By Simon Kerr, Principal, Enhance Consulting and Publisher of “Hedge Fund Insight”

For seven or eight years we have been told that a wave of M&A was about to roll over the fund of hedge funds sector. There have been different reasons over that period, they all pointed towards consolidation, but somehow it has not happened to the extent that rationality would suggest.

A constant through the whole of this period was the pressure on fees. The increasing institutionalisation of the hedge fund industry gave larger buyers more ability to negotiate fees with their providers. And they have done since 2005 when it came to funds of hedge funds.

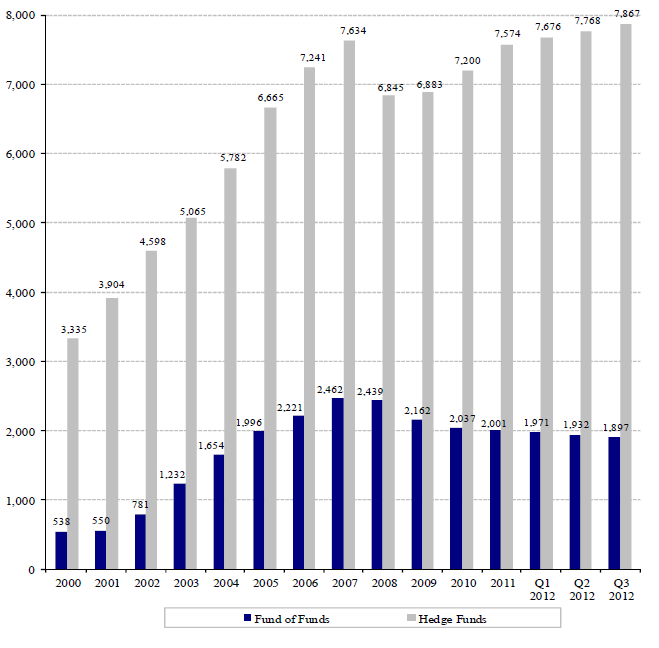

In the mid Noughties, an expansion phase in AUM and numbers of funds of funds (see graphic below), the costs of hiring appropriately knowledgeable and skilled people was going through the roof and the arms race of technology and depth of due diligence had started – both factors which would squeeze margins from the cost side. The margin squeeze was supposed to cause a slew of consolidations in FoFs as they tried to spread their fixed costs over more assets – it never happened then.

The peak for funds of hedge funds was mid-2007. That was when they hit their high as a proportion of industry assets. Ever afterwards proportionately more dollars went directly into single manager hedge funds than was routed through funds of hedge funds. The positive flows from institutions were still there, but collectively institutions began to use more specialist consultants or advisors and allocate directly to hedge funds as the institutions experience and confidence built.

The Catalytic Year

2008 was a catalytic year for funds of hedge funds, but not in a good way. The sector suffered a triple whammy. First there was Bernie Madoff’s Ponzi scheme. One of the rationales for using a fund of funds was that the FoF was supposed to save their investors from blow-ups. The awkward items on an agenda for an investment committee meeting for a pension plan or Endowment were meant to be avoided by paying a FoF to screen managers from the bottom up. Too many FoFs failed in this fundamental task – and big names too. The safety of using a big name FoF was challenged, and in particular too many European based funds of hedge funds were exposed to Madoff. Specifically, Geneva based fund of funds were found out by the Madoff scandal to have inadequate processes. Their HNWI clients were outraged, as they were by the second and, in particular, the third whammy of the three.

The second whammy was the performance of funds of hedge funds in 2008. It was bad enough from a client perspective that these absolute return vehicles did not protect the downside when they needed to in 2008, but worse than that, the organisations being paid to select managers from the bottom up and construct portfolios from the top-down by strategy allocation performed worse than the average single-manager hedge fund and charged a fee for it. The HFRI Fund Weighted Composite Index was down 19.03% in 2008, whilst the HFRI Fund of Funds Composite Index was down 21.37% that year.

