By Hedge Fund Insight staff

There is good visibility of hedge fund exposure and returns for state pension plans. Most investment committee papers are available, and often it is possible to read the hedge fund managers comments and presentations.

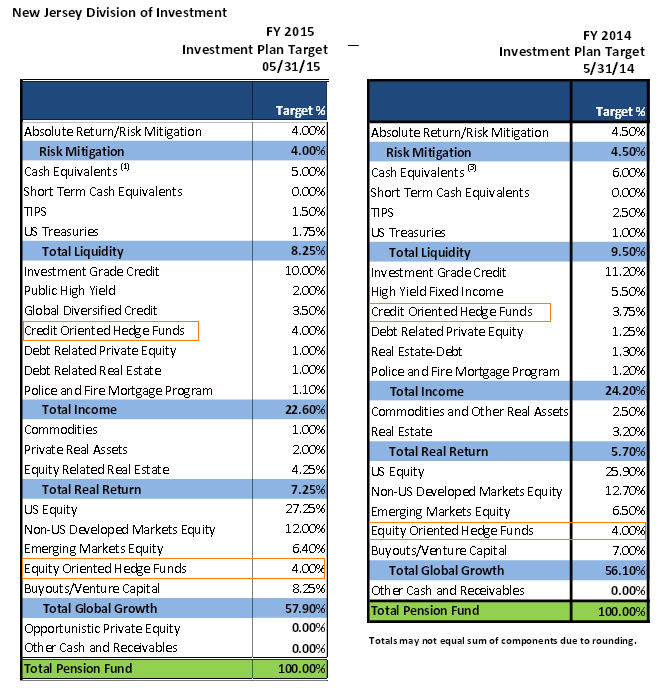

In the first graphic are two tables extracted from the monthly Investment Reports a year apart from the State of New Jersey’s Division of Investment.

Contrary to the thought that US pension plans are following the example of CalPERS (or Hermes in the UK) and reducing or eliminating hedge funds, the State of New Jersey’s plan has held its equity hedge fund exposures. At the margin the Division of Investment has persuaded its trustee board to increase exposures to credit oriented hedge funds to 4% of plan assets from 3.75%. This has been implemented through the granting of a $300m mandate to Chatham Asset Management, with the input of consultant Cliffwater LLC. As is common, the mandate will be implemented via a managed account which will mirror the Chatham Asset High Yield Master Fund. The managed account comes with a management fee of only 0.75% p.a., and the performance fee of 20% will be calculated over a two year period.

