By Hedge Fund Insight staff

The latest Weekly Brief from Lyxor Asset Management shows merger arbitrage as the best performing strategy this month (data up to 17th June). Merger arb is also one of the best performing strategies this year (up 3.3% YTD).

The Allergan vs. Valeant Pharmaceuticals International deal was the hottest spot this week.The graphic below shows the share price changes of the two stocks and the volume of trading of VRX since Valeant’s interest became public in April.

Previously, the board of the Botox-maker target had repeatedly refused to negotiate with Valeant Pharmaceuticals. Consequently, the acquirer (Valeant) decided to go hostile and formally launched an exchange offer to Allergan’s shareholders on Wednesday 11th June. The acquirer’s stock price was already heading South, as the market anticipated the move. The decline continued over the following week as the cost of acquisition was seen to rise. The sharp decrease of this last week will have generally benefited the event driven funds since they held short positions on that stock.

source: Lyxor Asset Management

source: Lyxor Asset Management

Managing position size is a an important skill in hedge fund portfolio management. The position size will vary with the strength of conviction, and the perceived scale of opportunity (target price v market price), and the potential impact on the rest of the portfolio taking account of correlation and volatility both within the portfolio and of potential factor impacts.

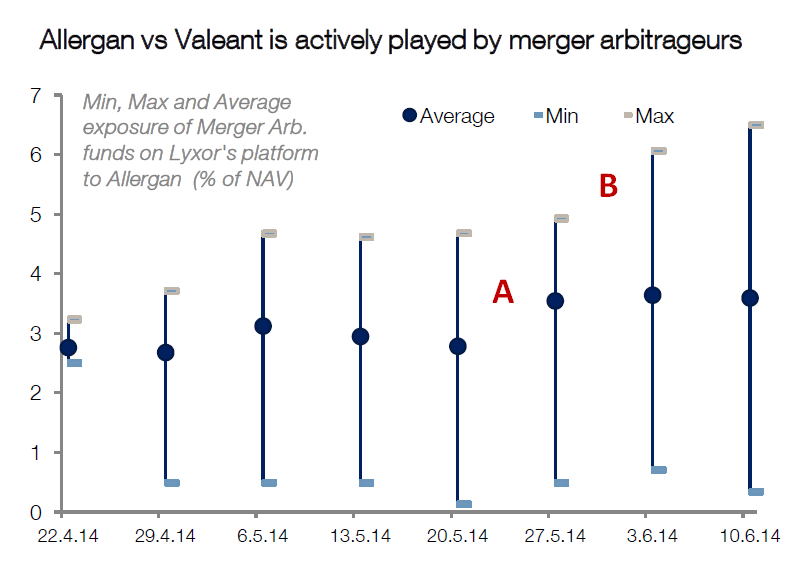

For event driven managers managing position size is a key skill, because the strategy requires managing positions against the calendar in a way which does not arise in other strategies. The graphic above shows the changes on a weekly basis of the exposure taken to Allergan by hedge fund managers on the Lyxor MAP. Note that the date for the exposure graphic covers a week less than the share price chart.

In the week marked A (20th-27th May) the typical merger arb fund (captured by the average exposure) expressed increasing confidence in the deal by adding just over half a percent to the existing Allergan position, taking the typical holding from around 2.8% to 3.4% (and the minimum exposure change confirms the additions).

In the following week (May 27th to June 3rd, marked B) the more aggressive merger arb managers expressed even more confidence that the deal was going to be profitable for them (either because of increased conviction or better spread available) by adding a further 1% to their positions, taking exposure to the deal from just below 5% to just over 6% of funds NAVs. Some even added to the positions in the following week.

Positions are typically trimmed and added to in most hedge fund strategies on a tactical basis. This example illustrates that for event driven strategies a key element of success is correctly managing position sizes through the life cycle of the deal, taking account of the disposition of the whole portfolio, and the dynamics of the risk/reward of the particular deal.

This year has been a banner year for deal flow, as investors in hedge funds had anticipated at the start of the year. To benefit from event driven strategies in the early and middle stages of the cycle for the strategy is not difficult as all managers make money. Investors in funds in event driven strategies have much greater difficulty making good consistent returns as the cycles for the sub-strategies mature. A key area for distinguishing between the managers, and identifying which ones to retain, is to see how (and why) they manage the changes to position size within their portfolios.

Related Articles:

Managing An Existing Macro Position – Aussie Dollar Example from Bridgewater As Would Be Managed by Caxton Associates

Top Macro Manager Talks Through Set-Ups, Triggers and Sizing Positions