By Stephen L. Nesbitt, CEO and Eli J. Sokolov, Managing Director of Cliffwater LLC

Introduction

We first wrote about how many hedge funds constituted an appropriately diversified portfolio in 2006, arguing that most investors tended to over diversify their hedge fund portfolios, particularly those investing in funds-of-funds.1 We showed that the accumulation of hedge funds beyond approximately 15 to 20 would likely result in the dilution of alpha, little to no diversification gains, and a proportionally higher fee drag. Most hedge fund investors have now moved in this direction and construct higher conviction portfolios with a more manageable number of funds.

This paper extends our earlier work to include the impact of investor skill in hedge fund selection on the optimal number of hedge funds. We find that varying selection skills produce optimal portfolios of hedge funds ranging roughly between 10 and 40 in number. Absent other factors,2 optimal portfolios for highly skilled selectors contain 15-20 hedge funds while optimal portfolios for skilled selectors contain 20-30 hedge funds. Investors with limited experience should consider holding between 30-50 hedge funds.

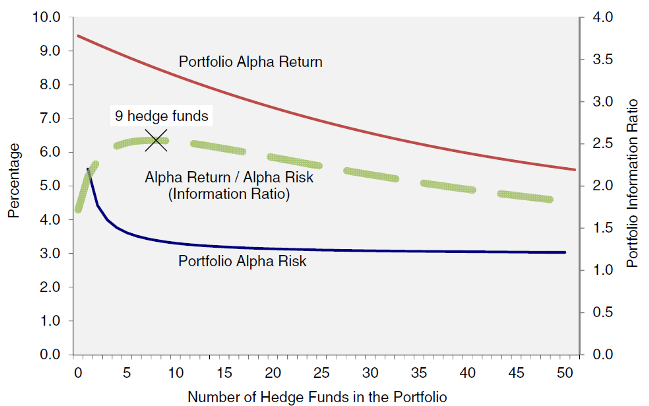

Exhibit 1 describes graphically the dual role of portfolio alpha and risk in the decision process for identifying the optimal number of hedge funds, and reports our finding that a portfolio should have at least 9 hedge funds, even if the investor has perfect foreknowledge of individual hedge fund outcomes.

Exhibit 1: The Optimal # of Hedge Funds with Perfect Selection Skill

Of course, manager selection skill is imperfect and varies by investor experience, resources and know-how. We use the balance of this paper to show how and why the optimal number of hedge funds increases as manager selection skill decreases.

Our analysis combines the risk reducing diversification benefits gained from adding more hedge funds to a portfolio (blue line in Exhibit 1) with the reduction in overall portfolio return from adding hedge funds with likely lower return potential (red line in Exhibit 1). The optimal number of hedge funds in a portfolio is where the ratio of portfolio return-to-risk is at its maximum. That maximum equals 9 hedge funds in Exhibit 1, assuming perfect selection skill.

The specifications for the lines in Exhibit 1 are based upon data drawn from approximately 120 institutional quality hedge funds that Cliffwater recommends to clients, based upon investment and operational due diligence. Also, our analysis focuses on alpha return and alpha risk instead of total return and total risk for two reasons: (1) alpha is the component of return that investors want most from hedge funds and (2) beta return and risk can’t be diversified away by adding hedge funds and therefore their inclusion or exclusion would not change our findings.

Diversification Benefits

The average alpha risk of our 120 hedge fund sample equals 5.50% over the five years ended December 31, 2014. The average alpha correlation among these hedge funds equals 0.29.3 The blue line shows the change in portfolio alpha risk as the number of hedge funds within a portfolio increases. Significant risk reduction occurs but the incremental benefits diminish significantly after about 12-15 hedge funds. Approximately 95% of the maximum diversification benefit occurs at 13 hedge funds and 98% of the maximum benefit occurs at 20 hedge funds.

Alpha (Return) Dilution

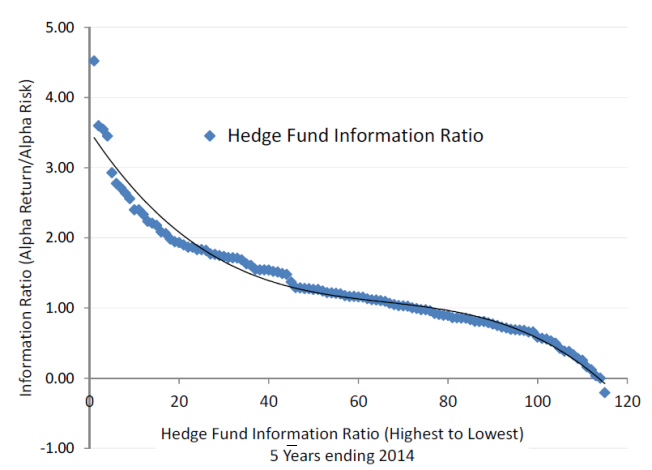

It is a reasonable expectation that portfolio alpha (return) will decline as hedge funds are added to a portfolio. Not all hedge funds are the same in their return potential and if one assumes the best are included first due to manager selection skill, the marginal expected return declines as the number of hedge funds is increased. We quantify the “marginal decline in alpha” in Exhibit 2 by ranking 5 year historical information ratios for our 120 hedge fund sample from highest to lowest, which gives us a quantitative measure of how alpha might decline. We use the fitted line in Exhibit 2 as the basis for Portfolio Alpha Return (red line) in Exhibit 1, where we take the best manager first, followed by the next best, and so forth.

