By Andrew Beer, Chief Executive Officer of Beachhead Capital

Investors and managers find themselves at an interesting inflection point in the evolution of the hedge fund industry. The growth of liquid alternatives has focused attention on what happens when talented hedge fund managers are asked to manage money within the constraints of a mutual fund structure. The results so far are disappointing: alternative multi-manager mutual funds underperformed the HFRI Fund of Funds index by close to 200 bps in 2014, despite a 200-300 bps fee advantage (and, as noted in a previous paper[1], underperformed by 400 bps on average in 2013 and 2012). This underperformance mirrors the issues with investable indices, which lagged by an even wider margin in the early years.

Constraints are the Achilles heel of talented investors. Despite deep levels of talent and resources, the vast majority of traditional managers underperform lower cost indices over time. The original concept of the hedge fund industry was that with fewer constraints, talented managers could deliver exceptional returns. Not surprisingly, many of the original distressed debt investors in the early 1990s were merger arbitrage specialists – when the junk bond market collapsed, they moved to capitalize on it.

The institutionalization of the hedge fund industry has introduced a new set of constraints. Institutional fear of strategy shift relegates most managers to narrow mandates: a talented equity long/short manager with health care expertise faces an uphill battle explaining to current investors why half the portfolio should be in credit, another sector, or even cash if the opportunity set within healthcare is not compelling. Effectively, most managers are given a hammer and instructed to look for one particular kind of nail.

This paper looks at two less well known examples: strategy bias in hedge fund indices, which have been overweight underperforming sectors post-crisis, and funds of funds, whose own constraints have led to meaningful underperformance relative to less constrained multi-strategy portfolios.

Strategy Bias in Hedge Fund Indices

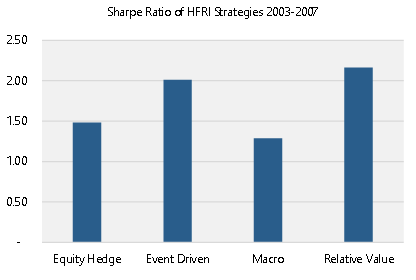

The pre-crisis years were relatively easy sledding for hedge fund allocators, such as funds of funds. In 2003-07, all major hedge fund strategies generated high risk adjusted returns. Equity Hedge, Relative Value, Event Driven and Macro all had Sharpe ratios of between 1.29 and 2.17 – exceptionally high relative to traditional assets, where long-term Sharpe ratios typically are 0.2-0.3.

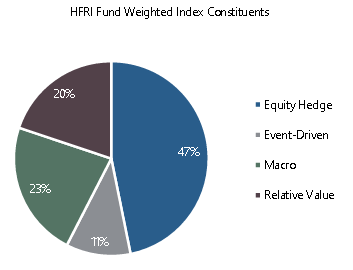

In this environment, an allocator throwing darts at a wall of hedge fund names would have meaningfully outperformed traditional assets. This led to the development of a “fully diversified” hedge fund portfolio – relatively static allocations across strategies and, sometimes, dozens of managers. Diversification would minimize manager risk and, in theory, protect against market drawdowns. Consequently, the portfolios tended to reflect the composition of the overall industry which, in terms of number of funds, has always been heavily biased to Equity Hedge and Macro. Today, 70% of the HFR Fund Weighted Index consists of Equity Hedge and Macro funds.

Why is this? Because the barriers to entry are lowest – it’s much easier to launch Equity Hedge and Macro funds, so most funds at any given point in time will consist of those strategies. Further, because reporting to indices is elective and is viewed as a de facto form of marketing, the composition of the database similarly will reflect the composition of the number of funds across the overall industry.

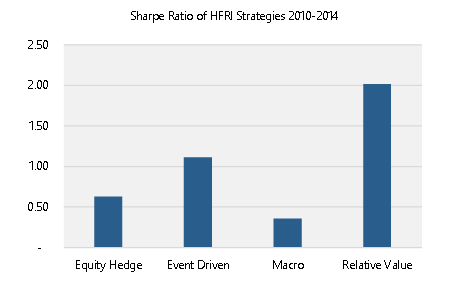

The post-crisis years have been a rude awakening, with a wide divergence in the risk adjusted returns of the same strategies. The Sharpe ratio of Macro strategies, for instance, dropped by two-thirds from the pre-crisis to post-crisis period, and was less than a quarter that of Relative Value. The Sharpe ratio of Equity Hedge strategies dropped by half over the same period.