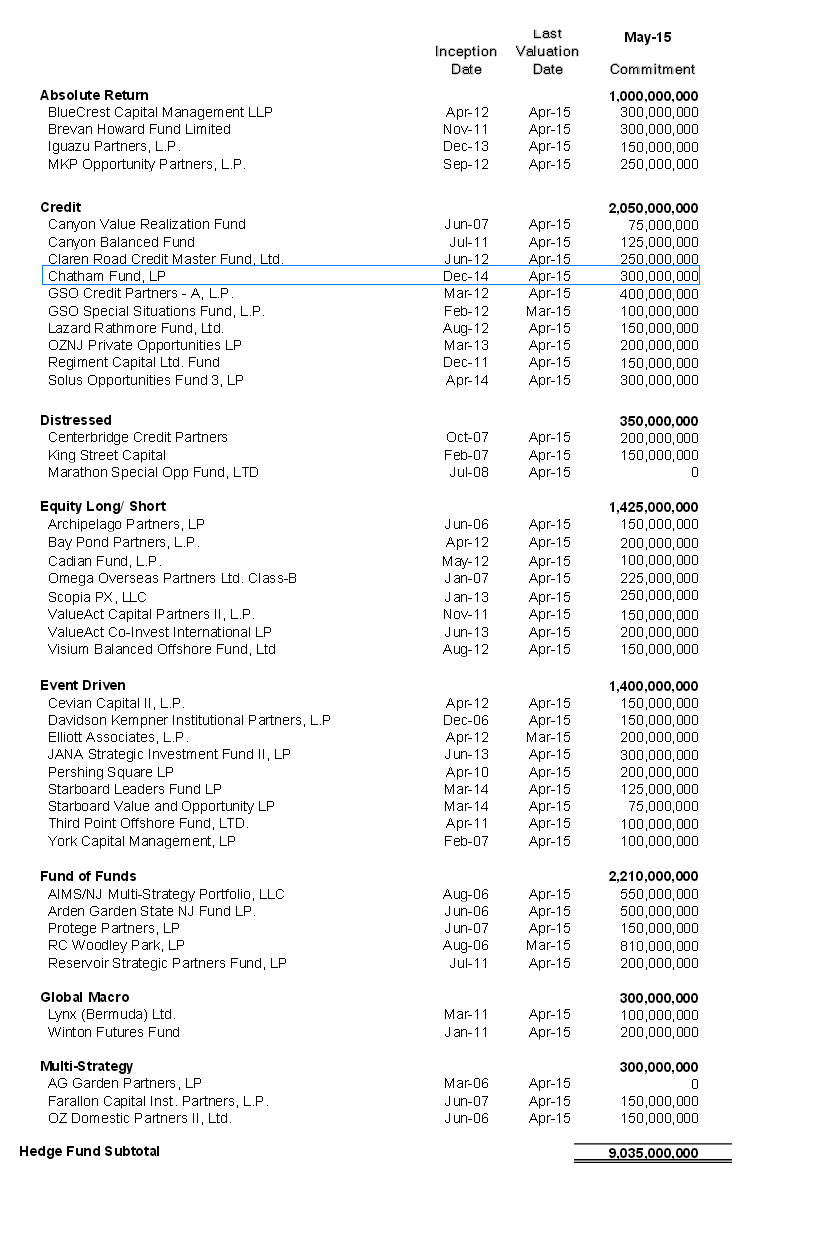

The full roster of the State of New Jersey’s hedge funds is shown in the graphic below.

It is interesting that an organisation such as the State of New Jersey’s Division of Investment, which by now is an experienced investor in hedge funds, with hedge fund investments going back nearly a decade, should persist with funds of hedge funds. The rationale is thought to be that the Garden State fund has access to hedge fund selection and monitoring smarts via the likes of Rock Creek Group and Arden for fees as low as 0.2%. In addition, investing through Protege Partners and the Reservoir Strategic Partners Fund gives the New Jersey fund exposure to new and emerging hedge fund managers.

It is interesting that an organisation such as the State of New Jersey’s Division of Investment, which by now is an experienced investor in hedge funds, with hedge fund investments going back nearly a decade, should persist with funds of hedge funds. The rationale is thought to be that the Garden State fund has access to hedge fund selection and monitoring smarts via the likes of Rock Creek Group and Arden for fees as low as 0.2%. In addition, investing through Protege Partners and the Reservoir Strategic Partners Fund gives the New Jersey fund exposure to new and emerging hedge fund managers.

The Reservoir Strategic Partners Fund engages in seeding of hedge fund managers, and so is able to negotiate participation in the economics of the management companies of the hedge funds. This concept of economic participation is one that the State of New Jersey’s Division of Investment has bought into via another of it’s investments, shown separately from the investments in hedge funds. Dyal Partners run private equity-style funds that take stakes in mature hedge fund businesses. For example, a stake of 20% of Jana Partners was recently acquired. The New Jersey pension plan has invested in both Dyal funds (for $200 and $250m respectively). The first of the Dyal Partners funds shows a book profit of 17% over two-and-a-half years, while the second is carried at cost at the moment. As Dyal Partners is considering a public listing these investments will get more attention shortly.

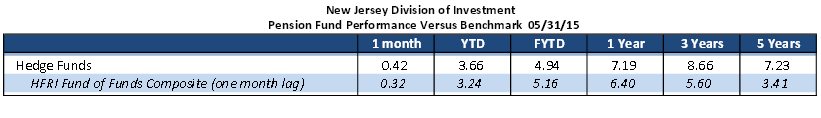

The third graphic of the day is the return data for the hedge fund investments of the pension plan for New Jersey’s public sector workers.

Over 1,3 and 5 years the hedge fund assets have comfortably beaten the industry benchmark, the investible fund of funds composite constructed by HFR. This reflects the good job that the investment professionals of the Pension Plan have done up to this point. Last month Samantha Rosenstock joined the Division of Investment as Hedge Fund Portfolio Manager – good luck in keeping the record going.

Over 1,3 and 5 years the hedge fund assets have comfortably beaten the industry benchmark, the investible fund of funds composite constructed by HFR. This reflects the good job that the investment professionals of the Pension Plan have done up to this point. Last month Samantha Rosenstock joined the Division of Investment as Hedge Fund Portfolio Manager – good luck in keeping the record going.