The third whammy was partly a consequence of the absolute return and of relative performance of funds of hedge funds, but also of the dash-for-cash of 2008. Investors in single manager hedge funds and funds of hedge funds exposed the mismatches in liquidity of both by asking for the return of their capital. Wealthy Individuals have never forgiven hedge funds in general for pulling the grills down on redemptions at this time. The inability to liquidate their holdings in 2008-9 has meant that HNWIs have never come back to hedge funds in the way that institutions have in the period since the Credit Crunch. This psychological hurdle for the wealthy individual has impeded the recovery of all the conduits for their capital to hedge funds – private banks, platforms and funds of funds.

The state of play for funds of hedge funds post the Credit Crunch was extremely difficult. With high fixed costs (salaries, occupancy costs and systems) and management fee income falling with the asset base (down over 20% from falls in NAV compounded by redemptions of 20-30% of assets) there was a lot of pressure on the managements of funds of funds.

Investor Perspective

Investors in hedge funds had their own agendas to address. As institutional investors gain experience in a sector they like to reduce the costs of the exposures they have taken on – often by replication or indexation of the investment strategy, or by adding to their own expertise and bringing the activity in-house. When it comes to hedge funds, institutional investors have tended to favour a combination of adding to their own expertise and relying more on external experts – hence the rise of direct investing in single managers and the use of hedge fund consultants.

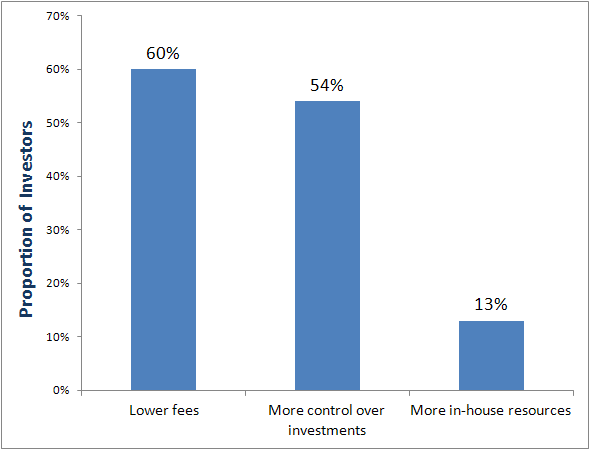

Evidence from surveys of institutional investors confirms that the reduction of fees is a primary motivation for them moving away from using funds of hedge funds. However, Graphic 1 shows that in a survey of 50 investors taken in 2010 by Preqin it was nearly as common for investors to cite increasing control over their hedge fund investments as a reason for moving away from funds of funds.

Graphic 1. Top Reasons Given By Investors for Moving Away from Funds of Hedge Funds to Direct Investment

Source:Preqin (2010)

The consequences of these motivations being put into practice have been the rise of the specialist hedge fund consultant working with institutional investors, and increasing pressure on fund of funds fees. The squeeze on fees can be thought of in terms of a simple demand curve – Graphic 2 illustrates that the number of funds of funds declined very slowly after 2008 (so supply fell marginally), and demand for funds of funds services fell much more quickly after the Credit Crunch (because of the triple whammy).

Graphic 2. Estimated Number of Funds: Hedge Funds vs. Fund of Funds 2000 – Q3 2012

Source:HFR

Post Credit Crunch Blues For Funds of Funds

What has surprised industry observers is that these commercial pressures did not result in mergers and takeovers amongst funds of hedge funds from 2009 onwards. By the end of 2009 the first discernible positive capital flows into the industry at the aggregate level arrived. The first flows went to the big name single managers that had been closed to new investors and new investments before the Credit Crunch – the likes of SAC and Tudor. Through time, in 2010 and 2011, the inflows continued and spread wider, though with a pronounced tendency to go to the largest management companies, and always (net) to single managers. Funds of hedge funds as a group have had negative flows ever since the Credit Crunch.

