Investment Due Diligence Report

March 27, 2015

Executive Summary

This review has been requested by The Client. The scope of this review and the rating is limited to the general investment capabilities of Halcyon Asset management, LLC (the “Firm” or “Halcyon”) within the strategies listed in the second table below, as well as the anticipated merits of its new European product. It does not extend to an operational due diligence of the Firm.

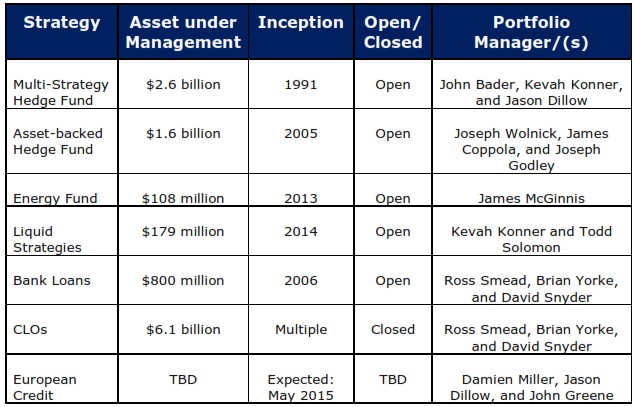

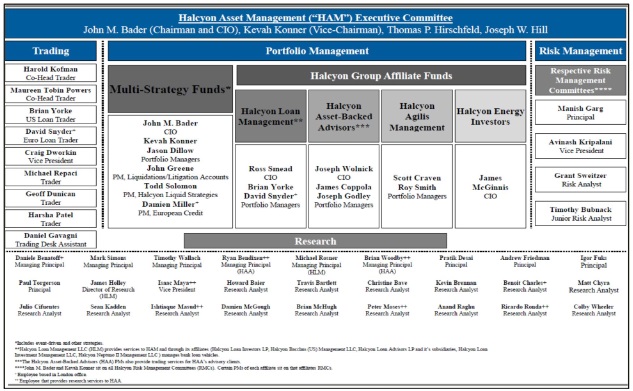

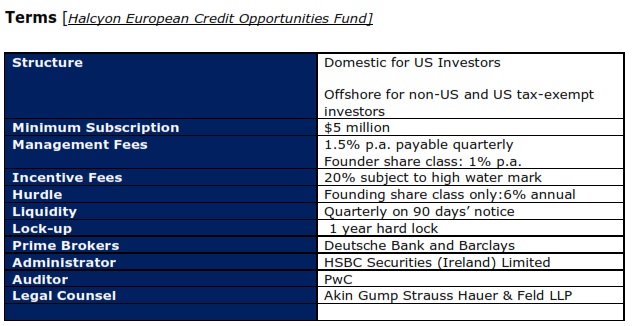

Halcyon is an investment management firm based in New York. The Firm manages approximately $11 billion across various strategies and products including event-driven multi-strategy, structured credit, liquid loans, collateralized debt obligations, and energy. It is now in the process of launching a new product – Halcyon European Credit Opportunities Fund (the “Fund”), which will invest in distressed and special situations opportunities in Western Europe. This Fund is expected to launch on May 1, 2015 with approximately $100 million.

The Client has negotiated a Master Custodial Account (MCA) agreement with Halcyon that allows The Client to invest up to $125 million in various Halcyon products. The Client may also invest in direct co-investment opportunities that may be offered by Halcyon. The MCA excludes investments in Halcyon’s structured credit (ABS) product. As laid out in its investment plan, policy and guidelines, the MCA enables The Client to initially invest $50 million in the newly launched Halcyon European Credit Opportunities Fund. This investment will be limited to 50% of the total account on a fully built-out basis. In addition, the MCA limits investments to a maximum of 25% to any individual fund and to a maximum of 10% to any individual direct investment opportunity. Exceptions to these limits may be allowed pursuant to a written permission from The Client.

A Consultant research recognizes that the MCA mandate is intended to be flexible and opportunistic. It will allow The Client to invest tactically across a range of Halcyon funds and direct co-investments. While A Consultant cannot vet each future allocation that may be made under this mandate, it anticipates that The Client’s staff will review each investment, independently on its own merit, as well as in the context of the The Client’s portfolio at the time of making such investment.

The Fund has been rated Neutral by A Consultant’s Alternative Assets Committee

Firm/Organization

In 1981, Alan B. Slifka started to manage capital for some US high net worth individuals. This was the genesis of Halcyon Asset Management LLC (“Halcyon”). Mr. Slifka was a well-known investor and the founding chairman of the Big Apple Circus. He passed away in 2011.

From 1981-1991, Mr. Slifka managed assets by mostly investing in merger arbitrage strategies. Later, in 1991, he hired Mr. John Bader (current Chairman and CIO) as a senior portfolio manager to expand the investment mandate to other strategies like corporate distressed debt and special situations. In 1996, Halcyon Offshore Asset Management, LLC was officially launched and the investor base was expanded to non-US and offshore institutional investors.

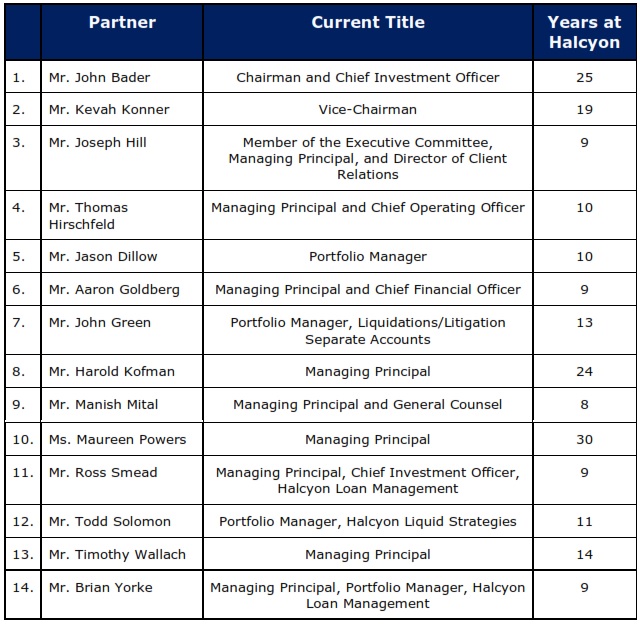

Since then, the Firm has progressively expanded its businesses and global footprint. It currently manages approximately $11 billion in assets across a wide array of products and strategies. The Firm has 14 partners and 125 employees, 50 of whom are investment professionals. Halcyon is headquartered in New York City and has satellite offices in Houston and London. The Firm is registered with the SEC in the US and with the FCA in the UK.

Firm Ownership

Currently, 80% of the Firm is owned primarily by 14 active partners, none of whom own a majority ownership stake. The remaining 20% is owned by Dyal Capital, an affiliate of Neuberger Berman. This is a passive interest which does not carry any voting rights or investment authority.

.

This article is part of a series on HFI which shows what process is used by institutional investors to invest in hedge funds. The other articles are:

How Do Pension Plans Monitor Their Hedge Funds, For Example Florida SBA?

Ford Pension Plans Cut Equity And Event For Macro And Multi-Strat

Graphics of the Day – State of New Jersey Pension Fund’s Hedge Funds

Translations of a Due Diligence Meeting for a Hedge Fund

Money Bytes – Video Interview with Michael Van Biema