Exhibit 2: Hedge Fund Information Ratio Ranked Highest to Lowest

With perfect knowledge of how managers rank by information ratio and the rate of performance decline expressed in Exhibit 2, the optimal number of hedge funds equals 9, as shown in Exhibit 1. In practice, investors are imperfect in their hedge fund selections and could end up with higher ranked or lower ranked hedge funds depending upon their level of selection skill. Intuitively, the lower an investor’s selection skill, the more hedge funds should be included in the portfolio, but the exact relationship can’t be understood without an ability to measure selection skill. Below, we

describe a measure of investor selection skill and introduce a simulation process for recalibrating Exhibit 1 for less than perfect selection skill.

Monte Carlo Simulation

We apply Monte Carlo simulation to study the relationship between hedge fund selection skill and the optimal number of hedge funds. Our study involves the following steps:

- The hedge fund sample group consists of the same 120 hedge funds used to construct Exhibits 1 and 2 above.

- The study objective is to find the number of hedge funds that produce the highest risk-adjusted return (information ratio) over the past five years, ending December 2014.

- Monte Carlo simulation is used to randomly draw hedge funds to construct portfolios of differing numbers (1, 2, 3 … 50), rather than drawing the highest to lowest returning hedge funds as was done in Exhibit 1.

- We impose a selection probability array based upon the level of hedge fund selection skill. A selection probability of 1.0 would be assigned to the best performing hedge fund, and zero to the remaining 119 to represent the investor with perfect selection skill. Once selected, a probability of 1.0 is assigned to the next highest returning hedge fund, and so on.4 On the other hand, for an investor with zero selection skill, an equal selection probability of 1/120 (0.083) is assigned to each hedge fund. For investors with varying levels of selection skill, a linear declining selection probability is assigned. Highly skilled investors would have higher selection probabilities assigned to higher performing funds and lower selection probabilities assigned to lower performing funds.

- For each investor skill level, 1,000 separate portfolios (trials) are randomly constructed for each portfolio holding size (1, 2, 3 … 50). The average information ratio value for each trial is then recorded. The “optimal” number of hedge funds equals the highest average value across the 50 simulations of differing hedge fund constituent sized portfolios.

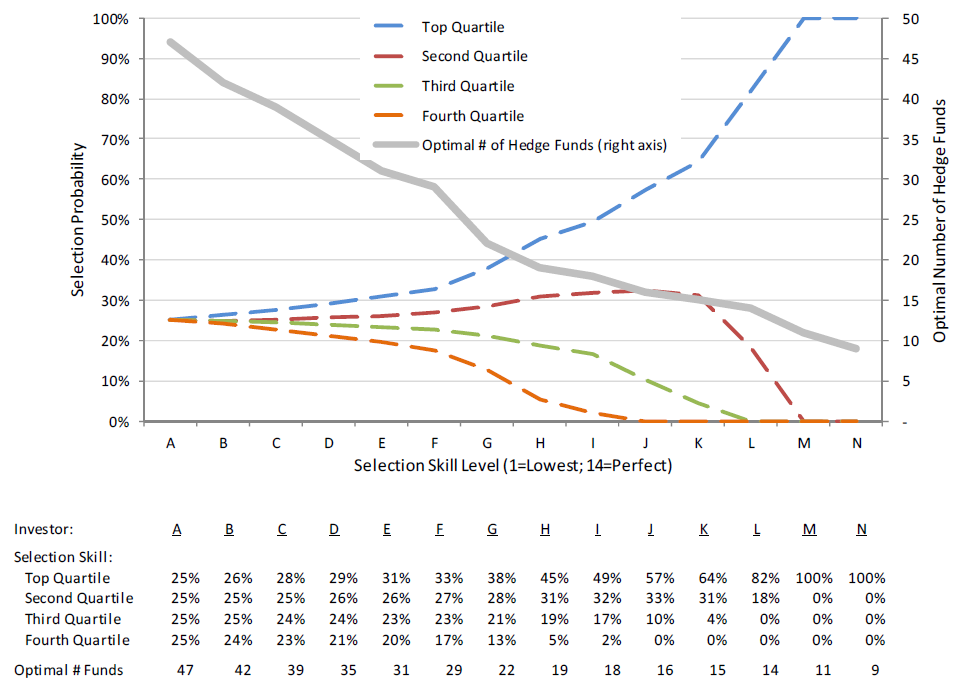

Our study results are shown in Exhibits 3 and 4.

