By Hedge Fund Insight staff The latest Weekly Brief from Lyxor Asset Management shows merger arbitrage as the best performing strategy this month (data up to 17th June). Merger arb is also one of the best performing strategies this year (up 3.3% YTD). The Allergan vs. Valeant Pharmaceuticals International deal was the hottest spot […] Read more »

Tom Sandell: Everything International

By Josh Black, Editor of Activism Monthly Premium For Thomas Sandell, the media interest in his fund’s campaign at FirstGroup was somewhat unexpected. “We were a little bit surprised by the volume of publicity,” admits the Swedish-born, US-based investor. But more disturbing to Sandell was the lack of understanding of his plans from Fleet […] Read more »

Event Driven in May

By Hedge Fund Insight staff* Event Driven managers had a negative month in May despite the high level of deal activity and the positive contribution from special situations trading. A number of the larger deal spreads either broke (Astra-Zeneca/Pfizer was not an official deal break, but it had the same effect) or widened. This was […] Read more »

Hedge Funds Increase Short Bets On US Bonds According To Lyxor Data

From Lyxor Asset Management* Hedge funds are increasing their short bets on US rates as the flow of economic data improved and inflation figures edged higher. Moderate price pressures materialised recently (PCE deflator at 1.6% yoy in April), though the inflation rate remains below the 2% target of the Fed. This triggered a rise […] Read more »

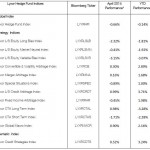

Lyxor Hedge Fund Index Commentary For April

From Lyxor Asset Management The Lyxor Hedge Fund Index was down -0.7% in April (YTD -0.1%). 6 out of 12 Lyxor Indices ended the month of April in positive territory, led by the Lyxor L/S Credit Arbitrage Index(+1%), the CTA Long Term Index (+1%) and the Lyxor Global Macro Index (+0.9%). Data published in […] Read more »

Event Driven Strategy Outlook: Looking Beyond Merger Arb

By Alex Gavrish, Etalon Investment Research and author of “Wall Street Back To Basics” Credit Suisse recently released its Annual Hedge Fund Investor Survey. The survey, produced by Credit Suisse’s Capital Services Group, is one of the most comprehensive in the industry, with over 500 respondents – including pension funds, endowments, consultants, family offices […] Read more »

Special Situations Funds Ride The Wave Of M&A In February

From Lyxor Asset Management The Lyxor Hedge Fund Index was up +1.9% in February, bringing year to date performance to +1.45%. 11 Lyxor Strategy Indices out of 12 ended the month in positive territory, led by the Lyxor Special Situations Index (+3.48%), the Lyxor CTA Long Term Index (+3.4%) and the Lyxor L/S Equity […] Read more »

Long Term CTAs Down Ugly As Short Term CTAs Hold On In January

From Lyxor Asset Management The global economy finished was down only -0.4% in January, outperforming the MSCI World down -3.8%. 8 Lyxor Strategy Indices out of 12 ended the month in positive territory, led by the Lyxor Fixed Income Arbitrage Index (+1.74%), the Lyxor Merger Arbitrage Index (+0.92%) and the Lyxor L/S Equity Market Neutral […] Read more »

Merger Arbitrage Outlook in 2014

By Vertex One Asset Management The Vertex Arbitrage Fund launched on October 31st. The fund finished the year almost fully invested in over 20 deals. A significant number of our more meaningful positions are Canadian opportunities that are slightly off the radar and offer an attractive risk/reward. A significant component of the performance this quarter […] Read more »

Lyxor AM Emphasises Special Sits Managers For 2014

From Lyxor Asset Management The global economy finished on solid footing in 2013 and growth is set to maintain a healthy pace in 2014. Demand in the developed economies is recovering steadily aided by supportive policies which have helped smooth the deleveraging cycle. Growth in the US is leading other regions and is helped by […] Read more »