It was common for there to be a sequence of activity amongst the users of FoF services which explains the lag between the Credit Crunch and more rapid shrinkage and M&A amongst the providers. The users of FoFs took some time to decide to stick with hedge funds in concept (post Credit Crunch). Then they had to decide whether they should change allocations to alternatives – and a decent majority (bar Endowments) decided to add to hedge fund allocations. Then came the “how to” decision with an increased determination as a group to do more in-house and take manager selection decisions directly. After that comes implementation – which in the institutional timeframe can take 18 months. All tolled the sequence takes a multiple of years – hence the lag on the demand side.

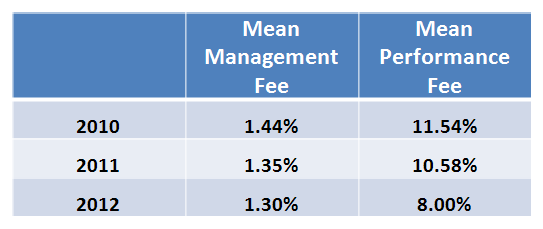

The impact of the strategic decision of institutional investors in aggregate to switch to direct hedge fund investing and away from funds of hedge funds at the margin can be observed in the fees that funds of funds have been able to charge. Table 1 shows mean fees charged by funds of funds over the last three years from a database study by Preqin.

Table 1. Mean Management and Performance Fees Paid by Investors to Funds of Hedge Funds

Source: Preqin

It is easy to conclude that the downward pressure on fund of funds fees is a new phenomenon. But a study of the Top 50 Funds of Funds in 2005 (when the top 20 FoFs managed 44% of sector assets) showed the average reported management fee to be 1.36% and the average performance fee of the largest FoF managers was 8.71%. The first explanation is that there has long been a significant difference between the sticker price for fund of hedge fund services and the actual fee levels paid by large investors, just as this (more recently) is a rising phenomenon in single manager hedge funds. Sticker prices shown on databases are getting closer to the real rates charged. The second explanation is that only the larger, more overtly commercial funds of funds actually serve investing institutions and they recognised the need for discounting from the rack rate nearly a decade ago.

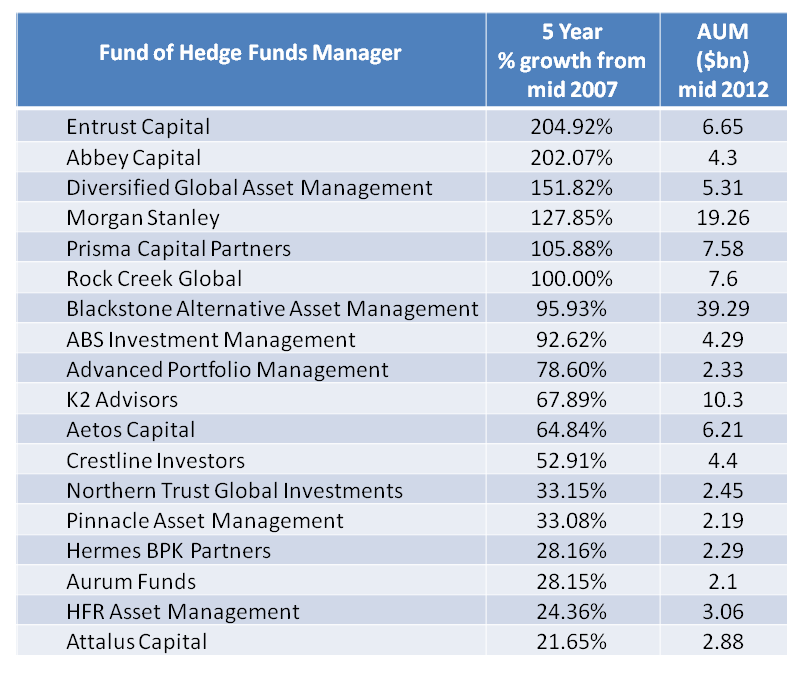

Of course there have been some winners amongst the funds of hedge funds post 2009. The table below (Table 2) shows which funds amongst those with a $1bn-plus under management have grown their assets by more than 20% since the relative peak of the sector in mid-2007. It is natural that these companies are seen to be either potential acquirers or have something that is worth acquiring in assets, processes, people and/or track record.

