- The investor services desk at Quantedge facilitates investors’ due diligence and transactions. We do not conduct ‘marketing’ in the conventional sales sense (nobody in the firm does that, although, we happy to speak with investors and potential investors).

- Sometimes, the trade press inform us of their intention to write an article about Quantedge. We would send over the relevant info via email so as not be to misquoted. We do not usually solicit media coverage.

- As of now, there is no intention to carry out any marketing campaign, hence, we have no interest to engage any 3PM.

- We can provide potential investors with the additional information that they may need as well as arranging for a meeting or a call with one of the directors. Choong Tze and Kah Shin may sometimes get involved in speaking with investors, especially the larger ones, but they generally prefer to focus on managing the portfolio.

I think having a properly resourced marketing capability is just about essential for a hedge fund management company. There may be an inference that external relations in general are not taken seriously, and all hedge funds have to keep their clients engaged and happy. The extreme opposite of Quantedge Capital is possibly Bridgewater Associates. The firm which runs the world’s largest hedge fund has a Marketing department, a Client Services department and a Counterparty & Client Relations department. More than 10% of the 1,200 staff at Bridgewater Associates work in Client Services.

Quantedge Capital is an established and successful hedge fund management company. At the least it is easy to assume that the firm could have hit the $1bn milestone a lot sooner if there was a marketing department, but the unwillingness to engage more generally is a minor red flag to some potential investors.