Viewed in this light, the indices have been overweight underperforming strategies for years. This explains in part why many of the actively managed hedge fund portfolios have been able to persistently outperform the indices. As the opportunity sets change, they adapt accordingly.

Funds of Funds vs. Multi-Strategy Hedge Funds

Take the performance of the HFRI Fund of Funds index versus the largest multi-strategy funds.[2] The latter, by definition, have open mandates to pursue opportunities wherever and whenever they arise. Managers with billions of dollars of capital at stake have the right incentives and resources to maximize risk adjusted returns over time.

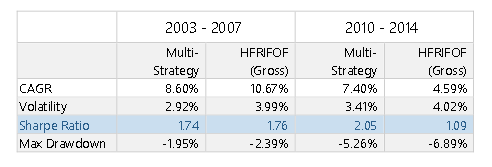

In the pre-crisis period, risk-adjusted returns between large multi-strategy funds and the HFRI Fund of Funds index (adjusted for the second layer of fees) were comparable. However, in the past five years, the Sharpe ratio of multi-strategy funds was almost double that of the typical fund of hedge funds.

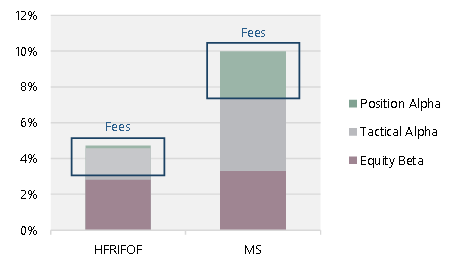

What has driven the outperformance by multi-strategy managers in recent years? In large part, multi-strategy funds have been much better at adjusting their portfolios to capitalize on shifts in the opportunity set. The following chart breaks down pre-fee performance according to equity beta, tactical alpha (shifts in asset allocation among key markets), and position alpha (primarily security selection and illiquidity premia).

The results are striking: despite similar beta exposure, multi-strategy managers generated vastly more tactical alpha and position alpha. We see this in greater exposure to credit and emerging markets post 2008, more illiquid assets in 2012, and more aggressive shifts to US equity exposure in 2012-13. By contrast, under pressure from investors who fear a repeat of the gatings and suspensions from 2009, many funds of funds have shifted to more liquid strategies, which have underperformed on a risk adjusted basis.

Conclusion

The implications of this analysis are several-fold. First, the most sophisticated allocators, including leading funds of funds, have become more adept at shifting exposures across strategies based on feedback from underlying managers. In analyzing dozens of live portfolios, we’ve seen persistent outperformance of 300 bps or more relative to the indices: the best allocators are becoming more like multi-strategy funds than index trackers.

Second, the perception that hedge fund indices, with their relatively static weights, have generated disappointing performance is valid. By analogy, it’s as if the S&P was significantly overweight industrials during a tech boom. In the replication space, we’ve seen how successfully tracking (and in most cases, outperforming) the fund of funds and liquid indices has failed to produce absolute returns commensurate with expectations from the pre-crisis period.

Finally, there are serious questions about the degree to which newly-launched liquid alternative products – with a panoply of new constraints – will continue to underperform investor expectations. In some strategies, such as equity long/short, the impact should be minimal. However, in a diversified model – such as that employed by alternative multi-manager mutual funds – the impact of regulatory constraints on performance may be expected to be far more pronounced.

[1] See Performance Drag of Alternative Multi-Manager Mutual Funds

[2] Custom equal weighted index based on the 16 largest funds in the Credit Suisse Multi Strategy Index.

This article has been published with the kind permission of the author.

One Response to “Multi-Strat v Fund-of-Funds: Multi-Strat Has Won Out Because Of Flexibility”

Read below or add a comment...