By Hedge Fund Insight staff

On of the best and most widely read articles on this website is the one by Cliffwater titled “How Many Hedge Funds? Only 15-20 For The Highly Skilled” – see the original article. The article is going to be referenced when new data becomes available that gives real world examples.

The first real world example comes from Skybridge Capital. On has to be careful in describing a fund as typical, as funds change through time, and it can be difficult to pin down what is the flagship or representational. This is particularly true post-Credit Crunch as more bespoke portfolios of funds have been sought by the dominant providers of capital, investing institutions.

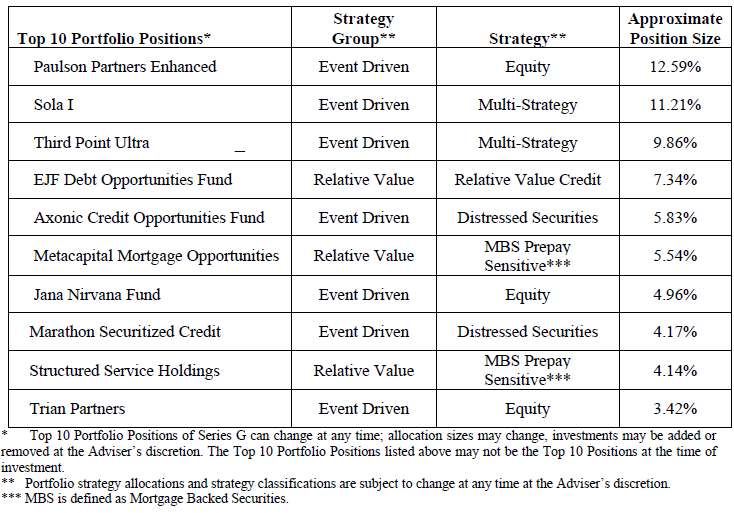

That written, there is no doubt that SkyBridge Multi-Adviser Hedge Fund Portfolios LLC’s Series G is the flagship product for the firm. The Table below shows the funds largest positions as at the end of May 2015.

The C5 and C10 percentages are 46.83% and 69.06%. These figures are entirely consistent with the style of Ray Nolte and his team. The CIO implements a view on markets and strategy opportunity through large hedge fund strategy weightings which vary considerably through time. The individual fund weightings show a high degree of confidence in the underlying managers and their processes, brought about through a lot of direct contact.

One Response to “Update 1 of “How Many Hedge Funds in a Fund of Funds””

Read below or add a comment...