In Exhibit 3 we have defined investors (A, B, C … N) of varying levels of hedge fund selection skill. Investor “A” has no skill, demonstrated by the fact that his selections fall equally (25%) across performance quartiles. Investor “N” is our perfect foresight friend, always picking the best of the litter. Investor “M” is similarly skilled, though not perfect. Her selections are always in the first quartile of performance though not always the absolute best. Finally, we present an array of a dozen other investors of varying skill. For example, practitioners would probably view Investor “I” as having excellent skill, with over 80% of his selections falling in the first or second quartile and less than 20% below median. Even Investor “F” with 60% of her selections in the top two quartiles, would be considered possessing good skill.

Exhibit 3: Selection Skill and Optimal Number of Hedge Funds

The percentage of time each of our investors’ selections occurs within each quartile is plotted by dashed lines in Exhibit 3. The better the selection skill, the higher is the percentage of funds found in the top two quartiles and the lower the percentage found in the bottom two quartiles.

Findings

The simulation results are shown on the solid line, referenced by right axis. As selection skill increases, the optimal number of hedge funds falls steadily, from 47 for an investor with no skill to 9 for the investor with perfect foreknowledge. We would suspect that most experienced hedge fund investors possess5 selection skill levels somewhere between Investors “F” and “K,” which suggests an optimal number of hedge funds between 15 and 29.

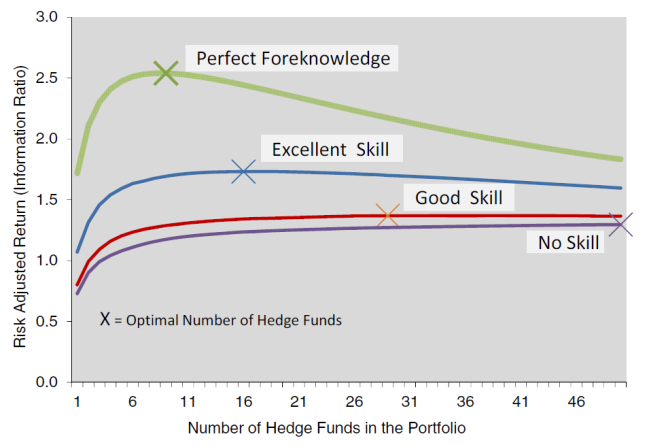

Exhibit 4 further illustrates our findings by showing how selection skill might also impact portfolio information ratio. The four lines displayed represent our Investors “A”, “F”, “K” and “N.” Three observations are worth noting. First, risk-adjusted return falls fairly significantly with lower selection skill, which points to the value in good selection ability. Second, having too many hedge funds hurts investors with more selection skill compared with those with less selection skill. And finally, having too few hedge funds appears to be a more costly problem than too many hedge

funds, though this mistake is less frequently seen in practice.

More generally, and absent other considerations, optimal portfolios for highly skilled selectors contain 15-20 hedge funds while optimal portfolios for skilled selectors contain 20-30 hedge funds. Investors with limited experience should consider holding between 30-50 hedge funds.

Exhibit 4: Returns, Selection Skill and Optimal Number of Hedge Funds

Other Considerations

In practice, other considerations may significantly impact the optimal number of hedge funds in a portfolio, and generally towards a larger number. Both the total dollars invested in hedge funds and the percentage of total assets that hedge funds comprise, create the potential need for a greater number if hedge funds. Also, the best managers often close their hedge funds to new asset flows, forcing investors to look elsewhere. Finally, redeeming from poorly performing hedge funds can often take time, creating a temporary number of legacy holdings.

Conclusion

An important portfolio construction question is the correct number of hedge funds to include in a diversified portfolio. Our prior analysis focused primarily on excessive diversification found in many funds-of-funds, which diluted alpha without the benefit of risk reduction. This report goes a step further and attempts to show the impact of the distribution of hedge fund manager alpha and investor hedge fund selection skill on the optimal number of hedge funds. We find that, absent other factors, investor selection skill has a significant impact on the optimal number of hedge funds and that skilled selectors should have fewer hedge fund holdings, generally between 15 and 20. Those with good, but lesser skill (or less confidence in their skill set), should have between 20 and 30 hedge funds. Finally, investors with little or no skill (or no confidence in their skill set) should include at least 30 hedge funds in their portfolio.

©2015 Cliffwater LLC. All rights reserved.

——————————-

1 See Cliffwater Research, “Hedge Fund Investing: Direct, Fund-of-Funds, or Both? (May 2006)” and “Constructing a

Portfolio of Hedge Funds (April 2011).”

2 We discuss other considerations (i.e. size and liquidity) later in the report, most of which suggest a somewhat larger

number of hedge fund holdings than our analysis recommends, if they apply to investors.

3 In theory, alpha returns should have no correlation (correlation equal to 0.0) to one another. However, factors common to hedge funds exist (“hedge fund beta”) which give rise to positive correlations despite eliminating major market factors, i.e. the MSCI ACWI Index

4 This process is known as “simulation without replacement.”

5 Or believe they possess.

2 Responses to “How Many Hedge Funds? Only 15-20 For The Highly Skilled”

Read below or add a comment...