Table 2. Larger Funds of Hedge Funds with Growth in AUM Over Last 5 Years

Source: InvestHedge

There have been deals for fund of hedge fund management companies in the previous couple of years:

2010

April: SkyBridge Capital acquires Citi Alternative Investments

September: Nexar Capital Group buys Allianz Alternative Asset Management

2011

January: William Blair acquires Guidance Capital

May: Nexar Capital Group purchases Ermitage Group

June: Arden Asset Management buys Robeco Sage

July: Athena Capital Advisors takes over Stonehorse Capital Management

Nov: Evercore acquires stake in ABS Investment Management Dec:Cantor Fitzgerald buys Cadogan Management

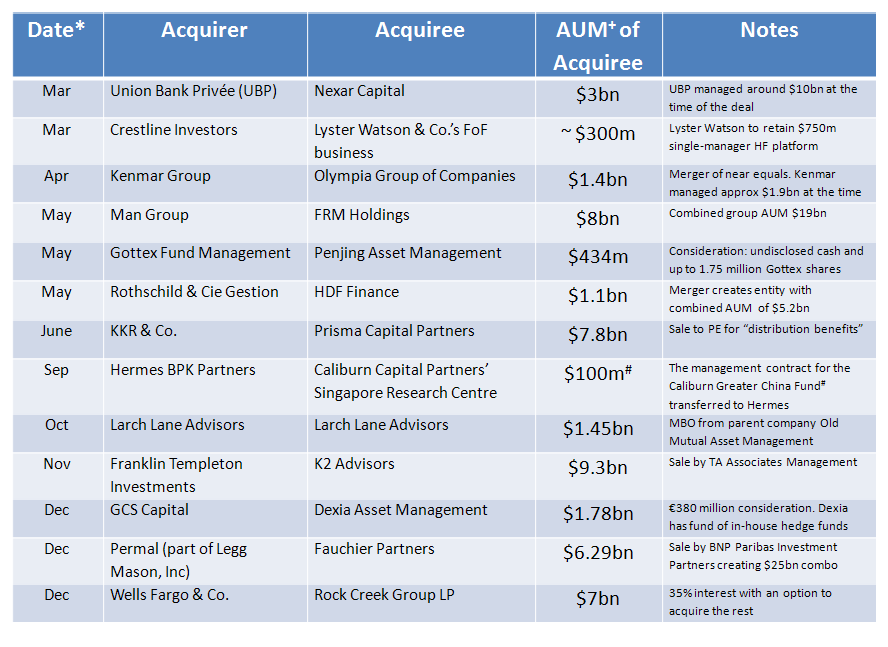

But Table 3 shows that there have been more deals and larger deals in 2012, and in particular that there was a flurry of M&A activity in November/December when three big deals got done.

Table 3. Fund of Hedge Fund Deals in 2012

Source: HFI *Date of announcement, +AUM at time of deal or nearest data point

It has been a long gestation period, but the burst of takeovers in 2012 might infer that there has been a breakthrough in volume and number of transactions last year, as if a sluice gate had been opened on a swollen river. That is not necessarily the case.

In the deals done in the last year the positive strategic reasons given for doing a takeover or merger of funds of hedge fund businesses include:

I. Client base – acquisition of institutional clients, or addition of mass-affluent access.

II. Distribution capability by geography of client segment, sometimes looking for cross–selling opportunities or leverage through the parent company network or platform.

III. Strengthen research – specific investment expertise, or regional research capability.

IV. Managed account platform capability, particularly to hit the new normal of customised portfolios.

V. Absolute size – AUM, research team, client support, technical support

For example, the deal which brought together Man Group and FRM scored on ii, iii iv and v: in order, the deal gave some new FoF feedstock for Man Group to put together structured product, brought FRM’s systems to the public company, and it added some managed accounts to the extensive managed accounts run by Man Group through those which FRM had negotiated. Increasing absolute size is a given.

