By Leigh Walters, Global Head of Sales, Omgeo The middle office operations of European hedge funds, where trades between counterparties are matched and confirmed, has historically received little investment from hedge funds when compared to the front office spending, as well as little attention from investors, regulators or board members. However, post- global financial crisis, […] Read more »

SEC to Advisers: “Can You Hear Me Now?”

by Deborah Prutzman, The Regulatory Fundamentals Group LLC A little over a year ago the SEC warned advisers that the game has changed and that the agency would begin to use a risk-oriented, holistic approach to scrutinize senior managers and the control environment within their firms. Today, the warning sirens are growing even louder […] Read more »

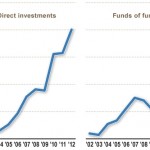

Chart Of The Day – Hedge Funds & The Largest 200 US Pension Funds

Growth of DB Pension Fund Assets in Hedge Funds Source: Pensions & Investments, Among the top 200 funds; assets are in billions for years ended Sept. 30. Investment in hedge funds among the 200 largest U.S. retirement funds jumped 20.3% to $134.7 billion in total hedge fund and hedge funds-of-funds in the year ended Sept. […] Read more »

Half Of UCITS Hedge Flows Into Fixed Income

By HFI Staff Writer Last year UCITS hedge funds assets under management (AUM) increased by 20% to reach a new high of €140 billion. The latest quarterly European research on the UCITS hedge funds industry published by Alix Capital, the Geneva-based provider of the UCITS Alternatives Index (UAI) family of indices, reveals that more than […] Read more »

SEC Preview Top Hedge Fund Enforcement Trends for 2013

By Perrie Michael Weiner, Patrick Hunnius and Stephanie Smith of DLA Piper In a recent speech* before the Regulatory Compliance Association, Bruce Karpati, Chief of the Securities and Exchange Commission’s Enforcement Division’s Asset Management Unit, suggested where the SEC may be heading regarding hedge fund oversight in the months to come. Mr. Karpati both […] Read more »

Review of Hedge Funds in 2012

By Charles Gubert, Editor of COOConnect Here is our take on what happened in 2012, and the clues we picked up as to what hedge fund COOs can look forward to over the next 12 months. In the spirit of the season, and to make it a bit harder for ourselves, we decided to restrict […] Read more »

Fund of Hedge Fund Takeovers – Bursting a Dam or Turning a Tap?

By Simon Kerr, Principal, Enhance Consulting and Publisher of “Hedge Fund Insight” For seven or eight years we have been told that a wave of M&A was about to roll over the fund of hedge funds sector. There have been different reasons over that period, they all pointed towards consolidation, but somehow it has […] Read more »

Opportunities Widen For Equity Long/ Short

By Simon Kerr, Publisher of Hedge Fund Insight Equity long/short managers have done okay in 2012. With the S&P500 up 15.0% in 2012 US based equity long/short managers were up 7.0% to the end of November according to the Greenwich Hedge Fund Index. Given the risk on/risk off market environment through 2012 that is a […] Read more »

IAM Gets Less Defensive

By Morten Spenner, CEO of International Asset Management (IAM) Here are our forward-looking investment views looking into 2013. Market context – more constructive on the market environment Overall, we continue to observe a global economy which is recovering and with investor sentiment increasingly reflecting this. The most noteworthy recent developments have been the effective […] Read more »

Why The Vast Majority of Hedge Funds Underperformed Indices

By Dr. Harold Ehrlich, CFA, Ehrlich Associates, LLC Sad to say, the vast majority of all hedge funds worldwide have well underperformed virtually every major stock or bond index for some four years now. Adding insult to injury, investors in such funds have paid 2% management fees and 20% of (paltry) profits for the privilege […] Read more »