By Hedge Fund Insight staff

BlackRock has had a strategic goal of stimulating and meeting retail demand for alternatives for some years. BlackRock launched its first alternative fund for retail investors in 2011 – the year that Morningstar first gave long/short debt funds their own category.

The commercial strategy has had several components – a diversification message, platforms access, sales channel support – and the strategy has had several goals.

BlackRock took the view that the traditional allocation of 60 percent stocks, 40 percent fixed income for retail clients was going to breakdown. That view, propounded five years ago, has been borne out as the traditional allocation split has been replaced by a new paradigm. And it is one that typically includes alternatives now, predicated on diversification benefits.

To benefit from the flows that it saw coming via retail, BlackRock has made efforts to have its products on the platforms of third-party broker-dealers. Having become one of the top 3 or 4 fund groups on the big platforms BlackRock has looked to increase penetration in each by cross-selling.

To move from selling fixed income or equity product to effectively selling alternative mutual funds on a broker-dealer platform is not easy, but has been achieved by many of the management companies with the best selling alternative mutual fund offerings. This success can partly be put down to brand awareness and the halo effect of top performing equity or multi-asset or fixed income mutual funds. But BlackRock was aware that it takes more than passive availability to market alternative mutual funds. The concept of alternatives has to be sold to broker dealer advisors and to end-retail-investors. Then there has to be support for the sales channel.

BlackRock implemented the support component through a team of alternative specialists which acts as experts for its wholesalers.

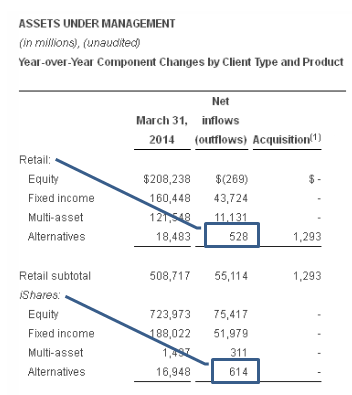

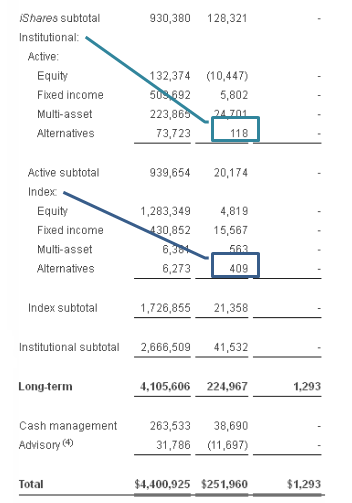

The pay-off for BlackRock Inc has come in flows from retail to its alternatives business. The graphic below is an extract from the first quarter results of BLK.

Over the twelve months to the end of March 2015 flows to the retail alternatives business of BlackRock have been nearly five times as big as the institutional flows to the active part BlackRock alternatives. In fact, looking over the four highlighted boxes, the institutional active part has been the smallest contributor to net flows to BlackRock’s alternatives business behind institutional index, iShares and retail flows. Given the margin of passive products compared to active products, the flows from retail alternatives at BlackRock must be very welcome, but are really a pay-off for a medium-to-long-term plan executed well.

related articles

How Many Hedge Funds? Only 15-20 For The Highly Skilled (Apr 2015)

Multi-Strat v Fund-of-Funds: Multi-Strat Has Won Out Because Of Flexibility (Mar 2015)

US Liquid Alternatives Had Good Flows in 2014, Unlike High Yield Funds (Jan 2015)

The Case for Liquid Alts from Credit Suisse Asset Management (Dec 2014)