Reason v, absolute size, has been frequently cited by participants in a deal. And indeed the C20 for the fund of hedge funds sector has gone from 44% in 2005 to 56% in 2012. But absolute scale in truth has been a consequence of M&A not a driver of it. In a no-growth industry consolidation is about cost cutting not synergistic/revenue benefits.

Potential Buyers

There are a couple of potential buyers of fund of hedge fund businesses that have made known their intentions. Aberdeen Asset Management, a serial acquirer of asset management businesses, has an existing FoF unit with AUM of $4bn, itself the result of acquisitions from RBS and Credit Suisse. Andrew McCaffery, Aberdeen’s global head of hedge funds, has gone on record saying that he is looking to take that to $10bn in a couple of years. Principal Global Investors, part of US-listed Principal Financial Group, has a funds of PE funds business, and is looking to grow a fund of hedge funds business. The parent company has an acquisition resource of $900m – a proportion of that would go a long way in the fund of hedge funds sector.

So there is a commercial need for consolidation in the sector, there have started to be some big transactions, and there are some ready and willing acquirers. Surely the sluice gate has been raised? According to research from Fitch Ratings the recent wave of consolidation in the hedge funds industry has left only a handful of candidates for potential large-scale acquisitions. There are few FoFs with assets over $2.5bn available to be bought – analysis of the ownership of funds of funds in this size category reveals there to be few obvious sellers. Fitch suggests that from a potential buyers’ perspective there are a string of risks to acquisition of smaller FoFs. The obstacles to M&A of FoFs in this category are given as poor financial condition, legacy issues and key person risk. Post acquisition the risks can be about asset retention and cultural differences.

For the owners of smaller funds of hedge funds businesses, say below $500m in assets, the funds of funds can be a way of looking after the assets of the family or principal. Indeed that is how FRM and LaFayette started. Such owners will only sell when they look to retire themselves, and will there be much to be acquired then if the family assets go with the founders? Given the difficulties Fitch identified, is it worth acquiring a string of small FoFs, given the risk and hassle in each deal? There are few available larger funds of hedge funds. That leaves the middle ground. The pressures on owners and managers of funds of funds businesses will not lessen this year. So the expectation is that we will see acquisitions of funds of hedge funds this year, but at no faster pace, and in no greater size than seen in 2012. The tap has been turned on, but no floodgate has been opened.

At Imqubator we have a strong pipeline of applications from new and small managers who are seeking seed tickets of 25 million from us. Although consolidation amongst giants may be the big story, there is lots of talent out there at the other end of the spectrum.

Tradex has a very unique skill set and has run large assets in the past with its TCM (fund of managed accounts, peak assets 2.5 b) and Tradex Global OSP (peak assets of 580m) We are doing very interesting “single HF,s where we hire trading advisors, sector focused concentrated fund with 4 mgrs. and customized managed accounts portfolios. We want to align ourselves with FO,s and institutions that want the skill set we have and like our expertise on smaller mgrs we have been focusing on since 1998. MB

Thank you for the article Simon!

but do not you think when you talk about the number of HFs and FoHFs it would be also good to see the AUM in each category? As you know, it is much more complicated and require to bear much more costs a FoHF structure than a HF and thus, the survivor rate will be higher in HF than in FoHFs and also it is easier to launch a HF than a FoHF, because of costs and structure mainly, and in a time like this with short liquidity, will be a pressure towards HFs rather than to FoHFs. I think this could be another reason why there are this mergers and acquirements.

Another reason could also be that both areas, HFs and FoHFs, tend to be concetrated in a few funds and when the universe is small, one lost is higher than in another that is bigger and I think we should to have a look on the percentage rather than on the number (when both go in the same direction, which is not the case here). Besides, I think it is much easier to merge FoHFs than HFs because of the focus of their expertise, know-how and investments.

Just trying to provide some more points to explain the current environment.

PM