From Lyxor Asset Management*

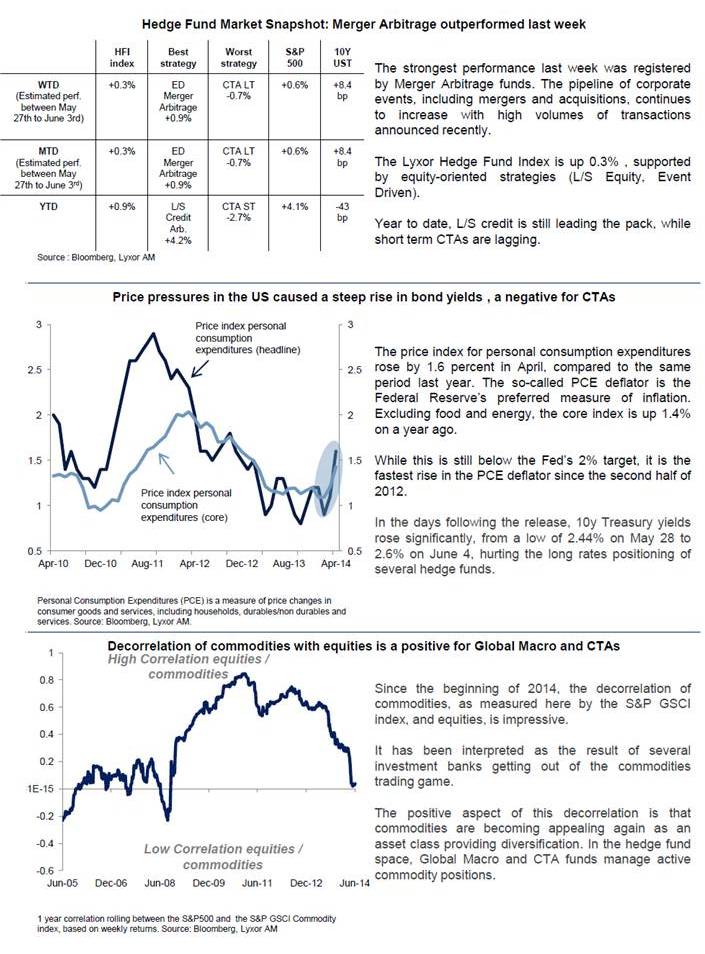

Hedge funds are increasing their short bets on US rates as the flow of economic data improved and inflation figures edged higher. Moderate price pressures materialised recently (PCE deflator at 1.6% yoy in April), though the inflation rate remains below the 2% target of the Fed. This triggered a rise in 10y Treasury yields last week which caused some losses on CTAs.

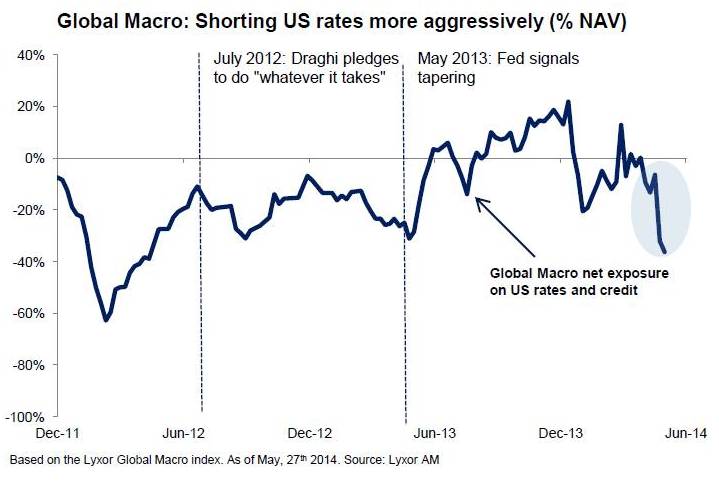

In this environment, Global Macro funds have cut quite aggressively their net short positioning on US rates and Credit, from -9% of net assets at the end of April to -36% currently.

With regards to recent performance, equity-oriented strategies (Event Driven, L/S Equity) continue to rebound while L/S Credit and Fixed Income Arbitrage remain resilient in spite of higher bond yields. The strongest performance last week was registered by Merger Arbitrage funds. The pipeline of corporate events, including mergers and acquisitions, continues to increase with high volumes of transactions announced recently.

We note finally that positioning on commodities has evolved. Some Global Macro and CTAs have increased their long positioning on energy, associated probably to the « mini-stimulus » package announced by Chinese authorities. The overall positioning of Global Macro funds on energy is moderate, but increasing from 1.8% of net assets in early May to 3.5% to date. Meanwhile, CTAs have considerably sizeable positions that increased from 20% of NAV to 25% during the same period.

*This is an extract from the weekly report from Lyxor’s Managed Account Platform Research team, focused on hedge fund flows, performance and positioning. It aims at identifying trends in hedge fund investing every week, while leveraging on the proprietary information accessible through the Managed Account Platform. There are approximately 100 funds on the platform with AUM of $12.1bn at end March 2014.